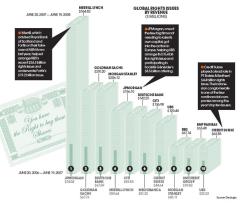

The slump in global stock markets has shut off the flow of IPOs in most financial centers. But for equity underwriters, there is at least one silver lining to the credit crisis: The need of banks and other institutions to replenish their capital bases has unleashed a flurry of major rights issues in recent months.

The volume of such issues more than doubled in the 12 months ended in late June, to $197.9 billion from $79.1 billion a year earlier. Underwriting revenues have shown a similarly strong increase, rising to $2.39 billion from $906 million. Who are the big beneficiaries? Ironically, the top underwriters have been bulge-bracket Wall Street firms, which normally eschew rights issues for their own capital needs but are happy to help their European counterparts. Merrill Lynch & Co. leads the league table with $364.8 million in rights issue revenues, followed by Goldman, Sachs & Co. and Morgan Stanley.