Evan Peterson, CME Group

AT A GLANCE

- A roundtable of experts discuss the old and new tools available to California agricultural producers looking for solutions to their annual water needs.

- A new futures contract based on the Nasdaq Veles California Water Index provides longer term visibility into the price of water, according to Roland Fumasi of RaboResearch.

California is facing another dry spring and summer in 2021, and for agricultural producers that means a difficult growing season. Drought emergencies have been declared for 41 California counties, mostly in Northern and Central California, home to the majority of the state’s farmland. The situation has put a strain on the state’s traditionally fragile water resources, resulting in water price spikes for producers looking to sustain their crop.

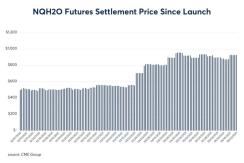

“This year is a critically dry year in California. It’s the second consecutive dry year in a row. And we’re seeing really high prices and lots of buy side competition,” said Matt Payne of WestWater Research of the current water situation in California. That point is supported by the Nasdaq NQH20 index, which reached a record near $900 per acre foot in May.

Payne joined Roland Fumasi of RaboResearch Food and Agribusiness in a discussion with Tim McCourt, CME Group’s Managing Director of Equity Products, about the water challenges facing California and how a new water futures contract based on the Nasdaq Veles California Water Index (NQH20) is playing a role as a new risk management tool available to producers in the state. Watch the full discussion in the video above. Intro Text can be Placed Here

"A Lot of Price Variability"

California is the top producing agricultural state by cash receipts. It’s top five products by total value in 2019 were dairy, almonds, grapes, cattle and strawberries, according to the California Department of Food and Agriculture.Traditionally, ag producers in the state have dealt with challenges of accessing scarce water supplies in one of a few ways, says Fumasi: Using reliable wells (up to 15,000 are drilled each year in the state), long-term contracting to buy water where there is an abundance, fallowing farm ground or buying additional surface water on the open market. “In the short run, that’s where you can see users have to deal with a lot of price variability,” says Fumasi.

Fumasi told McCourt that the NQH20 index and futures contract will help add transparency to the market for producers and ag lenders.

The contract helps” give you longer term visibility as to what the price of water might do,” he says. “It allows lenders and producers to make more informed decisions.”

Read more articles like this at OpenMarkets