By Gregor Spilker

AT A GLANCE

- With electric vehicle sales forecast to increase by 30% annually, the battery sector will become increasingly important for cobalt demand

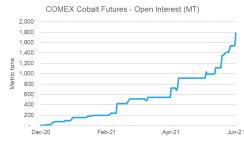

- Cobalt futures have seen wide adoption since launching in December 2020, with about $100 million open interest notional value at the start of July

With electric vehicle sales forecast to increase by 30% annually out to 2025, the battery sector will only become more relevant for overall cobalt demand.

Despite widespread lockdowns due to the pandemic, cobalt mining production was relatively stable year-on-year, dropping 6% versus 2019, to 145,000 MT. The DRCaccounts for 2/3 of global cobalt mining output. Cobalt recycling is a growing market and accounted for approximately 10,000 MT production volumes in 2020. Glencore, the world’s biggest cobalt producer, recently announced that its mothballed Mutanda mine in the Democratic Republic of Congo (DRC) will be put back into production by the end of 2021. In 2019, Mutanda produced 25,000 metric tons (MT) of cobalt, making it the world’s largest cobalt mine.

Responding to Changes

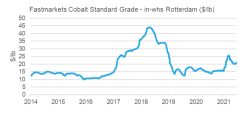

As for any commodity that is dug out of the ground, producers do not always have the spare capacity to instantly respond to changes in demand. A delayed response can contribute to volatility in the market clearing price for a commodity. When demand is low, producers do not invest enough to sustain or expand production. When the price rises, it takes months, or years, to react, by which time anticipated higher demand may have failed to materialize.This is what happened in cobalt markets in the 2010s. In anticipation of higher EV demand, the cobalt price more than doubled between 2017 and 2018. Just as producers ramped up production to respond to those higher market prices, EV demand growth failed to meet sky-high expectations, and the market was heavily oversupplied, eventually leading to prices falling to where they were pre-2017. Since the start of 2021, cobalt prices have risen to above $20/lb. again.

Source: Fastmarkets

Futures Trading

The COMEX Cobalt futures contract is a cash-settled futures contract that is based on an industry reference price, namely the Fastmarkets assessment for cobalt metal, standard grade, price basis in-warehouse Rotterdam.In the physical market, this assessment is widely used for floating price indexation in term contracts. Even though cobalt metal is not used in the manufacturing of batteries, cobalt hydroxide, the material actually used in batteries, is priced as a percentage of the cobalt metal price, meaning that the cobalt metal standard grade assessment has relevance across the entire supply chain.

Since launching in late December 2020, the contract has quickly amassed over 1,000 MT of open interest. As of July 1, 2021, open interest was 1,780 MT, the equivalent of about $100m notional value. Usually, futures markets develop with most activity concentrated on the short end of the forward curve, meaning contracts that have a nearby settlement date. In the case of cobalt, activity has mushroomed in both the short and long end of the curve, with traders using contract maturities as far out as December 2023. 43% of the total traded contracts had settlement dates in 2021, while 2022 contracts accounted for 42% of total volume. 2023 maturity contracts accounted for 15% of total trading activity.

Source: CME Group, data as of July 1st, 2021

Batteries Included

Participants along the cobalt supply chain need to consider how to manage price risk around the commodity as EV demand and battery chemistry continue to evolve. With the introduction of COMEX cobalt futures, a new hedging solution is available to these firms. The contract has had a promising start with over 2,400 MT traded to date and over 1,600 MT open interest going out to December-2023.As the EV sector grows, several commodities will move on the fundamentals of battery production, and cobalt is certainly one of those. Following a boom-and-bust cycle that lasted from 2017 to 2019, the cobalt market is now entering a new phase. Investments in EVs and battery applications will be the primary demand driver for the blue metal. Trading activity extending out to 2023 could suggest that market participants have different views about when cobalt (and EV) demand will truly accelerate.

Read more articles like this at OpenMarkets

1 Source for data: Cobalt Institute; ‘State of the Cobalt market’, May 2021