Tony Yoseloff, chief investment officer at Davidson Kempner Capital Management, wants investors to think differently about opportunistic credit.

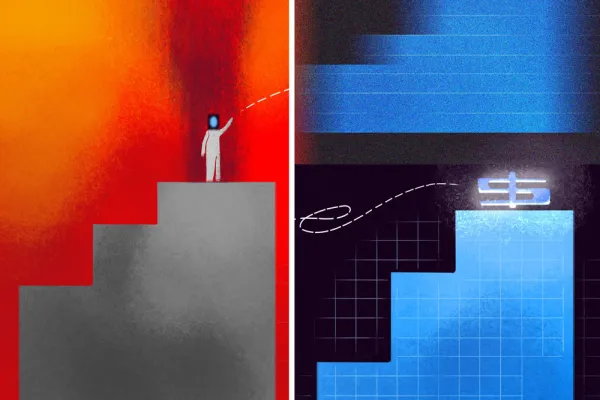

Not only do these strategies — which invest in mispriced and distressed assets — offer potentially attractive returns over the long term, but Yoseloff says allocators can also add opportunistic credit to ensure their ability to continually fund capital calls on growth equity and venture capital funds in down markets.

Using opportunistic credit to fund growth investments isn’t intuitive. Yoseloff said that’s part of the reason he decided to research the topic and publish a white paper, which is expected to be released on Monday.

“A question I sometimes get from clients and prospects is ‘why should we use what they would consider precious illiquid capital for opportunistic credit when strategies like growth equity and venture capital pencil out to higher rates of return over longer periods of time,’” Yoseloff said. “To be fair, we started getting these questions in 2021 in particular, which, with the benefit of hindsight, I would argue was the peak year for those strategies.”

Still, allocators often face the dilemma of how to put processes in place so that they can be contrarian and deploy money when capital is scarce and the return profile of growth investments is the most attractive. Davidson Kempner’s funding mechanism idea also comes as pension funds, endowments, and other institutions have a record amount of money allocated to illiquid investments. At the same time, investors may have trouble funding capital calls to new funds as cash distributions from older growth funds are curtailed in a slowing economy. That’s exactly the situation many allocators are facing in the current environment.

And it’s not enough to just sock away cash. As Yoseloff said, “Most institutional allocators have absolute caps, so they’re not going to have money to fund their better vintages within their illiquid bucket unless they have it coming from somewhere else in the illiquid bucket. They can’t necessarily rely upon cash that is put aside, because those [periods] are typically when investment committees might be the most skittish, and [they’re] not going to say lower your cash cushion and put more money into illiquids at the time when we’re doing the worst. By definition, you need it to come from somewhere within the illiquid bucket for this strategy to be successful, [in] most cases.”

Investors can get diversification with opportunistic credit, which can do well in troubled markets and generate cash — just as growth does the opposite.

The analysis bears this out. First, the correlation of returns between growth equity and opportunistic credit is 43 percent; the correlation between VC and opportunistic credit is 22 percent, according to the white paper. Perhaps more importantly, opportunistic credit funds provided far more cash than growth funds after the technology stock bubble burst in 2000 and following the global financial crisis. The correlation of distributions of growth equity and opportunistic credit is quite low — 8.6 percent; the correlation between VC distributions and opportunistic credit is 0.1 percent.

“You get cash back [at] exactly the time you’re going to need it to invest in the next series of growth funds. Even if you’re a growth investor, you still need a strategy like this in your portfolio,” he said.

The idea to use opportunistic credit as a funding mechanism comes as investors are struggling with how to construct their portfolios amid resurgent inflation and a potentially low-growth economic environment over the next few years. Davidson Kempner points out that investors might be at the “beginning of an extended inflationary period.” Over the next several years, companies will need to develop business models that are not as dependent on low financing rates and those that took on huge amounts of debt will be restructured.

“Institutional investors who only have those strategies in their illiquid portfolio are going to be hit with a double whammy, where not only will they have lower rates of return, but it will take a lot longer to get the capital back from those strategies to deploy into new opportunities,” said Yoseloff.

“That’s the problem we were trying to solve for, and I do feel like opportunistic credit does a very good job of counterbalancing that in portfolios, because it returns cash a lot more quickly and it returns cash in time periods where the growthier strategies don’t return cash.”