- Many investors are fixated on selecting products that offer the lowest operating costs when deciding to invest in mutual funds and exchange-traded funds (ETFs).

- However, when doing so, fixed-income investors can pay considerable opportunity costs for seemingly low-cost, passive strategies.

- Once opportunity costs are factored into the equation, actively managed fixed-income portfolios can cost considerably less than passive strategies.

- Investing in products that closely or passively track indices with extremely low yields and high duration sensitivities could be problematic should rates rise.

Fixed-income markets, by their nature, offer structural inefficiencies that active managers may exploit to add alpha and manage risks. Bond markets and investors are highly segmented benchmarks that are rigidly constructed, and there is an enormous pool of fixed-income securities for investors to choose from. Each of these inefficiencies provides an opportunity for exploitation, yet passive instruments, by definition, are precluded from taking advantage of them. This equates to passive investors paying higher opportunity costs than active investors.

Active managers have outperformed passive strategies

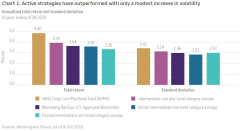

Over the past 10 years, the average active intermediate core bond fund has outperformed the passive intermediate core bond fund average by 26 basis points (bps), net of fees. Investment strategies in the intermediate core plus bond category, those that offer investors greater opportunity to invest beyond the U.S. Aggregate Bond Index—and that have more opportunities to exploit inefficiencies—have outperformed by an even greater degree. Chart 1 shows the 10-year trailing returns and volatility for the intermediate core plus bond category relative to the active and passive intermediate core bond category. For an incremental increase in volatility, active core bond and core plus bond investors have reduced their opportunity costs and realized higher total returns.

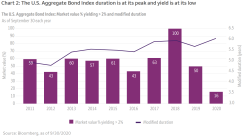

Now could be a tough time to be passive

Passive strategies are constructed to closely track their index. As of September 30, 2020, the Bloomberg Barclays U.S. Aggregate Bond Index had 70% of its assets in high-quality, AAA-rated government securities such as Treasuries and agency debt or securitized products such as agency mortgage-backed securities. These bonds tend to offer lower yields and are highly duration sensitive. The yield to worst on the index set an all-time low in August of 1.02% and today only 16% of the U.S. Aggregate Bond Index is trading with a yield greater than 2%, as shown in Chart 2. At the same time, the modified duration of the index has extended over the past decade to recently hit its all-time high. This leaves U.S. aggregate-centric investors caught earning the lowest yields they’ve ever earned to take the greatest duration risk they’ve ever taken in the index. Choosing now to closely track an index filled with low-yielding, highly duration- sensitive securities could be problematic with an even modest increase in market yields.

Highly rated, duration-sensitive securities tend to outperform in only a single market environment: risk- off periods. If fixed-income investors generally define a “risk-off period” as a month in which the yield on the 10-year U.S. Treasury note falls 10 bps or more, we would find 51 such periods out of the 153 monthly periods since 2008. The benefit of outperformance in these periods (about one-third of the time) can be overwhelmed by trailing during “risk-on” or “flat” risk environments (the other two-thirds of the time), diminishing the benefit of closely tracking the index.

Choosing an active manager who exploits inefficiencies

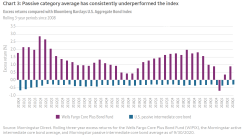

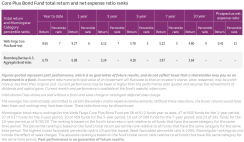

As seen in Chart 1, the Wells Fargo Core Plus Bond Fund has outperformed the Bloomberg Barclays U.S. Aggregate Bond Index and the passive core bond category average over the past 10 years. The strategy benefits from its ability to source alpha and mitigate risks through active exposures both within and outside of the U.S. Aggregate Bond Index. As a result of the aforementioned benefits, this strategy has achieved top-decile performance ranks over near- and long-term periods relative to peers in the intermediate core plus space — year-to-date, 1-year, 3-year, 5-year, 7-year, and 10-year. The Institutional Class for the funds also ranks in the 13th percentile for the prospectus expense ratio, leaving the fund less expensive than 87% of the category peers.

The opportunity costs incurred from investing in a passive instrument tied closely to the benchmark, without the opportunity to exploit inefficiencies, can be meaningful. These costs are also persistent and can materially affect total returns. As seen in Chart 3, on a rolling basis, the Wells Fargo Core Plus Bond Fund produced excess returns relative to the Bloomberg Barclays U.S. Aggregate Bond Index 98% of the time since 2008 with an average excess return of 1.37%. The passive intermediate core bond category average lagged the benchmark net of fees over the entire period.

Costs do matter. And in fixed-income markets, every basis point is important. Passive investors have become very focused on lowering their costs, but once opportunity costs are factored in, actively managed strategies may offer more compelling value. With bond yields around the world hitting all-time lows, investors may benefit from considering active solutions that can exploit inefficiencies and source attractive income, thus reducing their opportunity costs. That’s why active fixed-income investing is a low-cost option.

The views expressed and any forward-looking statements are as of October 31, 2020, and are those of Danny Sarnowski, portfolio specialist, and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the fund and its share price can be sudden and unpredictable. Loans are subject to risks similar to those associated with other below-investment-grade bond investments, such as risk of greater volatility in value, credit risk (for example, risk of issuer default), and risk that the loan may become illiquid or difficult to price. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This fund is exposed to foreign investment risk, high-yield securities risk, and mortgage- and asset-backed securities risk. High-yield securities have a greater risk of default and tend to be more volatile than higher-rated debt securities. Consult the fund’s prospectus for additional information on these and other risks.

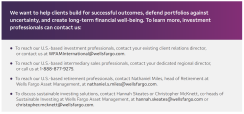

Wells Fargo Asset Management (WFAM) is the trade name for certain investment advisory/management firms owned by Wells Fargo & Company. These firms include but are not limited to Wells Capital Management Incorporated and Wells Fargo Funds Management, LLC. Certain products managed by WFAM entities are distributed by Wells Fargo Funds Distributor, LLC (a broker-dealer and Member FINRA).

FOR INVESTMENT PROFESSIONAL USE ONLY – NOT FOR USE WITH THE RETAIL PUBLIC

INVESTMENT PRODUCTS: NOT FDIC INSURED – NO BANK GUARANTEE n MAY LOSE VALUE

© 2020 Wells Fargo & Company. All rights reserved.

PAR-1020-00229