Erik Norland, CME Group

At a Glance:

- Mexican equities offer potential diversification opportunities from U.S. stocks because of their historically low correlation.

- When looking at total returns for each index, it’s important to consider currency performance.

As U.S. stocks continue to hit record highs, some investors might be looking beyond its borders for portfolio diversification. Mexico, with its distinct economic landscape and newly introduced futures contract on the Mexican S&P BMV IPC index, may present an opportunity. It's a timely question to ask: Are Mexican stocks a bargain compared to their U.S. counterparts?

Valuation and Industry Differences

When examining price-to-earnings ratios, Mexican stocks appear to be significantly cheaper compared to their U.S. counterparts. The S&P 500 is trading at around 25 times its estimated 2025 earnings, whereas the Mexican stock market is valued at just 13 times earnings.

However, this valuation gap is complicated by macroeconomic factors. Mexican interest rates are currently double those in the U.S. and this higher rate environment translates into a higher discount factor applied to Mexican earnings, making the relative value proposition on a price-to-earnings basis somewhat ambiguous. But there's a lot more to know beyond valuation levels about Mexican equities.

Comparing Performance: Local vs. Same Currency

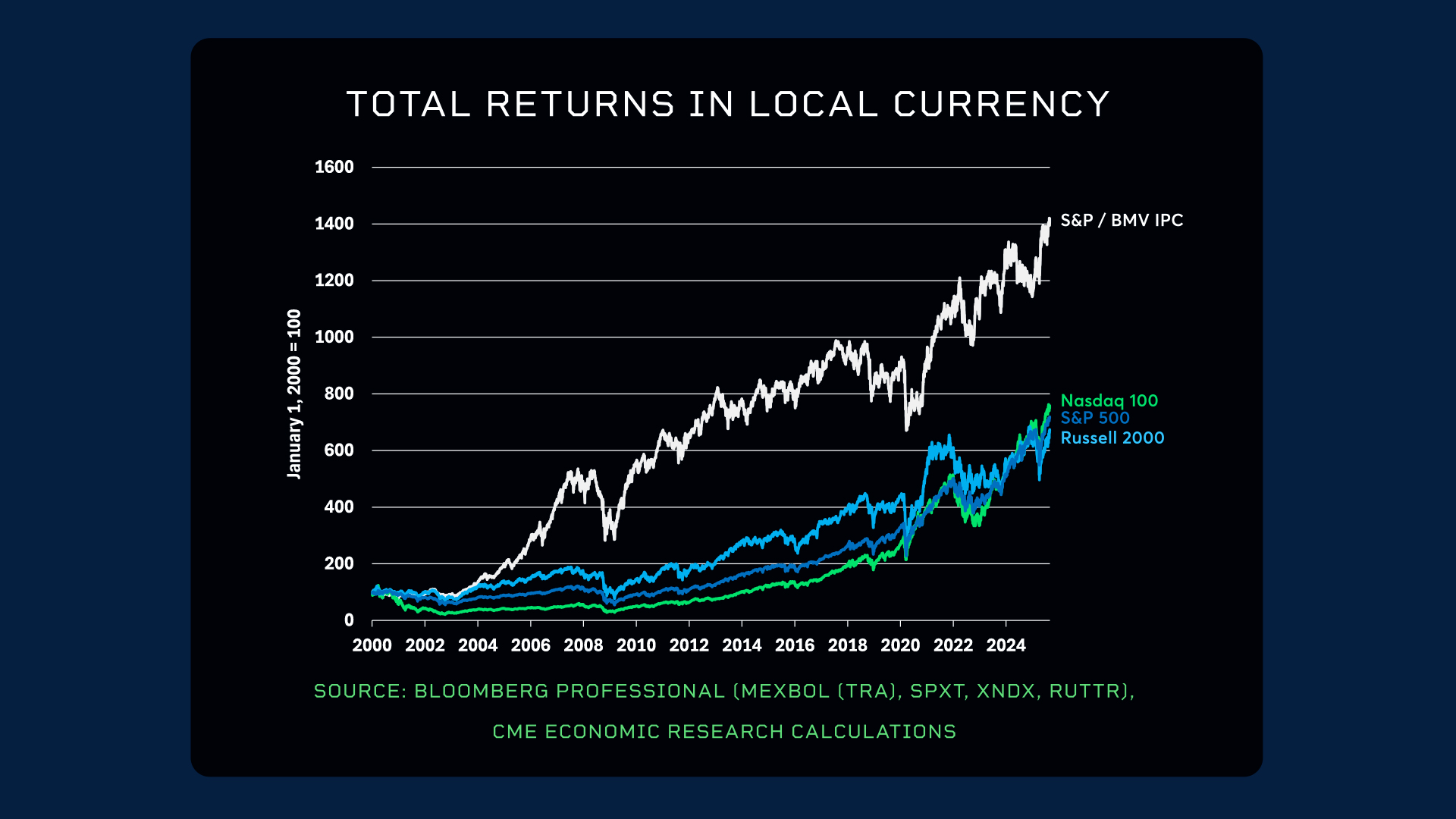

Looking back to the year 2000, Mexican equities have shown strong performance in local currency terms. The S&P/BMV IPC Index has delivered returns roughly twice those of the Russell 2000, Nasdaq 100 and S&P 500.

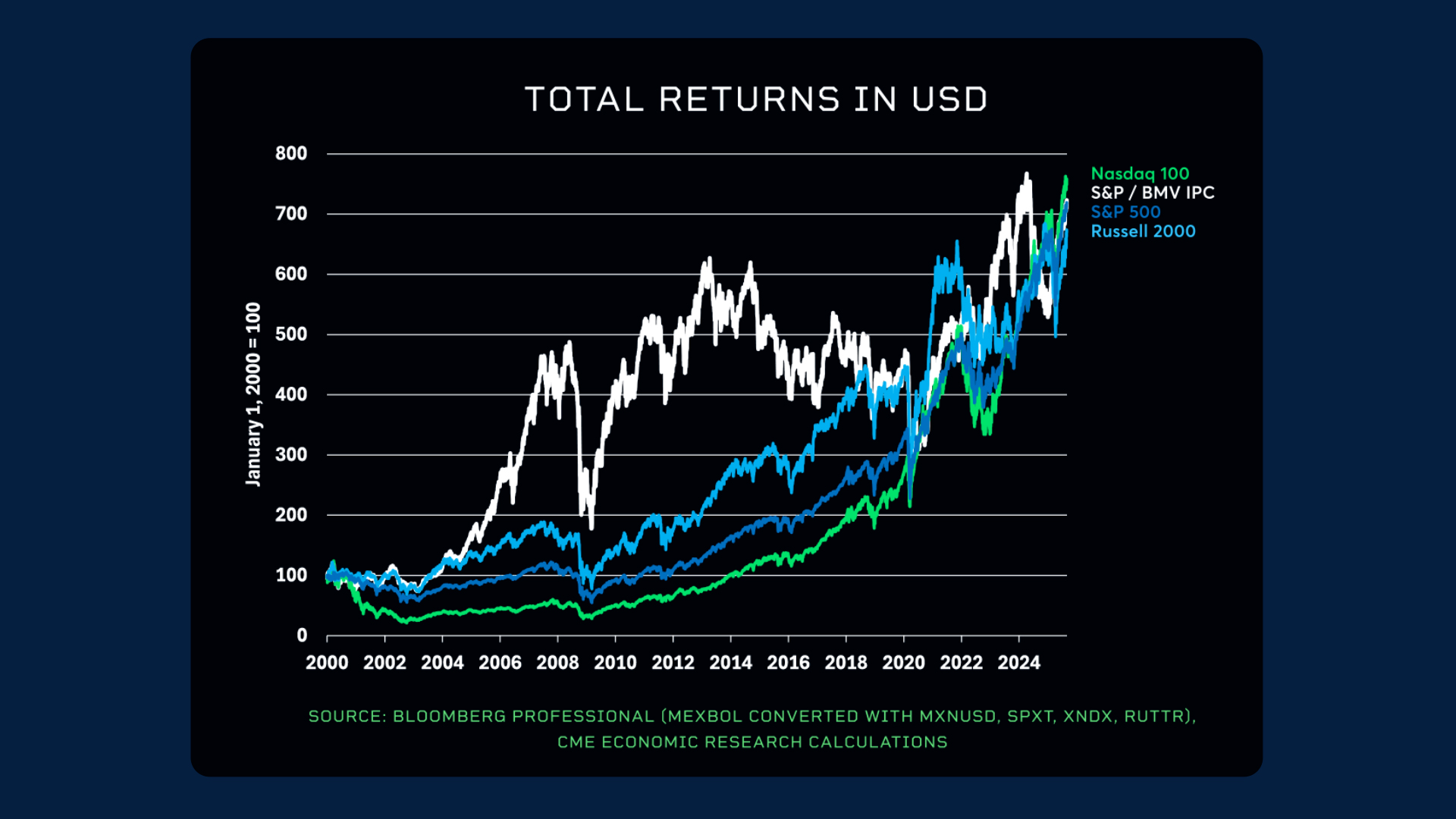

However, the Mexican peso has depreciated by about 50% against the U.S. dollar over the same period. When viewed in U.S. dollar terms, Mexico's stock market has returned almost the same as the major U.S. indices since 2000.

What's particularly noteworthy is the timing of these returns. From 2000 to 2012, Mexican stocks were the standout performers. Since 2012, U.S. stocks have taken the lead. This suggests that Mexican equities and U.S. stocks have delivered different returns at different times, making the Mexican market a potential portfolio diversifier.

The Case for Portfolio Diversification

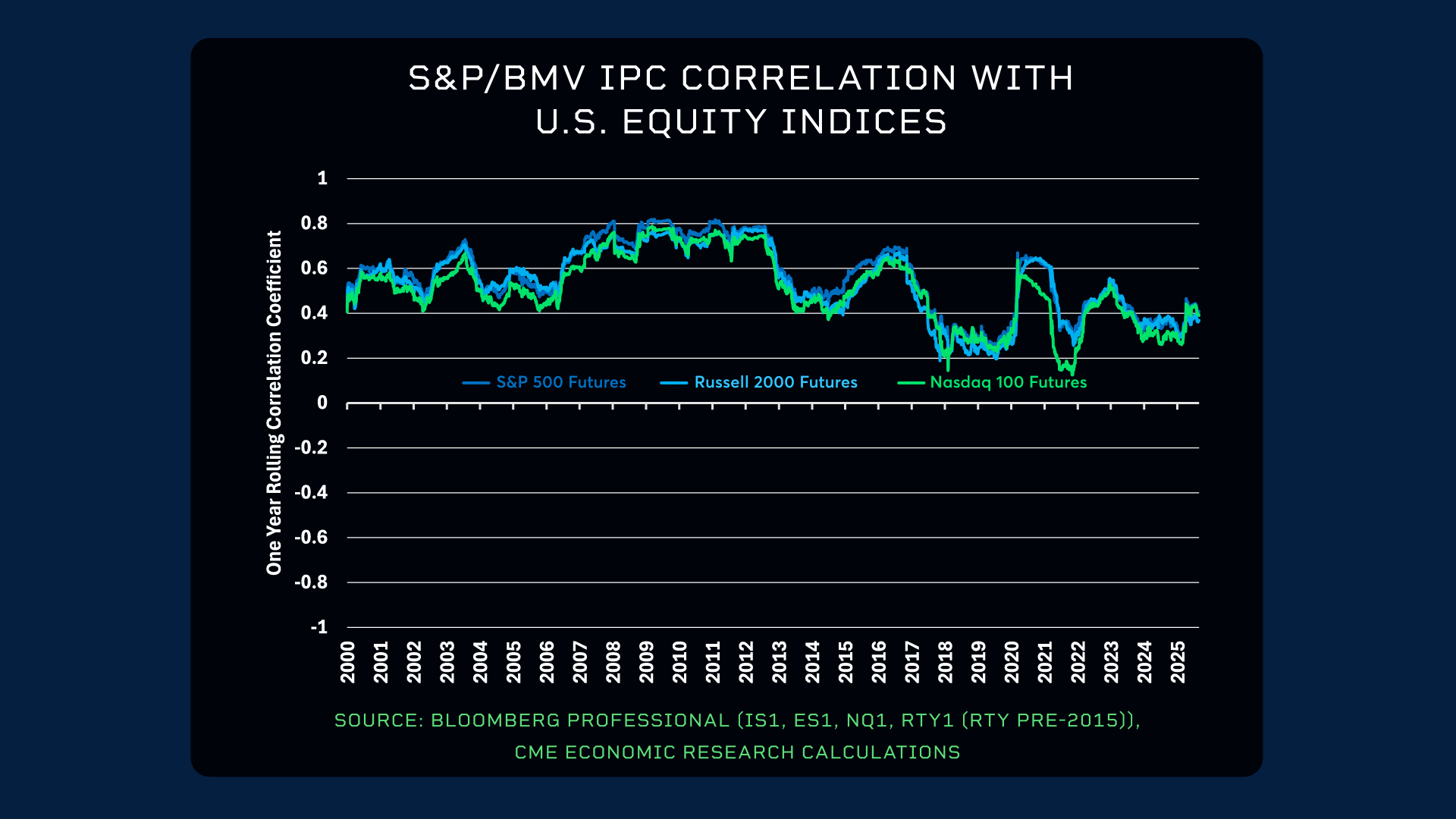

The one year rolling correlation coefficient between Mexican and U.S. stocks over the past dozen years has averaged around +0.4, indicating a relatively weak correlation.

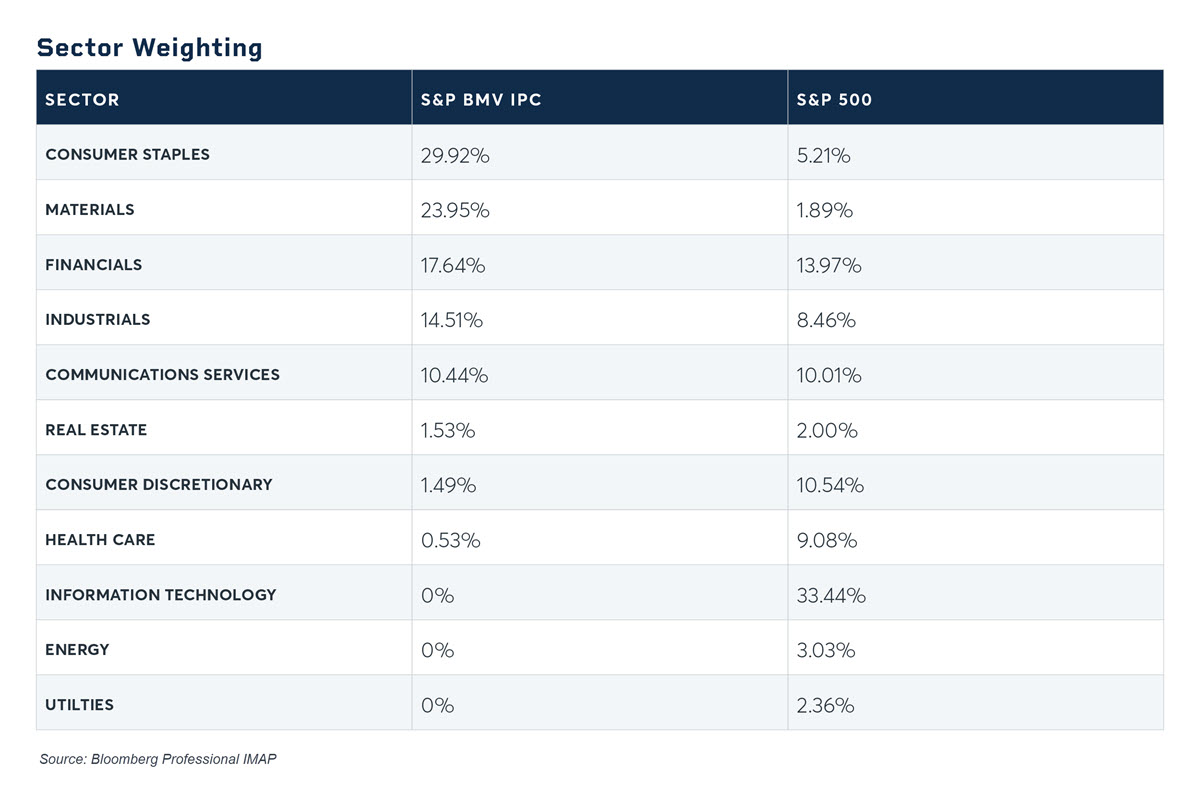

The sector composition of the Mexican stock market also differs significantly from that of the U.S. The Mexican market is heavily weighted toward consumer staples, materials, industrials and financials, while technology stocks make up over one-third of the S&P 500's value. This divergence in sector composition further explains the low correlation.

Given these factors, Mexican stocks could be an intriguing diversification opportunity for U.S. market portfolios.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer. Copyright © 2025 CME Group Inc.