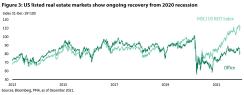

With the global economy experiencing its fastest year of economic growth in 2021 (5.9%) since the IMF began calculating global GDP, it was a year in which both property and infrastructure delivered strong returns for investors. Performance data for the first half of 2021 for infrastructure shows that it delivered an 11.1% annualized return1 in that period, just above its long-run average of 9.9%. For property, data to the third quarter of 2021 reveals that global fund level (leveraged) returns were 12.4% over the past 12 months for core strategies, well above its 10-year average of 7.6%.

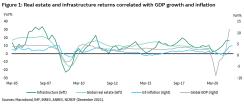

Looking forward in 2022, macroeconomic conditions are likely to be supportive of further healthy return performance. For both asset classes, GDP growth and inflation are key drivers of returns2 (see Fig. 1 below). With the IMF expecting 4.9% global GDP growth this year and 3.8% inflation, these two key variables are likely to remain a tailwind for both asset classes.

“A lot may depend on what happens to the long-end of the yield curve,” says Daniel McCormack, Economist, Macquarie Asset Management. “Developed world central banks are likely to be tightening monetary policy this year, led by the Fed.”

One of the most interesting developments in late 2021 was the lack of response from 10-year U.S Treasury yields over the second half of 2021 as inflation rose, central bank rhetoric became more hawkish, and market expectations for future policy rates shifted higher. One key reason could be that market participants believe the ultimate peak in policy rates hasn’t changed much, if at all, or that the Fed will be forced to reverse any rate rises over the medium term as a result of financial market volatility.

“Whether that view continues to hold through 2022 is an open question, but neutral policy rates have shifted down to very low levels in recent years. Put simply, long-term government bond yields may not rise much in 2022, particularly if inflation peaks around mid-year, as we expect,” says McCormack.

Property: Lead indicators are green

For property, although cap rates (ex retail) have moved down in recent years and net yields are at low levels relative to history, the spread to bond yields has widened in many circumstances and remains elevated relative to history. Perhaps the downswing in property during the global financial crisis remains a lingering concern for many, when property spreads to bonds and borrowing costs turned negative in many gateway markets and pricing subsequently softened sharply. Either way, real estate debt and capital markets remain healthy, with the sector continuing to see strong capital inflows and a rebound in transactions as investors look to boost returns via higher leverage, increasing development exposure in sectors with healthy fundamentals, and investments into less traditional asset classes (including operationally intensive property).“Generally, real estate fundamentals remain healthy, particularly in sectors such as industrial, rental housing and specialized sectors which continue to be supported by strong tailwinds and robust cash flows,” says David Roberts, Global Real Estate Strategist, Macquarie Asset Management.

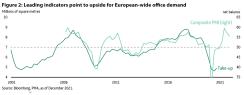

Even in the office sector, leading demand indicators point to a solid 12 months ahead with some potential upside for office valuations. But any focus is likely to be on prime office assets given rising environmental, social, and governance (ESG) considerations with investors shifting towards low carbon operational buildings and tech-friendly fit-outs. Occupiers are also focusing on higher quality space as they shift to a hybrid working model and implement strategies to entice workers back to the office for at least part of the week.

“Another risk could be a sharp rise in 10-year Treasury yields if inflation expectations rise rapidly and the Fed increases policy rates more quickly than expected,” says McCormack. “We don’t see signs of that happening right now and the fact that central banks are now taking action against inflation increases our confidence that inflation expectations are likely to remain moored around normal levels. But if it did happen it could be a headwind for valuations in 2022 and therefore returns.”

“Our focus is on investments into new economy sectors which include industrial, rental housing, high quality offices, and specialized sectors such as manufactured homes and self-storage underpinned by stronger growth prospects and low capital-expenditure requirements,” says Roberts. “In many respects, COVID-19 has accelerated shifts that were expected to take place in the pre-COVID environment, such as the move to online spending and remote working.”

Infrastructure: Resilience through the crisis

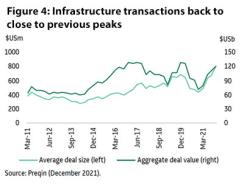

Infrastructure’s performance proved resilient through the COVID-19 period, experiencing only one quarter of negative returns (1Q21), with returns averaging 16.5% annualized since. The short-lived nature of the downturn no doubt helped investors to look through the volatility, while the fact that debt markets remained open also enabled tail risks to be avoided. Deal activity also recovered in 2021, with transaction volumes rising back to close to previous peaks. On a four-quarter moving average basis, total deals reached $US122 billion in Q4 2021, with the average deal size reaching $US813 million. For average deal size this is a record high, while for total deals it is only 6.4% below the previous high of $US130 million in 2Q17.

As for property, overall macroeconomic conditions are supportive of returns. “Infrastructure’s strong link to inflation relative to other assets means that it is likely to fair better than many other asset classes in the unlikely event that inflation expectations start to move higher,” says McCormack. “It also means that infrastructure returns should hold up well in the face of rising bond yields, provided that rise is driven by inflation and GDP growth.”

Historically, infrastructure has delivered better returns when bond yields are rising than when they are falling. The rise in inflation is likely to be particularly beneficial for infrastructure assets at the lower end of the risk-return spectrum, given that for many of these assets the link between returns and inflation is tighter than for those higher up the risk spectrum. While it’s harder to generalize by sector, utilities (such as generation assets and electricity and gas distribution networks) should continue to have a solid year in 2022. Digital infrastructure has grown in popularity in recent years and COVID-19 has brought forward demand levels in this sector by a number of years and reinforced to investors just how critical these assets are to daily life.

For transport, the outlook is more uncertain and more varied by sub-sector. Road volumes have tracked economic activity quite closely through the COVID-19 period, so if GDP growth is as strong as the IMF expects this year, it should be a good one for toll road volumes generally.

Air travel has proved very sensitive to COVID-19 infection rates and the associated travel restrictions. Should Omicron prove worse than currently expected, there is the risk that it has a negative impact on travel growth in 2022. But the data for 2021 show a very rapid recovery in air travel volumes as travel restrictions were lifted and consumers became more comfortable with taking the COVID-19 risks associated with flying. For example, in August 2021, 58.5 billion passenger miles were flown in the U.S., which is 132% higher than at the start of the year and 202% higher than August 2020.

“There may be a powerful pent-up demand effect in the data, something that our estimates suggest many industry forecasters are not including in their projections,” says McCormack. “Port volumes have been different again. After a remarkably strong performance during COVID-19 as goods spending surged, volumes growth then fell back as capacity constraints and the reopening of economies in 2021 – and related redirection of spending away from goods and to services weighed on activity. But with GDP growth expected to be robust in 2021, this shouldn’t last long, with volumes likely to pick up again around mid-year in our view.”

Check out the current opportunities in global equities and fixed income.

1 This return excludes costs and performance fees.

2 Note that for infrastructure, inflation is a strong determinant of returns, while for property this is less the case

More from Macquarie Asset Management:

Navigating a Tale of Two Tapers in Fixed IncomeOpportunities in Global Equity Markets

The Path to Investment Opportunity