Alternative strategies can be programmed to deliver a dizzying variety of return patterns. To cut through the clutter, investors can start by understanding the settings a manager uses.

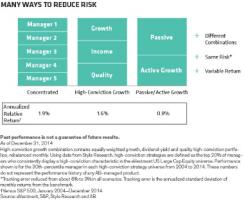

The number of alternative strategies continues to grow, but category definitions remain a lot broader than equity categories. Because alternative managers can follow so many approaches, their return patterns may vary substantially (see chart 1). A few commonsense steps can help you pin down which strategy makes sense for you.

First, ask yourself what you really want from an alternative investment — and be specific. What balance of return potential, diversification and downside protection is most appropriate for you? How much of each thing do you really want?

Once you’ve set those criteria, you can identify which alternative subcategory to focus on. Then you can start zeroing in on a manager with a philosophy and approach that are able to deliver the balance you need.

The key here is to understand three manager decisions that act like levers in defining a strategy’s potential return patterns:

Type of market risk. A manager’s choice, such as a specific geographic focus, market cap and even sector specialization, can tell a lot about the likely direction of the returns of the fund in question. Let’s say you buy a long-short equity strategy to hedge your market risk, and the long positions in the strategy are U.S. large-cap stocks. If U.S. large-caps decline, your alternative strategy will probably decline too.

Amount of market risk. The second lever defines how great a decline your strategy can cause when the market is down. Some managers take more risk than the market — in technical terms, their beta is greater than 1. Other managers take less risk than the market, or a beta of less than 1. If strategies vary their betas over time, the performance gaps can be even bigger. The bottom line: Over a full market cycle, two strategies can operate in the same market but deliver very different return experiences.

Structure of market risk. Managers can combine a wide variety of exposures to attain the same amount of market risk. They can mix long stock positions, short positions in specific stocks or market indexes and even cash. Each choice changes the way a strategy behaves, including how it tracks the market and the balance of stock-specific and market risk.

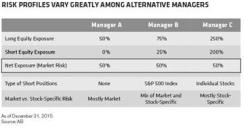

Three hypothetical managers (see chart 2) illustrate how these three levers can influence returns. Each strategy invests in U.S. large caps and has net market exposure of 50 percent — its long exposure net of short exposure is 50 percent. In other words, the first two levers are set the same for each strategy.

These managers use very different portfolio structures, or combinations of risks. Differences in that third lever alone can create very different risk profiles.

Manager A’s performance will move up and down with the market, but its net market exposure is only 50 percent, so it will move only half as much. Manager B has the same 50 percent net market exposure, but it has 75 percent in long stock positions, so it has 25 percent more stock-specific risk than Manager A: 75 percent versus 50 percent. This also means that Manager B has a lower correlation to the market than Manager A.

Then there’s Manager C, also with 50 percent market risk: 250 percent long exposure minus 200 percent short exposure. Because all of C’s positions are in individual stocks, there’s a lot more stock-specific risk than for the other managers. C also likely has the lowest correlation to the large-cap equity market.

So, three alternative managers in the same category can have the same amount of market risk but very different levels of security-specific risk. A has the least, C has the most, and B falls in the middle. The more security-specific risk a manager takes relative to market risk, the more differentiated the overall performance is likely to be.

Alternative managers set and adjust these three levers to define the way their strategies operate. As these levers interact, their impact can multiply, creating the broad return dispersion we see in alternative categories today.

This diversity can be a challenge to navigate, but it can also provide an advantage: better portfolio diversification. No strategy can be all things to all investors. But understanding the settings managers use can help you find a strategy that’s the right fit for your portfolio.

Richard Brink is a managing director in the alternatives and multiasset group at AllianceBernstein in New York.

See AB’s disclaimer.

Get more on hedge funds and alternatives.