Frequently Asked Questions About Target Date or Lifecycle Funds

What are target date or lifecycle funds?

Target date funds, which are also called lifecycle funds, are designed to offer a convenient way to invest for a person expecting to retire around a particular date. A target date fund pursues a long-term investment strategy, using a mix of asset classes (or asset allocation) that the fund provider adjusts to become more conservative over time. Research shows that asset allocation is one of the most important factors in long-term portfolio performance.

Target date funds are designed to help investors avoid some of the most common investment mistakes. Their features include:

- Diversification across asset classes: Target date funds invest in a mix of asset classes, including stocks (equity), bonds (fixed income), and cash.

- Avoiding extreme asset allocations: Research shows that some young workers invest very conservatively, by allocating all or almost all of their accounts to fixed income investments, while some participants nearing retirement invest very aggressively, allocating all or almost all of their accounts to equity. Target date funds follow professionally designed asset allocation models to eliminate such extremes.

- Automatic rebalancing: Target date funds are automatically rebalanced periodically to maintain their target asset allocation, so that swings in the markets do not throw a participant’s allocation off course. Research shows that systematic rebalancing tends to improve a portfolio’s long-term performance.

- Automatic adjustment for changing risk profile: The asset allocation of a target date fund is adjusted to become more conservative over time to account for factors that affect an investor’s risk profile: a shorter time horizon, fewer chances to make contributions to savings, and greater sensitivity to capital market swings.

What is a target date fund’s “glide path”?

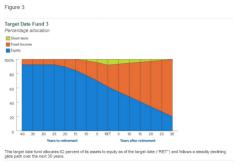

The glide path is the asset allocation path that the target date fund follows to become more conservative over time. Since discussions of anticipated asset allocation usually focus on the percentage of the portfolio invested in equities, the glide path reflects the declining percentage of equities in the portfolio as it approaches (and, in some cases, passes) the target date. While glide paths differ based on the assumptions and calculations providers use in designing their funds, all target date fund glide paths provide for more exposure to equities for younger investors and more exposure to fixed income and cash for investors near retirement. As the illustrations show, many funds’ glide paths continue to adjust the funds’ equity exposure downward after the target date is reached. Some funds also actively manage asset allocations along the glide path within preset limits to respond to prevailing market conditions.

Caption: These three figures illustrate different “glide paths” for the asset allocation of different target date funds. This fund allocates 50 percent of its assets to equity as of the target date (“RET”) and reaches its most conservative allocation (20 percent equity) 15 years later.

Caption: This target date fund has one-third of its assets in equity as of the target date (“RET”) and reaches its most conservative allocation (32 percent equity) within five years of retirement.

Caption: This target date fund allocates 62 percent of its assets to equity as of the target date (“RET”) and follows a steadily declining glide path over the next 30 years.

What does the date in a target date fund name mean?

The date in a target date fund name generally means the date at which the “typical” investor for whom that fund is designed would reach retirement age and stop making new investments in the fund.

Target date does not necessarily mean the date at which an investor should cash out the entire target date fund investment. In this respect, target date funds are generally designed to be held beyond the presumed retirement date, to offer a continuing investment option for the investor in retirement. Target date also does not typically mean the date at which the fund arrives at its most conservative asset allocation. Many target date funds do not reach their most conservative asset allocation until after the target date.

Investors may choose to purchase target date funds with dates other than their presumed retirement date. An investor who expects to retire in 2035, for example, might select a 2030 fund (to be more conservative) or a 2040 fund (to be more aggressive).

Is there a difference between lifestyle funds and target date funds?

Yes. Lifestyle funds offer a mix of asset classes to provide a predetermined level of risk and generally use words such as “conservative,” “moderate,” or “aggressive” in their names to indicate the fund’s risk level. Lifestyle funds generally do not change their asset allocations over time in a predetermined way. Target date funds, by contrast, are usually identified by their specified target date (“2010 fund,” “2025 fund,” etc.) and adjust their asset allocation over time to become more conservative.

Who offers target date funds?

Target date funds are offered by mutual fund managers, banks, trust companies, and insurance companies. They are offered to 401(k) and other defined contribution plans, to IRA investors, and to individuals saving for retirement outside of tax-advantaged savings programs. Many target date funds are mutual funds, but many other providers offer target date funds in the DC plan market as collective trusts or separate accounts.

Use of Target Date Funds

Who should use these funds?

Investors who would like to hold a mix of asset classes and who would like their portfolio to be adjusted automatically to become more conservative over time may prefer investing in a target date fund rather than managing their own portfolio of funds. The target date fund provider will rebalance and adjust the fund to offset market fluctuations and investors’ evolving risk profile. To achieve the same benefits with a self-managed portfolio, an investor would have to monitor the individual funds in his or her portfolio and regularly transfer money between them. Sponsors of DC plans may choose to include target date funds in their plans as an option for participant-directed investment or as a qualified default investment alternative, or “QDIA.”

How much is invested in these funds? What’s the trend in their usage?

At the end of June 2014, approximately $678 billion was invested in target date mutual funds. 1 Net cash flows into target date funds have grown significantly. For example, target date mutual funds received $53 billion in net new cash flow during 2013, compared to $22 billion in 2005 and $4 billion in 2002.

At year-end 2012, nearly three-quarters of 401(k) plans in the EBRI/ICI database2 included target date funds in their investment menu.3 In plans that offer target date funds, 60 percent of participants had at least some portion of their account in these funds. About 15 percent of total assets in 401(k) plans were in target date funds at the end of 2012.

What are the advantages or disadvantages of target date funds for long-term investing, compared to picking my own investments?

Research shows that asset allocation is one of the most important factors in long-term portfolio performance. Target date funds provide age-based asset allocations that are professionally constructed and managed, that are periodically rebalanced, and that become more conservative over time. Target date funds invest in multiple asset classes, ranging from domestic and international stocks to corporate and government bonds to cash. To achieve the same benefits with a self-managed portfolio, an investor would have to be able to invest in a range of asset classes, to monitor the individual funds in his or her portfolio, and regularly transfer money among them to offset market fluctuations and evolving risk tolerance.

Target date funds avoid the extremes in asset allocation that are observed in some plan participant accounts, in which some young workers allocate all of their accounts to fixed income investments, while some participants near retirement allocate all or almost all of their accounts to equity investments.

Target date funds do not, however, take into account the individual risk tolerance of any particular investor or any investor’s individual circumstances, including any holdings of other assets, and target date funds do not take a uniform approach in constructing their glide paths. While all target date funds provide for more investment in equities for younger investors and more investments in fixed income for investors near or at retirement, the glide paths used by different fund providers vary. For example, some providers design their target date funds to reach their most conservative asset mix at or shortly after the target date. Other providers design their funds to reach their most conservative asset mix 10, 20, or more years after the target date.

Investors in target date funds should be aware of how a particular fund intends to reach its investment objectives and what risks that fund’s strategies might entail, just as they would with any other investment. In the case of mutual funds, this information is disclosed in the risk-return summary portion of the prospectus (immediately following the cover page and fee table) and explained in more detail later in the prospectus. Investors may find additional helpful information, such as fund fact sheets, at fund websites, or, for 401(k) and similar plans, the employer or recordkeeper website.

I’m a conservative investor. How should I pick a target date fund?

An individual investor may have more or less tolerance for the investment risk than the investor for whom a fund with a particular target date is designed. Many fund sponsors provide useful information to investors or plan administrators regarding the current asset allocation of each target date fund. If an investor feels that the asset allocation mix associated with the investor’s target date involves more risk than he or she wants to assume, the investor can choose a fund with a target date that will occur prior to the investor’s expected retirement date. An investor who is less risk-averse than the fund’s target investor might choose a fund with a target date that will occur after the investor’s expected retirement date.

Safeguards for Target Date Fund Investors

What are the investor safeguards in target date funds?

Target date funds that are mutual funds include several layers of investor safeguards. Like all mutual funds, target date mutual funds are subject to regulatory and disclosure requirements under the federal securities laws, including the Investment Company Act of 1940, which imposes significant requirements on the organization and operation of mutual funds and imposes fiduciary duties on mutual fund boards of directors and their advisers. Target date funds often operate as funds of funds—funds that invest in other mutual funds—which must meet additional, strict requirements under the 1940 Act.

Disclosure is one key safeguard. Target date mutual funds explain their asset allocation approaches and glide paths in disclosure documents required by the Securities and Exchange Commission (SEC). Fund advertising materials intended for retail investors are reviewed by the Financial Industry Regulatory Authority (FINRA). Fund advertising materials also must comply with SEC and FINRA requirements designed to assure these materials are not misleading. Underwriters and brokers who sell mutual fund shares are subject to the Securities Exchange Act of 1934 and the regulations of FINRA. Advisers to mutual funds are subject to regulation under the Investment Advisers Act of 1940.

When target date funds are used in retirement plans, additional safeguards apply under the Employee Retirement Income Security Act of 1974. A plan’s fiduciary—usually the employer who sponsors the plan—selects and monitors target date funds for use in the plan’s investment lineup. In doing so, the fiduciary must comply with a comprehensive set of ERISA obligations that require it to act with prudence and for the exclusive benefit of the plan and its participants. These regulations prohibit self-dealing and restrict conflicts of interest, among other practices.

Other target date funds, offered as collective trusts or separate accounts, are also subject to different or additional regulatory regimes, not discussed here.

Can an investor lose money in a target date fund?

Yes. As with any investment, target date funds can lose money. The mix of assets in a target date fund is intended to diminish the risk of loss, but, as demonstrated by market events in 2008, sometimes stocks, bonds, and other assets in a target date fund’s portfolio may lose value simultaneously. The specific risks of investing in a particular target date mutual fund are disclosed in the fund’s prospectus. While target date funds are managed to reduce equity market exposure and, therefore, equity market risk over time, target date fund investors, like all investors, are exposed to market risk and other risks associated with the fund’s portfolio.

Design of Target Date Funds

How do fund companies design target date funds?

In designing target date funds, providers may consider historical information about the markets and the behavior of retirement investors for whom the fund is designed, including the provider’s assessment of investors’ wealth accumulation, savings behavior, risk tolerance, and spending patterns in retirement. Fund providers may also consider various risks that investors may face, including return volatility risk, inflation risk, and longevity risk (i.e., risk of outliving one’s assets).

Based on these considerations, fund providers typically develop a glide path using modern portfolio theory, including the principles of diversification and asset allocation, and test the model through extensive simulations over various market conditions. Providers may periodically review the assumptions and historical information underlying their target date funds and may make adjustments over time. Some providers also actively adjust asset allocation along the glide path within the preset limits to take into account market conditions.

Why do the asset allocations in target date funds vary from fund company to fund company, even when the funds have the same stated target date?

There are many possible glide paths, and no single “ideal” allocation has been identified by investors or fund managers. The asset allocations and glide paths of target date funds based on the same retirement dates often vary depending on how different fund providers balance the various considerations discussed above. As a result, funds differ in their initial allocation to equity; in the point in time at which they begin to reduce exposure to equity; in the rate at which they reduce equity exposure; in the point in time at which they reach their most conservative asset allocation; in the amount of equity exposure in their most conservative asset allocation; and in whether they follow a preset glide path or actively manage asset allocation along the glide path within preset limits to respond to prevailing market conditions. Some providers place higher priority on seeking to produce immediate income and to preserve assets at retirement age, while others emphasize the need to seek higher returns at and after retirement age to increase assets and generate income later in retirement to address longevity risk.

Where can investors find information on how their target date fund is designed?

Investors have many tools to assist them in learning more about a target date fund. Target date funds that are mutual funds disclose the design of the target date fund, including its asset allocation and glide path, in the prospectus. An investor receives the prospectus upon, or soon after, purchasing the fund; in addition, an investor can request a prospectus from the mutual fund, and typically can view it on the fund company’s website. Mutual funds also file their prospectuses with the SEC, which makes fund materials available through its website. More updated information is disclosed in a fund’s annual and semiannual reports and quarterly reports of fund holdings, which are available on the SEC website and often on a fund’s website.

Fund providers often make available additional materials about their target date funds, from basic fact sheets to in-depth papers that describe the design process. These can be found on the websites of the fund or the employer or recordkeeper, or can be obtained from fund providers upon request.

Where can an investor find information on the performance of target date funds?

Any target date fund that is a mutual fund registered with the SEC must provide performance information both in its summary prospectus and statutory prospectus, as specified in SEC rules. The required information includes, among other things, a bar chart showing the fund’s annual total returns for each of the last 10 calendar years (or for the period that the fund has existed if less than 10 years); information on the fund’s highest and lowest quarterly return during the period covered by the bar chart; and a table showing the fund’s average annual total returns for the one-, five-, and ten-year periods (as applicable), along with similar information for an appropriate broad-based securities market index. The SEC regulates the manner in which funds calculate returns.

In their annual shareholder reports, mutual funds also are required to provide a line graph comparing the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years to those of an appropriate broad-based securities market index, and the fund’s average annual total returns for the most recent one, five, and 10 years.

While not required to do so, funds also include performance information in a variety of other media, including newspaper advertisements, fund fact sheets, and websites. Both the SEC and FINRA regulate the presentation of mutual fund performance information.

For target date funds that are investment options in defined contribution plans, performance information may also be available on the website of the plan or the plan’s recordkeeper.

Target Date Funds in Retirement Plans

Who picks the funds used in retirement plans?

Every benefit plan operated under the Employee Retirement Income Security Act of 1974 has a plan fiduciary. In the case of retirement plans, this is usually a representative of the employer sponsoring the plan. The plan fiduciary is responsible for selecting and monitoring all plan investment options, including target date funds. As with any other plan investment option, participants can invest in target date funds only after the funds are vetted by plan fiduciaries in accordance with ERISA standards.

How can a retirement plan participant invest in these funds?

Participants may invest in the target date fund by affirmatively electing to invest in a target date fund, if a retirement plan includes target date funds in its investment menu. Additionally, an employee’s DC account may be invested in a target date fund by default if (a) the plan fiduciary has selected target date funds as a default investment; (b) the employee has not given affirmative instructions to select investments; and (c) the employee has received information in advance about the plan’s investment options and his or her opportunity to select investments for the account.

All participants have the option to change how their accounts are invested. Some plans only allow changes at specified intervals, but most plans allow changes at any time.

I’ve heard that target date mutual funds used in retirement plans aren’t regulated. Is that true?

Absolutely not. When target date funds are used in retirement plans, plan fiduciaries must comply with ERISA’s fiduciary obligations in selecting and monitoring target date funds as investment options. A plan’s fiduciary—usually a representative of the employer—selects and monitors target date funds for use in the plan’s investment lineup. In doing so, the fiduciary must comply with a comprehensive set of ERISA obligations that require it to act with prudence and for the exclusive benefit of the plan and its participants. These regulations prohibit self-dealing and restrict conflicts of interest, among other practices.

Target date funds offered by mutual fund companies are subject to the Investment Company Act of 1940, like any other mutual fund.4 The SEC has broad powers under the 1940 Act to regulate the activities of mutual funds in the public interest and for the protection of investors. The 1940 Act imposes detailed requirements and prohibitions on the structure, governance, and day-to-day operations of mutual funds—rules designed to provide investors with adequate information, protect fund assets, prohibit or regulate conflicts of interest and self-dealing, and ensure fair valuation of investor purchases and redemptions. Target date funds often operate as funds of funds—funds that invest in other mutual funds—which must meet additional, strict requirements under the 1940 Act.

Mutual funds are also subject to regulation under the disclosure and advertising rules of the Securities Act of 1933. Target date mutual funds explain their asset allocation approaches and glide paths in disclosure documents required by the SEC. Fund advertising materials intended for retail investors are reviewed by FINRA and must comply with SEC and FINRA requirements designed to assure these materials are not misleading. Underwriters and brokers who sell mutual fund shares are subject to the Securities Exchange Act of 1934 and the regulations of FINRA. Advisers to mutual funds are subject to regulation under the Investment Advisers Act of 1940.

Qualified Default Investment Alternatives (QDIAs) and Target Date Funds

What are “default” investments, and why do 401(k) plans need them?

Under some circumstances, an employee enrolled in a 401(k) plan fails to give affirmative instructions for investing his or her account. In those cases, a plan needs default investments to invest that employee’s contributions.

Default investments are especially important in a plan that uses automatic enrollment. In such plans, employees receive advance notice that they will be automatically enrolled in the plan, along with information about the default investment and how to invest in other plan investment options. If they do not take the opportunity to select investments for their accounts, the plan will invest their contributions and any employer contributions on their behalf in the plan’s default investment.

What is a “qualified default investment alternative”?

A “qualified default investment alternative” (QDIA) is an investment option in a retirement plan that meets certain requirements prescribed by the U.S. Department of Labor for default investments selected by plan fiduciaries. As part of the Pension Protection Act of 2006, Congress made a number of changes to ERISA to facilitate automatic enrollment in retirement plans. Congress directed the Department of Labor to issue a rule defining what investments could qualify as default investments. The Department’s rule on QDIAs was implemented in 2007.

Who picks a plan’s QDIA?

Under ERISA, a plan fiduciary is responsible for selecting and monitoring all plan investment options, including its QDIAs.

What types of investments can an employer pick as a plan’s QDIA?

The Labor Department QDIA regulation specifies three types of investments that may be used as long-term QDIAs:

· Target date funds or portfolios (called lifecycle funds or target retirement date funds in the QDIA regulation);

· Balanced funds or portfolios; or

· Managed accounts.

How are QDIAs regulated?

The use of QDIAs in plans is regulated by the Department of Labor. Plan fiduciaries are required to select and monitor QDIAs as they would any other plan investment in the exercise of their fiduciary duties. Before a participant may be invested by default in a QDIA, the plan must provide the participant with a prescribed notice, which includes information about the QDIA and the plan’s other investment options, and give the participant an opportunity to select investments for his or her account.

Why are target date funds appropriate as QDIAs?

Congress mandated that QDIAs must include a mix of asset classes consistent with capital preservation or long-term capital appreciation, or a blend of both. The Department of Labor concluded that target date funds satisfy this mandate.

Target Date Funds After Market Losses

What lessons are fund sponsors likely to draw from performance of target date funds in prior challenging market conditions?

Providers periodically monitor their target date fund designs and performance, and they test the validity of the assumptions underlying the fund’s design. The marketplace for investment products is highly competitive and sensitive to market demands. In response to market volatility, many providers review whether any changes are needed in the design of their funds. Providers also review disclosures and marketing materials for their target date funds with a view to enhancing investor understanding of these products.

October 2014

ENDNOTES

1 This number only includes assets in registered open-end investment companies or mutual funds. The Investment Company Institute tracks data on the assets of registered investment companies and does not have access to data for funds that are not registered investment companies.

2 The EBRI/ICI database includes data on target date funds offered by mutual funds, collective investment trusts, and others. The EBRI/ICI database is the largest, most representative repository of information about individual 401(k) plan participant accounts. As of December 31, 2012, the EBRI/ICI database included statistical information about 24.0 million 401(k) participants, in 64,619 employer-sponsored 401(k) plans, holding $1.536 trillion in assets.

3 See Holden, VanDerhei, Alonso, and Bass, 401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2012, ICI Research Perspective 19, no. 12 (December). Available at www.ici.org/pdf/per19-12.pdf.

4 Some target date funds offered in retirement plans are collective trusts or separate accounts. For example, collective investment funds are bank-administered funds subject to regulation by the Office of the Comptroller of the Currency. This FAQ does not address details of these other regulatory regimes.