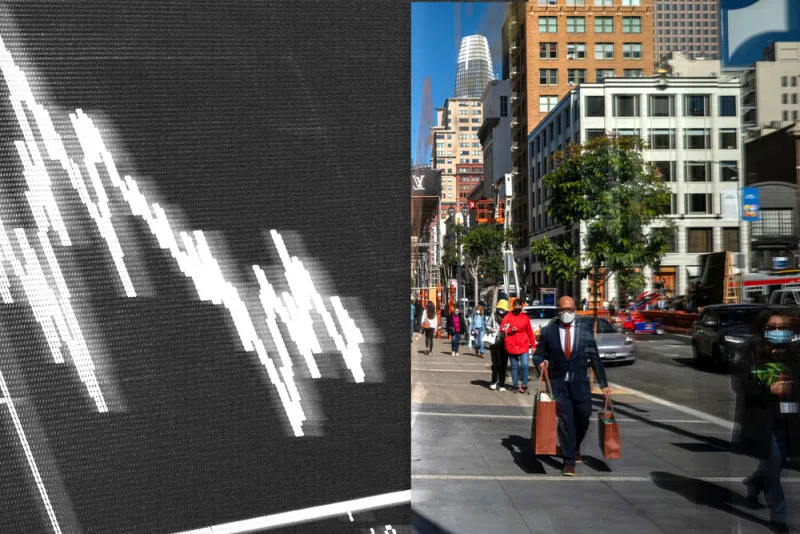

With the broad market officially in bear territory, investors are struggling with whether or not it’s a good time to put money to work.

In many cases, the decision comes down to managers’ views on what a recession means for investors and when it may be coming. Some people think the markets have bottomed out and the low valuations have already presented excellent investment opportunities. But others are holding off from making new investments and selling some holdings to raise cash, believing there’s more pain to come.

London-based Ruffer Investment Management is in the latter camp. Jenny Renton, investment director, told II that her team has been “preparing for a recession and a really difficult market environment.” That involves reducing exposure to growth equities and holding on to cash, she said.

“[There are] not very many places to hide in the very short term despite the inflationary dynamics,” Renton said. She has also considered hedging using derivatives, which can offer protection against certain risks, but they’ve become more expensive in recent months. That’s why Ruffer favors cash over everything else in the current markets.

Ruffer is in good company. Paula Volent, the chief investment officer of Rockefeller University and former CIO of Bowdoin College, is moving some of the $3 billion endowment to cash. At a June CAIA event in New York, Volent told the audience that her team recently sold off a $200 million buyout investment to temper the effects of an impending recession. Before joining Bowdoin, Volent worked at Yale University under legendary CIO David Swensen.

David Kelly, chief global strategist at J.P. Morgan Asset Management, said it’s time to get in despite the recession. He wrote in a note on Tuesday that valuations have returned to more reasonable levels after the massive selloffs in the first half of 2022. According to Kelly, the risk of a near-term recession has been increasing as inflation, rate hikes, and falling investor confidence besiege the U.S. economy. But he argues that the economic growth has returned to a more sustainable rate and inflation will start to cool down in the next two months. In addition, the S&P 500 is now selling below its 25-year average of 16.9x earnings. “This should present opportunities for those [who] are willing and able to invest today,” he wrote.

Nuveen, a TIAA company, also believes the low valuations are a signal for investors to enter the market. Brian Nick, Nuveen’s chief investment strategist, doesn’t believe a severe recession is likely, at least in the near term. As a result, he thinks investors can feel “safe” in buying securities now available at a much lower valuation.

“The first six months of 2022 have, I think, brightened the picture for the future,” Nick said. “The case I’ve been making to diversified investors is, now is a much better time [than 2021] to enter into basically all of these different asset classes and markets, across rates, credit, and the equities spectrum.”