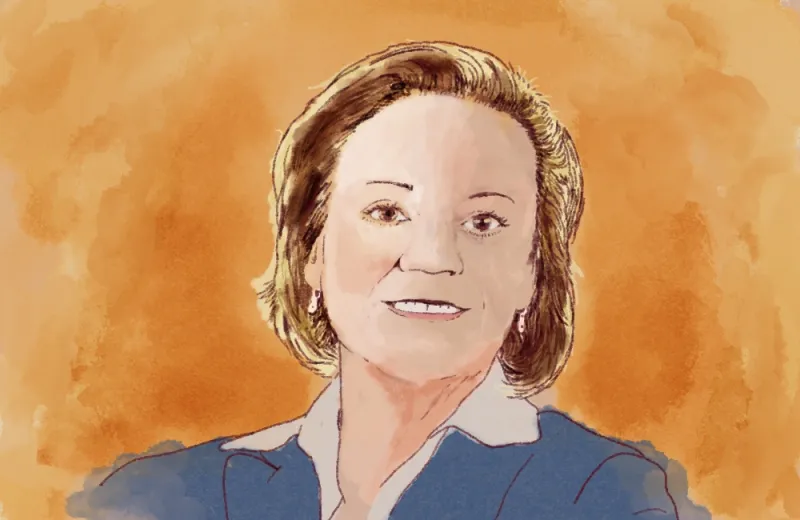

Now that she’s no longer a full-time fiduciary, Susan Ridlen wants to share and expand her institutional knowledge.

The 2023 Lifetime Achievement Award winner may have retired as Eli Lilly’s investment chief, but the celebrated allocator is still “hoping to stay very involved in the industry” — just on her own terms.

“I miss it already. I really do,” Ridlen told Institutional Investor over video. “I’m not leaving the institutional world. I’m just evolving my involvement in it to something a little bit more flexible.”

After overseeing Lilly’s U.S. and Puerto Rican retirement plans for nearly 21 years, Ridlen is still looking to share her institutional knowledge through board and advisory work. “I don't want to work 70 hours a week anymore, but I'd love to have one or two more board opportunities,” she said.

When Ridlen retired in August, she left behind a robust, resilient $25 billion portfolio that Lilly then outsourced to Goldman Sachs. As CIO, Ridlen regularly made the case to senior leadership for keeping the plan in-house — a strategy she assumed would continue upon her departure.

“I took an extremely active role in working with HR and the finance function in demonstrating to them what the economic value was of this plan, not just for participants, but for shareholders,” she said.

Over two decades, Ridlen repeatedly “showed numbers of CFOs and numbers of CEOs why” keeping the plan in-house “was economically the right thing to do for the bottom line.”

So when Ridlen announced her plan to retire in August, she assumed the Indianapolis-based pharma giant would continue managing the portfolio in-house, with her deputy assuming the role of CIO. Instead, Lilly opted to outsource to Goldman.

The Decision to Outsource “A Shock”

When Ridlen learned the news that Lilly was outsourcing, she “was a little bit surprised that Lilly decided to go in this direction.”

“That was not my choice, and it was a bit of a shock,” she said. “I didn't think Lilly was going to do that with an open plan.”

Though Ridlen didn’t receive the full rationale behind the decision, she noted that Lilly has been outsourcing many functions that are noncore to pharma since announcing executive leadership changes aimed at sharpening its focus on U.S. operations announced in May.

Goldman confirmed that Ridlen’s team will not be joining the OCIO giant as part of the transition. An Eli Lilly spokesperson declined to comment on the specifics of the decision.

Lilly’s move also reflects a broader industry trend where more plan sponsors are outsourcing, with OCIO assets projected to reach $4.2 trillion by 2028.

“There are… a few others right behind me that haven’t been maybe signed on the bottom line,” Ridlen said, referring to peers under pressure to outsource. “It’s just easier to hand it over to somebody and say, ‘you guys are the experts.’”

While Goldman will now manage the portfolio, Ridlen hopes the company continues to recognize and preserve the economic value the plan has delivered.

Ridlen is currently involved with two not-for-profits, including a cancer foundation where she’s served on the board for 13 years, and is looking to expand her board work, particularly with foundations and endowments.

“What's so lovely about this industry is… you can share a lot of your learnings and it's not competitive. It's an industry that's very supportive of each other,” she said. As Ridlen sees it, her thoughts on allocation, rebalancing, or liquidity management “aren't competitive strategies; those are just great learnings to share.”