By Jim Iuorio, for CME Group

AT A GLANCE

- CME Group’s slate of micro futures contracts is expanding to oil, FX and treasuries as the trend toward self-directed trading accelerates

- Micro contracts typically trade at one-tenth or less the size of larger futures contracts, which means “less capital requirement and more access”

2021 has been the year of the retail trader. According to Bank of America, more money has been invested in the U.S. stock market in the last six months than in the previous 12 years combined.

A huge part of this has been attributed to the retail trader. CME Group, long known for offering liquid futures products geared toward institutional use, has begun offering reduced size micro products to meet the needs of sophisticated active traders. In a recent discussion, CME’s Director of Client Development for Retail Craig Bewick commented, “we’ve seen individuals around the globe who have decided to take a little more control of their financial destiny” and “the overwhelming success of micros in equity indexes has led to an awareness of micros in general.”

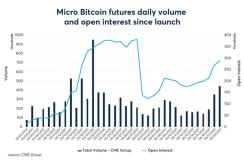

Recently CME Group has launched the Micro Bitcoin contract to complement the success of the standard Bitcoin contract. Bewick acknowledged that the standard contract, at five bitcoin, “is a large contract even for institutional traders especially when you consider that it trades at 80-120% volatility.” The Micro Bitcoin futures contract is sized at one-fiftieth of the standard contract and has been enthusiastically received by active traders. It traded more than one million contracts in its first two months.

Bob Iaccino, chief market strategist of Path Trading Partners, says Micro contracts provide more precision for those already involved in trading equities, bitcoin or other markets where micros are now available. “The smaller contracts mean less capital requirement and more access for individuals,” he says. “Micros allow you to take advantage on a more detailed level and give you the flexibility to scale in and out of positions with greater precision.”

CME Group is now following up with upcoming launches of Micros in WTI crude oil, treasury yields and FX. At present, “futures still remain a relatively small part of the global retail trading space,” according to Bewick, but the trend seems clear. It’s easy to see why the Micro contracts have seen explosive growth over the last year. Active raders want control, precision and near around the clock liquidity. Micros help to fill the voids that previously existed.

Watch Jim Iuorio, Bob Iaccino and Craig Bewick discuss the trend toward Micro futures in the video above.

Read more articles like this at OpenMarkets