Anna Ellis, CME Group

AT A GLANCE

- Global ESG assets may soon surpass $41 trillion, while trading in futures on the S&P 500 ESG Index have soared by over 100%

- S&P Dow Jones Indices implemented new eligibility requirements for their ESG indices in May, which excluded companies involved in activities like oil sands and military contracting

Changing ESG Index Eligibility

Bloomberg Intelligence reported in January that global ESG assets may surpass $41 trillion this year and reach $50 trillion by 2025. Most of this growth has been in the United States, which has seen 40% growth in assets in the past two years. This growth in ESG is bolstered by the fact that the S&P 500 ESG Index has outperformed the S&P 500 in recent months, illustrating the importance of these indices in meeting investor needs.

Source: S&P Dow Jones Indices

While the S&P 500 ESG Index is not designed to outperform the broader S&P 500 Index, it illustrates the growth in ESG markets in recent months.

On April 1, S&P Dow Jones Indices (S&P DJI) completed a consultation on eligibility requirements for their ESG indices, which culminated in revised exclusions on company involvement in certain defined business activities. While not all ESG equity products utilize negative screening, the exclusion-based approach is a beneficial way to manage ESG investments.

The outcomes of this consultation specifically address additional exclusions on companies involved in oil sands, small arms and military contracting activities; expanded exclusions on companies involved in controversial weapons activities; and revised exclusions on companies involved in tobacco activities. These changes took effect on May 2.

Built on the traditional S&P 500 Index, the S&P 500 ESG Index is comprised of companies that best manage their business while conforming to ESG principles. Eligibility and inclusion in the S&P 500 ESG Index are based on a robust ESG scoring system and the majority of exclusions are due to the removal of low ESG-scoring companies. Currently, the bottom 25% of each Global Industry Classification Standard (GICS) sector are excluded in addition to those companies involved in tobacco, military contracting, controversial weapons, and small arms activities. The results of S&P DJI’s latest consultation will amend the exclusion thresholds on companies involved in those non-ESG-compliant business activities.

The updates to exclusions and eligibility requirements reflect the growing need for index providers to properly account for a company’s business activities, which ultimately ensures ESG investors can accurately assess the behavior of those companies remaining within the index. These new exclusions are also likely to improve the tracking error of the ESG index with the S&P 500 Index, meaning potentially greater convergence of returns between the two indices.

The ESG space is continually evolving, and this is not the first time S&P DJI has changed index requirements in order to meet client demands. Most recently, additional thermal coal exclusions were introduced in 2020. The responsiveness of S&P DJI to adapt to the latest industry trends ensures their indices reflect the growing needs of ESG investors.

ESG Futures Growth

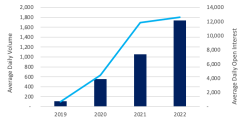

Starting May 2, these changes to the ESG indices were incorporated in the derivatives space, and recent trends in CME Group’s E-mini S&P 500 ESG Index Futures illustrate how asset managers, commodity trading advisors and other investors can find solutions that fit their ESG needs.Average daily volume (ADV) in ESG futures during the first quarter of 2022 was up over 100% compared to the same quarter last year and has steadily grown since the contract’s launch in November 2019.

Source: CME Group. Data as of May 1, 2022.

ESG futures contracts have surpassed $96 billion in traded notional and by the start of May had accumulated over 13,500 contracts in open interest, equivalent to nearly $2.5 billion.

The growth in futures follows the broader pattern of ESG investing. Market participants are looking to invest in sustainable solutions and good governance, while seeing returns similar to, or beyond, the broader S&P 500 index. Aligning the index with this demand is a necessary step, and part of the evolution of this rapidly growing market.

Learn more about E-mini S&P 500 ESG Index Futures.

Read more articles like this at OpenMarkets