In our 2023 outlook, Kunjal Gala, Head of Global Emerging Markets, outlines the key factors that could drive market returns for EM equity investors in the year ahead.

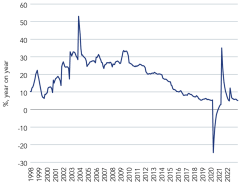

Theme one: Opportunities beyond re-opening China is at a critical juncture and faces three principal challenges: geopolitical rivalry with the US, the ongoing fallout from Covid-19, and issues in its property sector. These huge challenges will test the resolve of the Beijing leadership.

Figure 1: China fixed asset investment (%, year on year)

Source: Bloomberg, as at 19 January 2023.

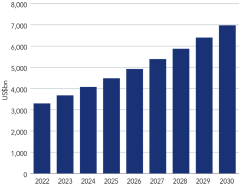

Theme two: A bright decade ahead for India The India story is likely to gain even greater prominence over the next decade. While the US and China will remain just as important, the rise of India’s economy is a force to watch. India is now the fifth largest economy in the world and will likely be the third largest in the next seven years, with its GDP more than doubling from the current US$3.3tn. According to our analysis, India is forecast to add more than US$400bn to its GDP annually, a scale that only the US and China surpass.

Figure 2: India’s GDP is on track to surpass the UK, Germany and Japan2

Source: Federated Hermes analysis as at January 2023. Forecast cannot be guaranteed.

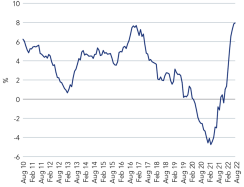

Theme three: A lost opportunity or time to get constructive on Brazil? The years between 2017 and 2021 – aside from the short, sharp shock of Covid-19 – were a period of relative respite for Brazilian investors; interest rates reached record low levels, there was comparative fiscal conservativism, a steady drip of microeconomic reforms, and an unprecedented initial public offering (IPO) boom. However, the last two years have seen the return of two familiar old devils to the Brazilian economy: high inflation and the threat of a fiscally-induced meltdown in government bond markets.

Figure 3: Brazil ex ante real interest rates

Source: Bloomberg, as at 13 January 2023.

Theme four: From cyclical to structural on memory Lockdowns and Covid-19 created significant dislocations in semiconductor inventories. Three key factors led to historically high inventory levels, supply-demand imbalances, and inflationary pressures: a China-centric supply chain, an aggressive uptick in demand and underinvestment in mature technologies.

What we are seeing today is a rapid unwinding of those imbalances. The capacity (i.e. supply) started to come on board, and at the same time, demand weakened throughout 2022, which led to severe oversupply in the memory industry.

To address the surplus and high levels of inventory upstream and downstream, key businesses in the sector have committed to unprecedented capital investment cuts to reverse the excess supply and stabilise the market during the first half of 2023. The industry is also expecting rapid digestion of inventories throughout 1H23 with the expectation that the sector will enter a healthier 2H23.

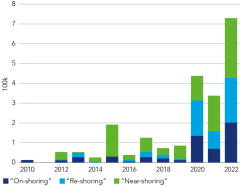

Theme five: Relocating supply chains to create long-term winners China faces six critical challenges to its position as the world’s dominant exporter and largest manufacturing hub: Politics, geopolitics, Covid, an ageing population, wage growth and decarbonisation.

Vietnam, Malaysia (and Singapore), Mexico and India could all be beneficiaries of reshoring in the coming months and years.

Figure 4: Company mentions of…

Source: HSBC, Asian Economics as at January 2023.

Theme six: A long-term perspective on commodities and energy It is hard to say anything particularly useful about commodity prices in the short term given the number of factors at play: the war in Ukraine, US monetary policy, China’s re-opening, the depth of recessions in the West, and temporary supply disruptions, to name but a few.

That said, the medium-term outlook for commodities involves an increased reliance on copper as we electrify transport, industry, and heating, build out renewable energy and expand the grid. Emerging markets will play a crucial part in meeting demand for this key metal given their control of supply and production.

EMs offer some of the most exciting ESG opportunities, many of which are intrinsically linked to the UN SDGs

Theme seven: A multi-year opportunity in electric vehicles

China is undoubtedly an EV superpower. It has the world’s largest lithium-ion battery producer and its associated supply chain. It also has the largest EV manufacturer in the world and the world’s largest EV consumer market – accounting for 53% of global EV sales.1

Although the increasingly protectionist policies adopted by the US would appear to be a challenge to China’s leadership in the EV supply chain, the reality is that major Chinese suppliers and automakers have limited exposure to the US market. The same automakers and suppliers are increasingly investing in local production in Europe and the rest of the world to avoid geopolitical issues in the future. We believe it will be difficult for the US to completely circumvent the Chinese supply chain, given the country’s dominance in specific components used in battery manufacture.

Theme eight: Hope for global tourism The growth of global air travel was temporarily paused by the Covid-19 pandemic in 2020 and has been in recovery mode ever since. This recovery has been somewhat uneven, with travel in the Americas and Europe returning significantly faster than in Asia. Asian governments were generally far more cautious about re-opening their countries to tourists and business travellers but have been gradually removing restrictions throughout 2022. The final ‘coup de grace’ to pandemic travel restrictions came in January 2023 as China effectively removed its international travel restrictions.

Therefore, we expect 2023 (despite presumed recessions in Europe and the US) to see continued growth in global passenger volumes on a relatively low post-pandemic base.

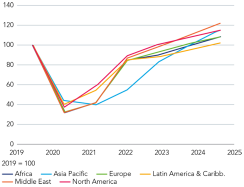

Figure 5: Global air traffic forecast to reach pre-Covid levels

Source: IATA Economics, as at December 2022. Forecast cannot be guaranteed.

Theme nine: Will China’s re-opening drive inflation? The consensus is that inflation will moderate in 2023, partly due to high base effects from 2022 and the fact that there has been no additional major oil or food price shock; so the year-on-year comparison will likely trend downwards. This view is further strengthened by slowing economic activity with demand already contracting across the globe, especially in advanced economies suffering from record inflation and as a result, hawkish central bank action.

There is a risk, however, albeit limited, that inflation and commodity prices will remain higher in 2023, supporting our preference for holding on to our investments in copper, aluminium and holdings in key commodity-producing nations such as Chile, Peru, South Africa, and Brazil.

Theme ten: ESG’s relevance for EMs in a complex world As the world faces growing social and environmental challenges, such as climate change, biodiversity loss, the cost-of-living crisis, and social inclusion, environmental, social, and corporate governance (ESG) concerns have particular relevance in emerging markets, where many of these challenges are most acute. On the flip side, EMs also offer some of the most exciting ESG opportunities, many of which are intrinsically linked to the UN’s Sustainable Development Goals (SDGs).

Among others, these include financial inclusion, digital rights, the carbon transition, worker rights and well-being and corporate governance – all of which emerging market companies will play a crucial role in addressing.

Read our full report to learn more about key themes for emerging markets in 2023.

1 Bloomberg New Energy Finance (BNEF)

Disclaimer:

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested. Investments in emerging markets tend to be more volatile than those in mature markets and the value of an investment can move sharply down or up. This advert is for professional investors only. This is a marketing communication. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. Issued and approved by Hermes Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.