While she was still in office, former Republican Senator Kelly Loeffler of Georgia and her husband sold up to $3.1 million in stock in January 2020 after she was privately briefed about the then nascent coronavirus. Two months later, the Covid-19 pandemic had blazed a trail of destruction, sending stocks tumbling in the fastest-ever bear market.

That same month, two government watchdog groups filed complaints with the U.S. Senate Select Committee on Ethics asking it to investigate whether Loeffler had traded on nonpublic information.

The groups also sought investigations of stock sales made in late January and early February by Senators James M. Inhofe, Republican of Oklahoma; Dianne Feinstein, Democrat of California; and Richard M. Burr, Republican of North Carolina, all of whom also attended closed-door meetings. The Justice Department cleared Loeffler, Inhofe, and Feinstein last May and ended its inquiry of Burr in January 2021.

[Like this article? Subscribe to RIA Intel’s' thrice-weekly newsletter.]

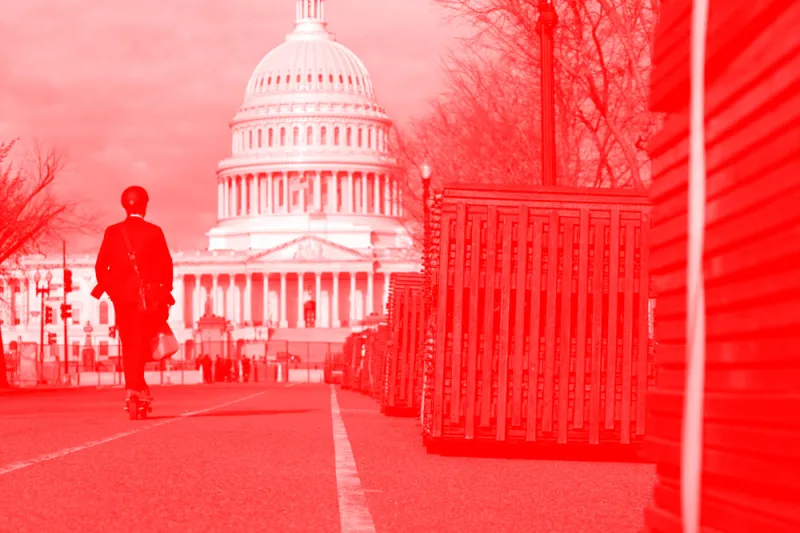

Politicians and those in their ecosystems have long been “cashing in on Capitol Hill,” using information obtained on the job to gain an advantage unavailable to other investors.

A new paper, however, suggests this practice is more widespread than generally thought: “Senators’ use of political inside information represents only the tip of the iceberg.”

What accounts for the hidden portion of the proverbial iceberg?

“There are many more legislators, politicians, and selected market participants who have access to the same information but do not have to file their returns,” the study notes. “In addition, many senators choose to file their transactions on paper, which makes them even more difficult to analyze.”

Examining electronically filed stock transactions from 2012 to 2019, University of South Florida researchers concluded that senators “use inside political information when investing and earn significant market-adjusted returns.”

Their analysis began with data from 2012, the year that former President Barack Obama signed into law the Stop Trading on Congressional Knowledge (STOCK) Act, which made it illegal for members of Congress along with the executive branch and their staffs to trade on material nonpublic information. Passed with fanfare and widespread bipartisan support during an election year, the law required government officials to report trades in an online, searchable database.

“The STOCK Act makes it clear that if members of Congress use nonpublic information to gain an unfair advantage in the market, then they are breaking the law,” Obama said during the signing ceremony.

Months later, a letter by 14 high-ranking national security members stated that “placing complete personal financial information of all senior officials on the internet would be a jackpot for enemies of the United States intent on finding security vulnerabilities they can exploit.” Citing the letter, the National Academy of Public Administration urged Obama and Congress to amend the STOCK Act.

The following April, Obama did just that, angering government watchdog groups by rolling back key provisions of the STOCK Act, which no longer required Congressional staffers and low-level executive branch officials to post their trades online.

To arrive at their conclusion, the study’s authors created a price-based measure of information risk around stock trades based on “abnormal idiosyncratic volatility (AIV), which captures the degree of information asymmetry around their trading dates.”

The study indicates that the senators’ trades are associated with “substantially high levels of AIV.” This suggests that they represent “only a tip of the iceberg” given that most unfiled transactions that used the same inside information “remain undetected.”

The researchers examined STOCK Act data as well as hand-collected information “to control for senator characteristics including age, tenure, state, and important committee memberships, among others.”

Stocks bought by senators outperformed the market in the two- to three-month period following purchases, the report states. And when senators bought home state stocks they performed “significantly better” over longer periods.

Also, “superior information” likely partly explains why senators’ purchases “outperform their recent sales by a significant margin.” And the dates when senators trade correlate with high levels of information risk (AIV), which suggests “many more people are trading on congressional knowledge.”

The study notes that a preference for stocks by politicians “could be motivated by a desire to engage in quid pro quo relations with firms” and that holdings may reflect “latent connections” between themselves and companies.

The authors acknowledge that federal-level politicians and legislators must report securities transactions. However, they note that their number “is much smaller than the number of politicians and legislators (e.g., at the state level), staff members, and lobbyists who may also have access to legislative knowledge and political insider information.”

Greg Bartalos (@gregorianchance) is editor of New York City-based RIA Intel.

Subscribe to RIA Intel’s thrice-weekly newsletter and follow the publication on Twitter and LinkedIn.