In August 2008, Hewlett-Packard Co. completed its $13.9 billion acquisition of Electronic Data Systems Corp. Although the deal made strategic sense and proved to be important for HP’s enterprise business transformation several years later, it presented interesting challenges from a pension management perspective. Just a year earlier HP had essentially immunized its U.S. pension risk by selling public equities, buying long-duration bonds and hedging 100 percent of the interest rate risk. Institutional Investor’s readers surely can see why this move was timely. Public equity peaked in late 2007, at about the time HP was making portfolio changes, and 2008 was such a monumental year that it earned a name in history: the global financial crisis. HP had made the perfect move right before the perfect storm. While most pension plans suffered heavy losses in assets and rising liabilities as a result of plunging interest rates, the HP pension plan was well protected: The funded ratio remained well above 100 percent throughout the crisis. Indeed, for those of us in pension management, there was no bigger victory than this. We held our position at the top of the mountain during the worst financial crisis of our careers.

Our victory dance was rather short, however. With the EDS purchase came EDS’s pension liabilities. The information technology services company’s funded status had plunged to approximately 60 percent during the crisis. After the two pensions merged in late 2009, the combined plan had funded status of just above 80 percent. We suddenly found ourselves in a situation similar to that of most other corporate plan sponsors, which had been fully funded or nearly fully funded before the financial crisis, only to be knocked down. We even cheekily used a picture of Sisyphus in one of our board meetings to suggest that those of us in pension management are, like the mythological Greek king, cursed to continually push an enormous boulder up a hill.

The HP pension plan is in a healthy place today, but we went through our share of ups and downs in funded status over the past decade. Breaking the Sisyphus curse became our mission. It took us years of trial and error to design a new investment strategy that will grow the pension assets and protect the gains when we are near the top.

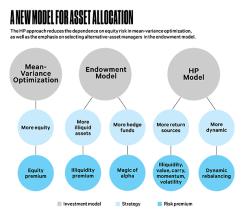

The challenges facing HP in this journey were not unique: ultralow interest rates, fragile economic growth and an uncertain equity market outlook. Yet we took an unconventional approach to solving the problem. We pretended that our portfolio, the investment team’s resources and our governance structure had no constraints, and we sought out the world’s best ideas for our plan. We examined and went beyond the conventional mean-variance optimization approach and the en vogue “endowment model,” and ended up with a dynamic, flexible, asset allocation (beta)–centric framework, in contrast to the traditional manager selection (alpha) approach.

As you are reading this article, I am most likely reading Pride and Prejudice and Zombies in the hammock in my backyard, enjoying the early summer in Northern California. I’ve just recently left HP after 13 years, the last nine on the pension team and the last six as the company’s chief investment officer. So perhaps there is no better time for a little personal reflection on this amazing journey. As much as I am savoring the time off, I already miss the wonderful people at HP and the broader pension community. Unlike the university world — where the competition for students, faculty, sports and endowment management can be intense — the pension world is highly collaborative. Many of the HP team’s peers selflessly shared their insights and experience with us as we went on our quest. It is my hope that the lessons we learned from this journey can resonate and be useful to others facing similar challenges.

When I became CIO of HP in 2010, I was new to the role but not really an investment newbie. I grew up in Taiwan, where my father owned and managed a retail stock brokerage firm. As a child I was intrigued by the stock analysis reports on my father’s desk and would discuss them with him over dinner. I often visited my father at his firm, and he sometimes would allow me to attend client meetings. I would sit silently, listen intently and evaluate what I heard. This early exposure sowed an intense interest in investments. It wasn’t an accident that I decided to work on Wall Street after I graduated from Wellesley College with a BA in mathematics.

Before joining HP’s pension team, I worked in different parts of the value chain of the capital markets for more than a decade. I had experience in new issue origination, primary and secondary offerings, and privately negotiated deals in a variety of asset classes: bonds, public and private equities, derivatives and asset-backed securities. As an investment banker at Merrill Lynch & Co. during the dot-com era, I saw that prices were determined as much by supply and demand of capital and comparisons with similar companies as by academic theories of dividend discount models and discounted cash flow models. I witnessed bankers inventing alternative valuation methods to justify high prices (price per click, share of eyeballs, anyone?). In business school at Massachusetts Institute of Technology, I had studied rational models that showed how market prices “should” be set, then I was in the midst of the real-world price-setting mechanism during the tech bubble — quite a contrast to theory.

One of the interesting observations I made during the dot-com bubble was that not all participants were willing. Stories of that era focus on retail investors lured by the promise of Internet riches, but there were even more large institutional investors that either invested passively or had tight tracking-error guidelines with asset managers that forced them to dance while the music was playing regardless of what they actually thought. If greed and animal spirits dominated in the formation of the bubble, there was also a fair amount of fear from the unwilling participants toward the end of the mania. Contrary to popular belief, it’s not difficult to know when markets are in a bubble; value is one of the easiest things to observe. It’s predicting when bubbles will burst that makes investing challenging, as they can be prolonged by these large but unwilling participants.

On the other end of market action, I was a McKinsey & Co. consultant, assisting large financial institutions in their restructuring efforts during the 1997 Asian financial crisis. My client was a large European bank interested in buying local Asian banks following the crisis to expand into the region. I saw how long and how severe the dislocation could be when markets were in distress, moving prices far beyond intrinsic values, even well below book values. I learned the two things that had the most lasting impact on me as an investor: first, the importance of liquidity and dry powder; second, the impact that regulation can have on financial markets.

Those struggling Asian banks were local and highly regulated. When they needed capital infusions, there were not many local or even regional banks left that hadn’t also been affected by the crisis. Though some were unwilling and nationalistic, many governments ultimately changed regulations to allow foreign banks to enter the markets to rescue the local banks. Foreign banks had not been allowed in local markets up to that point, but the market distress entirely changed the landscape. Those foreign banks with dry powder to exploit the opportunities were richly rewarded.

Witnessing these extreme market experiences was like going back to school and reevaluating what I had been taught. Are markets efficient? Yes, mostly, but sometimes no. Are investors rational, and will they choose the asset with the higher expected return given the same risk profile? Yes, mostly, but sometimes no. Do investors invest along the efficient frontier in alignment with their stated risk profiles and preferences? Almost never. My career had been a lesson about the gap between investment theory and reality. Other than “buy low, sell high,” I did not embrace any investing religion; I wasn’t ready to sign up as a value or a growth investor. As such, my HP team and I tried to keep an open eye and an open mind. Other than that, we tended to shy away from trendy investment styles.

I joined HP’s corporate development team in 2003, after my bruising sell-side experience. One of the key reasons I decided to move in-house was the prospect of removing the principal-agent conflict that I had witnessed often on Wall Street. Additionally, as part of the corporate development team of a company with more than $100 billion in annual revenue, I was able to get exposure to corporate venture investing, minority equity investments and mergers and acquisitions of meaningful scale from the buy-side perspective. But I was also aware that HP had a sophisticated pension investment team, a wholly owned asset management subsidiary called Shoreline Investment Management Co., that oversaw various benefit plan assets. HP had a policy of promoting young talent from within before hiring externally. So when there was an opening at Shoreline, I jumped at the opportunity and joined the team in 2007, just in time to execute the massive immunization strategy before the crisis.

What HP did between 2007 and 2010, led by then-CIO Ken Frier, was innovative and appeared somewhat experimental at the time, but it made tremendous sense to me. Though the asset management industry calls it liability-driven investing, or LDI, it’s really about examining the risk-reward payoff for the plan and available asset classes, and acting or reacting in a dynamic way. The philosophy boils down to: “We will take risk for the plan when we have to, and we will take risk where the payoff is best. If we don’t need the risk or if the reward is not worth the risk, then we won’t take it.” The plan used derivatives and not a small amount of leverage to reduce risk, especially if the risk was not well compensated. It had the agility to take on more risk after the financial crisis, using its dry powder in areas such as credit and secondary private equities. This sounds like common sense, but the risk management mind-set, the dynamic approach to investing and the willingness and ability to act (and react) to market movements were certainly not common in the corporate pension world — or among any institutional investors, for that matter.

When I took over as CIO from Ken, I knew the company’s board and senior management had high expectations. Ken had guided the plan through the financial crisis and taken advantage of the markets’ subsequent rebound exceptionally well. I didn’t want to disappoint, but I also didn’t want to just follow the course. The market dynamics had certainly changed given unprecedented central bank interventions, the lingering fragility of the world financial system and growing concerns over the euro zone economy and its common currency.

Our first step in charting our path forward was to examine the existing asset allocation frameworks. There were two general approaches: the mean-variance optimization method used by most pension plans and consultants, and the Yale University approach favored by large schools, commonly referred to as the endowment model.

The mean-variance model is the result of Modern Portfolio Theory (MPT), introduced by Harry Markowitz in the 1950s, and it is still the most dominant portfolio construction method. It’s a fairly simple mathematical exercise to maximize a portfolio’s expected return subject to a given level of volatility with a menu of available asset classes in a portfolio. Because there is nothing special about the mathematical exercise, what drives different results is how accurately a particular modeler can forecast the portfolio’s ingredients before going into the optimization process — that is, the expected returns, volatility and correlation relationships of asset classes, including U.S. stocks, international stocks, Treasury bonds, private equity and hedge funds. So is the secret sauce of investment success simply being better at forecasting?

Our team had access to numerous investment consultants and asset management firms that produce asset-class forecasts. Over the years, HP has collected capital market assumptions from these various sources to compare the ingredients before they go into the optimization process. We analyzed not only the quarter-to-quarter and year-to-year changes to these forecasts but also the variance by the forecasters in a single asset class. The unfortunate truth is that these assumptions don’t change very much from year to year, if at all. The variance in the expected return of a single asset class is also quite small. It reminded me a bit of the Institutional Brokers’ Estimate System (I/B/E/S) consensus of price and earnings forecasts. So while industry practice is to look at these assumptions every three years or so to reset strategic allocations, if the inputs don’t change much, the resulting strategic allocation won’t change much either.

As with others before us, it did not take us very long to realize the limitations of the mean-variance optimization approach. The main problem, as described above, is that there is simply no evidence of consistent forecasting ability by any party. The mathematical model is so sensitive to the expected return assumptions that it’s no wonder most users use extremely long-term, normalized expected returns and then rationalize the output with constraints.

Another realization was that although these assumptions and models are static, we know from empirical evidence that the markets most certainly are not. The conventional wisdom says that ten years is long enough for a market cycle, and if this is true, we should expect that in most ten-year periods there will be some up markets and down markets but the annualized return should be within a reasonable range. In reality, since the 1950s a 60-40 portfolio (60 percent in equities and 40 percent in bonds) averages returns of about 6 percent a year, but the returns for a ten-year period can be as low as zero for the 1970s and 2000s or as high as almost 12 percent in the 1980s and 1990s.

Running an investment portfolio with a static approach is like wearing the same outfit in all weather conditions. The average temperature in New York is 55 degrees Fahrenheit. A New Yorker could dress for the average day every day, but the unfortunate result would be a lack of comfort most of the year. In the same way, “policy portfolio” allocations are set for long-term average conditions, which are rarely experienced in any given year. Just as our New Yorker would be woefully unprepared for a blizzard or a heat wave, policy portfolio constructions will tend to be quite wrong at the worst possible times. It would be challenging to be a CIO in one of those decades.

Under the traditional approach, to increase the return for our plan assets we could simply increase our allocation to equities. However, doing so would have alarming consequences:

• A portfolio with a 60 percent allocation to equities is dominated by equity risk (greater than 90 percent of total portfolio risk). It doesn’t seem prudent to take such concentrated risk. We all know that diversification is the only free lunch in finance, yet most pension plans have extremely concentrated risk in a single factor — equities. It would be far more sensible to avoid putting all the eggs in the equity basket than to further increase the equity allocation.

• Corporate pension plans are particularly exposed to equity bear markets. When the equity market is experiencing a downturn, it’s likely that the corporate plan sponsor is experiencing a similar downturn in its core businesses. This would be the worst time to turn to the sponsor for more contributions, and the time when the plan would have the greatest need.

How about the Yale model? Could it be the Holy Grail solution for us? Like everyone else, we were aware of and impressed by its results: As of June 2015 the Yale endowment portfolio had a 20-year annualized return of 13.7 percent, a remarkable 6.4 percentage points ahead of global equities per year. When I was a fresh MBA graduate, I had read David Swensen’s Pioneering Portfolio Management cover to cover. But that was back in 2000, and by 2010 the approach was starting to feel rather mainstream. Before making a decision to replicate the Yale model, we asked ourselves, Is the success of this model likely to continue in the future, and can it be replicated?

Indeed, consider the capital cycle we all know: A business makes outsize profits, and such outsize profits attract competition and overinvestment, which in turn reduce profit margins. At times the competition and overinvestment get so overheated that profit margins become unsustainably low. Eventually, the weaker competitors are driven out of the market, and the cycle begins all over again. As the endowment model continues to gain traction and popularity, it appears to be logical for us to ask, Where are we in the investment-style cycle, and is the endowment style of investing likely to produce continued success in the next five to ten years?

The endowment style of investing typically is characterized by a significant allocation to private, illiquid asset classes and hedge funds, sometimes referred to as alternative asset classes, in contrast to public equity and fixed income. It seeks to generate additional return through skillful selection of managers, as these investors are given a much higher degree of freedom to pursue opportunities than traditional managers, who are measured with a tight benchmark and guidelines.

There were many reasons we were cautious with the endowment model and wanted to fully investigate before jumping in. First, the managers in these alternative asset classes are very expensive; they typically charge management fees of 2 percent of assets on top of performance-based fees that are often 20 percent of any return greater than zero. Second, the term “illiquidity” is not adequate in describing the complexity of investing in alternatives. Some of the underlying asset classes are illiquid in nature, and that binds these investments with managers; in other words, if we lost confidence with a certain manager because of turnover or a change in investment style, we could not easily fire the manager and get our money back. Third, investing in alternatives is labor-intensive. We would likely need to invest in hundreds of these private partnerships to build a diversified portfolio big enough to make a difference for a pension plan of our size.

HP was not new to alternatives investing. Thanks to our location and legacy, the company was an early investor with many leading venture capital firms in Silicon Valley. We were fully aware of the access issue, and I was lucky to have inherited an excellent venture portfolio from HP’s previous pension investment teams. I was also aware that at times pension investors have been perceived as dumb money and may not carry as much prestige and negotiation power as the likes of Yale, Harvard and others, which could strike more-favorable side-letter terms than we could have. Paradoxically, we began to hear from many of the previously unavailable asset managers after the financial crisis, as they sought to diversify their investor bases. They knew HP had dry powder.

From the CIO’s perspective we would have had to invest heavily in head count if we wanted to embrace the endowment model. And to have a chance of succeeding, this team would have needed to be better than its peers at more-established organizations. Tilting the investment office to accommodate the endowment model would have meant a resource shift from other areas, such as risk management and our portfolio beta overlay practice. This was a big decision; I was willing to make the necessary changes, but only if we had conviction.

Our analysis found that although the endowment model was not dead, it certainly was getting very crowded. Additional returns available from that alternatives-heavy style were diminishing from their peak. And as mentioned, we had doubts about whether the model itself could be successfully replicated by us at that time.

The first concern was the supply and demand of this type of illiquid investing. Our investigation showed that there continued to be strong demand from institutional investors to enter the private, illiquid asset classes. According to Preqin and many other market research firms, there have been record numbers of funds and amounts raised for private equity. Indeed, dry powder (in this case defined as capital committed by limited partners not yet called or deployed) exceeded $1 trillion from 2007 to 2009, when the industry slowly digested record fundraising from immediately before the financial crisis. From 2010 to 2012 we saw significant private equity activity in the market, but deployment could not keep up with the supply of new capital. Dry powder for the industry has exceeded $1 trillion every year since 2013. In practice, we knew that the total investable assets were likely higher than reported. Over the previous five years, pressure to reduce fees had driven many large sovereign wealth funds and pension plans to initiate co-investment programs; the supply of capital added by these programs was difficult to gauge, but we didn’t need more convincing about the looming difficulty of deploying capital.

The second worry, which was somewhat scrutinized after the financial crisis, was that the major endowments had failed to avoid downside risk. We looked at the asset allocations of the three largest college endowments (see table, “Alternative Reality”). The heavy use of alternatives was intended to provide diversification from traditional assets, especially public equity, but it did not seem to work, at least not during the crisis. Our examination also showed that, in terms of asset allocation philosophy, although the three largest endowments relied heavily on alternatives, within their allocations they seemed to differ in their preferences: Harvard was much more invested in natural resources, whereas Yale made a big bet in real estate. Despite these differences, the three underperformed in stunningly similar fashion in the 2008–’09 fiscal year.

Outside the top three endowments, the investment performance of the average endowment, as reported by the National Association of College and University Business Officers (NACUBO), versus the performance of a traditional 60-40 portfolio was almost exactly the same in the ten years ended in 2014. Moreover, the correlation between the annual performance of the average endowment and that of global stocks over the past decade was 0.99. Despite the efforts to increase investment complexity and provide diversification from the first-generation mean-variance optimization model, there was no evidence that the second-generation effort — the endowment model — was effective in providing diversification or downside protection for the average investor.

The third concern we had was about lagged valuation, lack of transparency and degrees of difficulty in providing third-party pricing, and the impact on fair-value accounting. This is perhaps an issue that’s more critical for corporate pension plans than for private endowments and foundations. From an accounting perspective nearly all of the alternative asset classes that define the characteristics of the endowment model fall into the Level 3 asset class. These assets are defined as financial assets whose values are not based on readily observable, frequently traded markets and therefore require inputs from management’s own assumptions and expectations. In the wake of the financial crisis, Level 3 assets must be reported by all publicly traded companies. Not surprisingly, the allocation by a corporate pension plan into these assets will have an impact on its parent sponsor’s balance sheet.

By this point, we had doubts about our ability to compete with larger, more well-resourced organizations when pursuing the endowment model. We also recognized that being an average investor in the endowment model might not be attractive in the future, as these alternative asset classes had become crowded trades. And we were concerned that the lack of diversification and downside protection, coupled with accounting constraints, could have negative consequences if we experienced another major market downturn.

In December 2012 we presented our findings to our investment committee and recommended a new approach (we immodestly called it the HP model). The next month we took our ideas to HP’s board of directors, which had received a fair amount of criticism over the years. My experience with the board, however, had always been positive, and I was heartened by the thoughtful questions and intellectual debate when we outlined our strategy. No one asked, “What are other pensions doing?” Instead, they inquired, “What’s the best approach for us?”

It had taken us a few years to get to this point, but once our new investment strategy was approved, our team was energized to embark on the next leg of the journey. We decided to employ a diversified and dynamic model with an emphasis on asset allocation as a main portfolio strategy rather than manager selection (as in the endowment model). Now our approach has four key tenets:

• Employ risk-aware asset allocation that frequently adjusts the total portfolio exposure by using derivative overlays.

• Reduce the dependence on equity risk, with more real diversification from return sources other than equity and equitylike betas.

• Keep the portfolio liquid to take advantage of infrequent but severe market dislocations.

• Protect any gains in funded status by locking them in.

To implement the new strategy, we had to change our investment process and governance structure. We needed to enhance asset allocation to be risk-aware and dynamic. We started by taking a glide-path approach to determining strategic asset allocation, based on the risk-return target of the total portfolio. Now the CIO has the ability to move the allocation to risk asset classes by plus or minus 10 percent based on real-time market conditions: current prices, volatility, expected returns and risk factors. Adjustments to the desired target level are often executed via derivatives overlays (equity, currency and interest rates) rather than by moving physical assets. This has the advantage of minimizing transaction costs, facilitating quick response times and separating alpha (skill-based outperformance) and beta (market returns).

In the new model the asset-class heads are responsible not only for manager selection in their own coverage areas but also for reporting the current conditions and outlooks in an unbiased way in the monthly investment team meetings. As a result, our investment meetings have evolved from discussions about existing and potential external managers to what’s happening in the asset classes we cover. This allows the team to break down silos and connect information among asset classes.

We also changed our governance structure. In the past we had to get specific approval from the investment committee to make changes to asset-class exposures. In the current approach the investment committee and investment team agree ahead of time on a dynamic risk budget, glide path and trigger levels to make changes. Because we monitor the portfolio daily, the investment team can react quickly to adapt to current market conditions, and we notify the investment committee in the subsequent regularly scheduled meeting on the actions taken.

A key element of the HP model is to expand beyond the traditional equity and illiquidity risk premiums to find different sources of return that are not solely dependent on world economic growth or equity market gains. The portfolio has many more relative-value (long-short) positions in different asset classes and markets than traditional approaches do. For instance, there is more reliance on the value of one stock market versus another, or one country’s sovereign bonds versus those of another, as well as more long-short factor positions, using value, carry, trend and volatility. All these are scaled relative to the total portfolio risk.

Although this type of strategy has recently gained traction with investors, HP was among the early adopters and able to negotiate more-favorable fees with these external managers. While these factors — or smart beta or alternative betas — are still met with some skepticism, we think they are, on average, a useful way to diversify returns, though, as always, one will not have positive results in every period and should stay the course through a market cycle.

Corporate pension plans have liquidity constraints that are more stringent than those of most endowments and foundations, and they are often required to maintain highly liquid portfolios. For a long time this was perceived to be a disadvantage. However, we found that with so much money being dedicated to illiquid, long-term investing, there is an advantage to being more liquid.

Most investors probably overestimate the additional return that can be gained from illiquid investing. We often hear that an investor with a sufficiently long investment horizon is able to take on illiquid investments. That does not address the question of whether the illiquidity risk is worth taking. The most recent financial crisis showed us that investors with too much in illiquid assets were simply not able to take advantage of attractive valuations; because of liquidity constraints many limited partners in 2009 pleaded with the general partners of their external funds to not call capital, to not make investments, thus preventing what would likely have been outstanding investment returns. An institution with sufficient dry powder has the ability to wait for the fat pitch — and swing when it counts the most.

Unlike the equity risk premium, illiquidity risk premiums are not easily calculated. One can’t easily pull that number from Bloomberg. In recent years there has been a greater academic research effort to define and calculate the actual illiquidity risk premium. Nonetheless, just like the equity risk premium, the illiquidity risk premium will change over time — and when the illiquidity risk premium is small, it may not be worth taking.

Although Sisyphus has been our guiding companion on this journey, we know from our experience that it is possible to lock in the fully funded status for good, as HP did in 2007 to weather the storm. The key is, how do we maximize our chance of getting there? When our funded status dropped, we reintroduced investment risk to our plan to grow the assets faster than the liabilities. We added higher-risk assets to the portfolio and moved to less than 100 percent hedge coverage of the interest rate risk of the liabilities. After we made these changes, any large increase in public equity values or rise in interest rates improved the funded status. Every time the funded status improved, we reduced the risk that led to the improvement, hence reducing the probability of a funded status decline. Suppose every time Sisyphus gained altitude, he stopped and erected a strong barrier just downhill from the boulder. That’s what our dynamic de-risking approach does for HP. It’s a ratchet process: Every gain is followed by a portfolio adjustment to protect that gain.

This dynamic rebalancing proved to be very beneficial. For instance, interest rates have mostly fallen in recent years. That has been detrimental to the funded status of many other corporate pension plans. But there have been enough large up and down cycles in rates for HP’s dynamic interest rate–hedging approach to contribute meaningfully to improving the funded status.

John Maynard Keynes famously said, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.” Indeed, it was quite an unlikely and unconventional journey that my team and I took to find success. Over the years, many of my CIO peers who were familiar with the HP story told me how lucky I was to be able to do things differently. First and foremost, I had the backing of our investment committee to do what we believed to be right even when there was no one else doing the same thing. Second, I had the backing of my team members, who were intellectually curious, talented and very hardworking, and willing to challenge conventional wisdom. The stars were aligned for us — the right place, right time and right people.

Any investor who wishes to outperform the average must possess at least one of the following: an information advantage, an analytical advantage or a behavioral advantage. In today’s environment the kind of information advantage available to a select few is difficult to come by. Similarly, it’s hard to see any significant analytical advantage that one organization can possess over another. In the past I have heard arguments that hedge funds have an analytical advantage because “we hire the best people” or “high pay attracts the best talent.” But the data simply doesn’t support such claims; the best people are not always motivated by money alone. Recent disappointing performance from the typical hedge fund manager perhaps proves this costly lesson: There is no magic of alpha.

What is left, and perhaps most controversial, is the behavioral advantage that can be exploited by investors, especially institutional investors. I believe the key to the HP model was behavioral advantage in introducing a dynamic and flexible approach to asset allocation, whereas the previous frameworks were static. If chasing alpha is getting harder in most asset classes, including alternatives, then better beta management must be the way forward. That’s the lesson of our journey in the past decade.

When I started at HP, the company logo had the word “invent” in it. The logo has changed over the years, but the spirit remains — and it was alive and well in the small, “can do” pension investment team. Despite our small team and limited resources, we built and tested many frameworks from scratch; it was more like working in a garage than in a Fortune 50 global company. As I wrap up my career at HP, this garage experience is what I will remember most fondly — and proudly. Whatever I choose to do next, I look forward to bringing this inventive spirit with me. •