Erik Norland, CME Group

AT A GLANCE

- Bitcoin prices rallied after each of the past three halvings, with prices rising by 559% after the most recent halving in 2020

- Despite slowing growth in the bitcoin user network, the recent approval of bitcoin ETFs and the upcoming halving may give bitcoin a lift

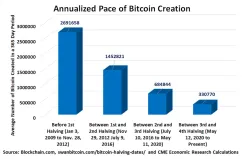

The second halving occurred on July 9, 2016, which dropped annual minting of new bitcoin to around 680,000. The most recent halving happened on May 11, 2020. Since that time, the number of new bitcoins further slowed to around 330,000 per year.

Market Rallied After Past Halvings

The three previous halvings were followed by rallies in bitcoin prices. In the 365 calendar days after the 2012 halving, bitcoin prices soared 8447%. In the 365 days following the 2016 halving, bitcoin prices rose by 290%. In the 365 days after the 2020 halving, bitcoin prices rose by 559%. However, even within the rallies, bitcoin prices remained volatile and experienced corrections of 20%-35% or more.

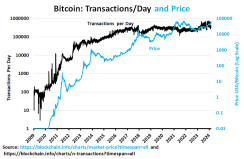

There is no guarantee that bitcoin will rally in response to its upcoming halving. Over time, bitcoin has been losing upward momentum as growth in its user network has slowed. In the beginning, the number of transactions per day was growing exponentially but that growth slowed after 2016.