Chris Farran, CME Group

AT A GLANCE

- Tighter monetary policy will likely drive choppiness in Euro repo markets

- The Sterling repo market may provide eurozone participants with insight into what they can expect once ECB rates increase

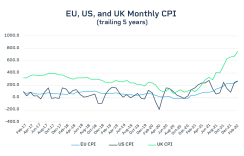

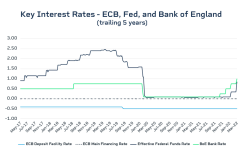

However, the European Central Bank (ECB) is notably absent from the list of central banks that have implemented rate increases. Unlike its counterparts in the United States (Federal Reserve) and the United Kingdom (Bank of England), the ECB has not yet made a move against inflation; its deposit facility rate is currently at -0.5% and its main refinancing rate is at 0%. The ECB did not lower interest rates in response to the COVID-19 pandemic that began in the first quarter of 2020 as its deposit facility rate was already at -0.5% at the time – meaning the ECB has held rates persistently at negative or zero since 2014.

Source: Federal Reserve, European Central Bank, Bank of England

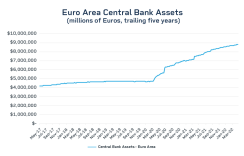

In addition, the ECB has only committed to raising interest rates after it stops purchasing bonds in the third quarter of 2022. The ECB has added over €3.8T to Euro area balance sheets since March 2020.

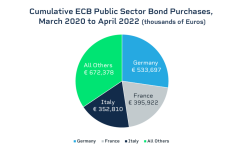

Two bond buying programs facilitated sovereign debt purchases during this time – the Public Sector Purchase Program (PSPP) and the Pandemic Emergency Purchase Program (PEPP). These two programs bought a total of €1.95T of sovereign bonds between March 2020 and April 2022. Three countries – Germany, France, and Italy – accounted for 66% of all sovereign purchases by the ECB.

Insights From Repo Funds Rate Indices

The Repo Funds Rate (RFR) Indices, compiled by CME Group, looks at daily overnight lending rates in ten sovereign bond markets across the eurozone in addition to an overarching rate for the EU. The indices provide data on two subcomponents – general collateral and specific collateral – of the repo market:· General collateral (GC) are repo transactions where the underlying asset consists a set of similar-but-unspecified securities.

· Special collateral (SC)are transactions where specified securities (such as a certain bond issue) are exchanged and thus are often in high demand.

These rates offer key insights into European money market participants and there are two recent and notable themes which are worth highlighting.

Key Theme #1: Repo Rates are Becoming More Negative

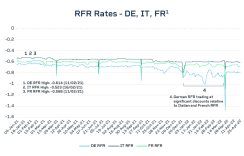

Many EU countries’ RFR rates trade more negatively now than at the beginning of 2021 despite an unchanged short-term interest rate policy. German, Italian, and French repo reached highs in the first quarter of 2021. All three countries have lower average rates in 2022 than in 2021. Lower rates are multifaceted; however, data suggests that collateral is becoming scarcer over time.

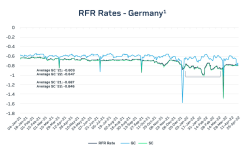

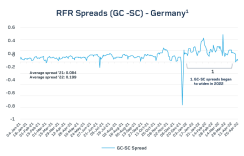

This trend is particularly acute in the German repo market. Often considered the highest quality of all sovereign debt in the EU, German RFR rates often transact significantly lower than other countries. Germany thus provides a “floor” on EU RFR rates. Note that the German SC rate average has decreased by about 18 basis points (bps) from 2021 to 2022, from -0.687 to -0.846, and that the average GC-SC spread increased from 0.084 in 2021 to 0.199 in 2022. While SC discount trading is a normal occurrence in the repo market, the extent to which this has recently occurred reflects the relatively high levels of short positions and the relatively low availability of German collateral in the market.

Source: CME Group

Source: CME Group

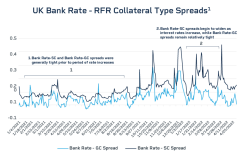

Key Theme #2: UK Repo Market May Give Insight into Future of the Eurozone

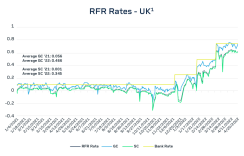

Relative to the ECB, the BoE has taken significant action to curb inflation with four interest rate increases since Dec 2021. The subsequent changes that have occurred in the Sterling repo market may provide eurozone participants with some insight into what they can expect once ECB rates increase.UK GC rates have closely followed the bank rate since the beginning of a series of rates increases in Dec 2021.

Read More about Repo Funds Rates

However, during this time, GC-SC spreads have widened and increased in volatility. This suggests that while GC rates may change alongside the bank rate, SC rates may be “sticky” or subject to technical factors beyond BoE short-term interest rate policy.

Source: CME Group

ECB monetary policy and market conditions will likely experience significant uncertainty in the short- and mid-term. RFR Indices are a rich source of data for any market participant looking to navigate uncertain markets.

Read more articles like this at OpenMarkets