In the fight against global climate change, more than 120 countries have pledged to reach net zero carbon emissions by around 2050, complemented by more than 100 regional governments, 800 cities and companies.1 This represents a huge and wide commitment towards net zero, with the aim of achieving a balance between the greenhouse gases (GHG) put into the atmosphere and those taken out, the most significant being carbon dioxide. In effect, dramatic action is required before 2030 in order to achieve those pledges, and some countries are even beginning to bring forward their net zero deadlines.

Natural resources are a requisite for decarbonisation

Many trillions of dollars will need to be invested, not only significantly increasing the demand and price for those natural resources that enable decarbonisation but, very importantly, also presenting opportunities for investors in the myriad enablers required to achieve net zero. Among others, this includes the building out of renewable infrastructure, production of more environmentally friendly blue and green hydrogen, acceleration of recycling rates to reduce energy consumption and hence emissions, smart farming, sustainable proteins, and the application of innovative science.While certain areas of the natural resources sector, such as metals production, are far from carbon neutral, they are critical to facilitating large scale aggregated carbon reductions. When judged relative to the decarbonisation that metals enable, all emissions directly and indirectly related to metals may potentially be negative through to 2050. There are limitations in the measurement of downstream emissions (related to production, processing, and transportation), such as the lack of and inaccuracy of data, as well as differing and evolving definitions and standards. This means existing assessment methods are crude, however experienced natural resource investment teams should have the capability and sufficient knowledge of companies to redefine how carbon is measured throughout the supply chain.

Wind, solar, electric mobility, and energy storage are the biggest contributors to carbon reduction. There are also, however, significant roles to be played for waste to be converted into energy, sustainable packaging, biofuels, alternative protein, reforestation and leveraging technology via smart farming.

Hard to decarbonise sectors like cement or fertiliser production will most likely turn to abatement (reduction/ending of usage) through carbon capture utilisation and storage (CCUS) where emissions are captured and then stored in the ground, or potentially used to produce precursors such as pure alcohol for several industrial processes. The know-how to do this lies in the hands of energy services companies which have historically managed oil and gas projects. The infrastructure to transport carbon dioxide and hydrogen will also be needed. Using carbon to produce nanotubes is also being discussed; these can be mixed into concrete to increase strength, reducing the amount of concrete for the same applications.

A GLOBAL CHALLENGE PRESENTING EXCITING INVESTMENT OPPORTUNITIES

We believe some of the most compelling investment opportunities lie in the energy, metals & mining and agriculture sectors.

Energy transition

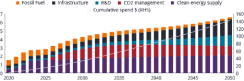

Clean energy currently makes up 15% of total energy consumed. It is forecast that this needs to increase to more than 55%2 among signatory countries to the Paris Agreement to have a chance of managing greenhouse gas emissions to a level that achieves climate neutrality by mid-century.Investment bank UBS estimates around US$140 trillion of cumulative investment is needed by 2050 to decarbonise just the world’s energy supply (see Chart 1). This will require large quantities of basic resources like steel, aluminium, copper, nickel and lithium. Considering that the amount of steel required to develop one megawatt of offshore wind or concentrated solar is three to four times higher than that in traditional coal fired, gas or nuclear power plants, the potential demand for these resources is staggering.

Chart 1: Annual investment needed to decarbonise energy supply

Source: UBS Equity Research Q-Series: Energy Transition: How will $140tn of investment be allocated across the energy supply chain? 25 March 2021. © UBS 2021. All rights reserved. Reproduced with permission. May not be forwarded or otherwise distributed.

As renewables generation grows, fossil fuels need to be significantly reduced from around 80% of the current energy mix to roughly half by 2050 if the world is to meet the minimum Paris Agreement target of 2 degrees warming.3 This poses a significant headwind for current producers of hydrocarbons and explains why most of the large oil companies are pivoting towards renewables and looking to become energy businesses rather than oil businesses.

Meanwhile, the increasing growth of renewable electricity enables the manufacture of electrolysis- produced zero-carbon green hydrogen, which is produced by splitting water into hydrogen and oxygen. This has huge potential to decarbonise steel production by replacing coking coal and may feature in the decarbonisation of heavy transportation such as lorries, airplanes and ships.

During the California Gold Rush of the 1840s and 1850s, prospectors needed to buy a pick and a shovel to mine for gold. While prospectors would not be guaranteed to find gold, the companies that sold the tools were making money. Within energy, the most attractive opportunities may be found in companies that are selling the ‘picks and shovels’ to facilitate the production and development of renewable energy. In our view, fewer opportunities are to be found in the utility companies running the projects and facing falling returns from increasing competition and new capital flows.

As an example within wind energy, we see strong potential in manufacturers of wind turbines and blades; copper cable that will connect offshore energy projects to the grid; energy services companies that provide ocean bed surveys; and the ship builders needed to construct offshore wind farms. We believe these are all companies that stand to benefit from the rising growth and demand for renewables.

Metals and mining, sustainable mobility and renewables

While good progress has been made in the adoption and manufacture of electric vehicles (EV), sustainable mobility needs to develop further; electric car sales need to grow from 3 million in 2020 to 56 million in 2030 to make a meaningful impact.4The amount of copper used in a battery electric vehicle is five to ten times higher than that used in a conventional combustion engine vehicle. The dominant battery chemistry uses nickel-cobalt-aluminium, iron-phosphate, and nickel-manganese-cobalt. All of these metals are going to see significant increases in demand with EV growth, and indeed we have seen their prices soar based on increasing pressure on the raw material supply chain. Total demand for copper by clean energy technologies is expected to see a three-fold increase by 2040.5

Aside from EVs, copper is in high demand as a key component used in renewable energy systems. Being a highly efficient conductor of electricity and heat, copper is required in the generation of hydro, solar, thermal, and wind energy.

Nickel used in lithium ion batteries could double in scale over that period. Meanwhile, Fitch Solutions forecasts EV sales will drive lithium consumption growth by around seven-fold through to 2030.

Agriculture ̶ sustainable agri-business

Decarbonisation is not limited to energy, metals and mining. Turning our attention to the agriculture space, by 2050 the UN predicts that almost ten billion people will be living on this planet. That means more food needs to be produced in the next 40 years than we have harvested in the last 8,000 years.At present, about a third of agricultural produce is wasted annually, a strong reason why more efficient farming and distribution of food are badly needed. We also need to consider changing the type of food that we consume. Plant-based or lab-grown ‘meat’ uses 90% less water, land and emissions than conventional livestock farming.6 This plays into the hands of large agricultural companies and producers, which are investing significantly in some cases to grow their plant-based nutrition businesses. The following chart provides an illustration of the significant opportunities within agriculture.

Chart 2: The future food market opportunity

Within agriculture, there are also opportunities to invest in large natural assets such as forests, which are increasingly recognised as carbon sinks that can absorb large amounts of carbon dioxide from Earth's atmosphere. Another opportunity is in providers of renewable construction materials to replace those that have a high-carbon content. Examples include replacing cement with wood, swapping out plastic packaging for paper products or utilising pulp in the manufacture of bioplastics and biofuels.

Challenges

The pathway towards net zero does come with risks to both the ultimate goal of achieving a climate neutral world as well as to the companies involved in this Herculean effort. Moreover, time is very much of the essence. There is a concern that materials could be sourced from countries with low environmental standards and poor labour practices. The rate at which the world requires new renewable energy is so high that there may be a risk it cannot be achieved within the time span expected. Will renewable energy projects be able to source the required funding, will specifications be met, will there be maintenance issues? Developing countries that are facing food shortages will not be able to modify their eating behaviour as quickly as developed populations. Lower energy costs in recent years have led to increasing energy consumption, while the switch to clean energy may not be as cost efficient as anticipated. The multiple cogs in the wheel to address climate change need to work in tandem, be it regulation, government policy, technology, socially responsible corporates, investors or end consumers.Natural resources, as an enabler of decarbonisation, is a sector facing a challenging and unmapped path with compelling opportunities along the way. From an investment perspective, we believe an active approach is warranted here to identify and engage with resource companies. Those that adhere to sustainable practices are, in our view, more likely to be well positioned for the future and have greater potential to deliver attractive returns to investors.

Conclusion

Through the process of decarbonisation, company engagement and supplier requirements, many natural resource companies are actively seeking to reduce their carbon footprint and are focusing their efforts towards this end goal. Those that can do this well are likely to be rewarded by investors. While there are obstacles along the way, a multi-decade runway lies ahead ̶ meaning the outlook for natural resources and the potential to change the world for the better appears as exciting as it has ever been.Learn more about Janus Henderson’s unique ESG insights here.

1 The Energy & Climate Intelligence Unit and Oxford Net Zero, March 2021: Taking stock: a global assessment of net zero targets.

2 UBS Equity Research, 25 March 2021, Q-Series: Energy transition: how will $140tn of investment be allocated across the energy supply chain.

3 S&P Global Platt Analytics, 23 June 2020.

4 International Energy Association (IEA), May 2021: Net zero by 2050.

5 International Energy Association (IEA), May 2021: The role of critical minerals in clean energy transitions.

6 BofA Global Research; 7 April 2020: We can’t keep (m)eating like this – future food primer.

Disclaimer:

For Institutional Investors use only. Issued in Singapore by Janus Henderson Investors (Singapore) Limited Company Registration No. 199700782N, licensed and regulated by the Monetary Authority of Singapore. This advertisement has not been reviewed by the Monetary Authority of Singapore. For Other Countries in Asia: This material is provided for your information purposes only and must not be distributed to other persons or redistributed.The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice, or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirement. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sources from third parties. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, and may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents have not been approved or endorsed by any regulatory agency.

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiary entities. © Janus Henderson Group plc.