By Raymond Sagayam, Chief Investment Officer, Fixed Income at Pictet Asset Management

Some might argue that building a sustainable economy is a technological problem. It isn’t. The world is sufficiently stocked with greenhouse gas-reducing technologies such as renewable fuels, carbon capture and energy storage. What it lacks is capital. According to the International Energy Agency, investments in clean energy alone will have to rise to an annual USD 4 trillion by the end of this decade to keep global warming in check. Realistically, funding on that scale can only come from the financial market – bond investors in particular.

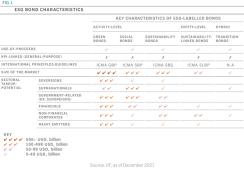

Encouragingly, fixed income markets appear to be up to the task. As governments, corporations and investors ramp up their climate commitments, securities that embed environmental, social and governance (ESG) considerations are in the ascendancy (see Fig. 1 below for key characteristics of ESG-labelled bonds).

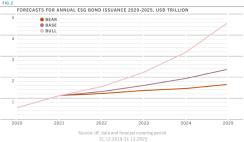

Green fixed income securities with specific use-of-proceeds requirements, sustainability-linked bonds with coupons tied to issuers’ environmental credentials and social bonds that fund educational programmes are just some examples of the innovative structures vying to go mainstream. Investors have responded enthusiastically so far. In 2021, over USD 1.1 trillion of new sustainable bonds were successfully placed, taking the size of the ESG bond market to well above USD 2 trillion. Research undertaken for Pictet Asset Management by the Institute of International Finance (IIF) suggests issuance could reach an annual pace of USD 4.5 trillion per year by 2025.

While most of that capital will be raised in the developed world, much of it can also be expected to come in the form of emerging market ESG bonds. It is essential that it does. For developing economies, private finance is crucial if they are to fulfil the UN Sustainable Development Goals (SDGs) by 2030.

Yet for sustainable debt to become mainstream, several obstacles need to be negotiated. The immediate priority is universal rules and standards. Currently, the labelling and certification of sustainable bonds differs considerably from one country to another, while efforts to harmonise disclosure requirements haven’t met with much success.

An analysis of the ESG securities with the longest track record – green bonds – reveals other potential trade-offs. Green bonds have delivered similar returns to non-green debt, yet they trade a premium: their yields tend to be persistently lower than those of traditional securities. This is despite the fact that green bonds are less liquid. Our analysis shows that such securities trade less often, in some cases far less often, than conventional fixed income. This reinforces our belief that purchasers of green and sustainability-linked bonds tend to be ‘buy and hold’ institutional investors such as pension funds, insurance funds and sovereign wealth funds. What it also suggests, however, is that the secondary market for such debt is not mature enough to absorb large buy or sell orders without precipitating significant shifts in price.

Ultimately, none of these hurdles are insurmountable. If world leaders are genuinely committed to net zero, they will also recognise that these ambitions require capital to flow freely. Which is why, in the battle against climate change, bond investors could soon find themselves in the front line.

ESG bonds are too big to ignore

With ESG issues dominating the international policy agenda – and as investor demand for new ESG financial products and services continues to grow – global debt markets, and by extension fixed income portfolios, are about to undergo a radical transformation. The ESG debt universe is expanding rapidly, not only in size but also in terms of the variety of instruments it contains and the range of activities it finances.It's an expansion that opens up new frontiers for investors. The opportunity now exists to build diversified portfolios that can fulfil both financial and non-financial goals – the mitigation of climate change, the protection of biodiversity and the promotion of social cohesion have become possible through bond investments.

At the same time, the growing importance of ESG factors has given both public and private sector borrowers unprecedented ability to tap sustainable debt markets and secure funding at attractive rates. With national and corporate net-zero commitments becoming more ambitious over the course of 2021, demand for low-carbon energy investments and technological innovation has boosted issuance of ESG securities. Total ESG debt issuance (bond and loans) during the first three quarters of 2021 reached USD 1.1 trillion, exceeding totals for the whole of 2020.

ESG Bonds Projected to Reach USD 35 Trillion by 2030

Nevertheless, for all their dynamism, ESG debt markets have yet to acquire the scale required to finance the transition to a low-carbon economy. For this to happen, further development of ESG debt markets is essential – and along several fronts. Progress towards greater harmonisation across sustainable finance taxonomies (ongoing efforts include the International Platform on Sustainable Finance) and ESG disclosures (notably the IFRS International Sustainability Standards Board) would foster more rapid market development. In addition, greater transparency on how ESG rating agencies collect, analyse and calculate sovereign and corporate ESG metrics could also boost the demand for – and supply of – ESG debt securities.

Such changes would be transformational. They would alert bond investors to new investment opportunities while directly channelling private sector funding toward sustainable development goals (SDGs). Under this scenario, we believe global ESG-labelled bond issuance could reach an annual pace of USD 4.5 trillion in as little as five years. By 2030, the volume of ESG and climate-aligned bonds outstanding could reach USD 60 trillion, equivalent to approximately a third of the entire global bond market.

Taking all this into account, and assuming that governments and regulators will continue to focus on sustainability, our baseline estimates suggest that annual ESG-labelled bond issuance could climb over fourfold from some USD 525 billion in 2020 to over USD 2.3 trillion in 2025.

Download the full report to discover more.

Disclaimer

Marketing communication

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Past performance is not a guide to future performance.