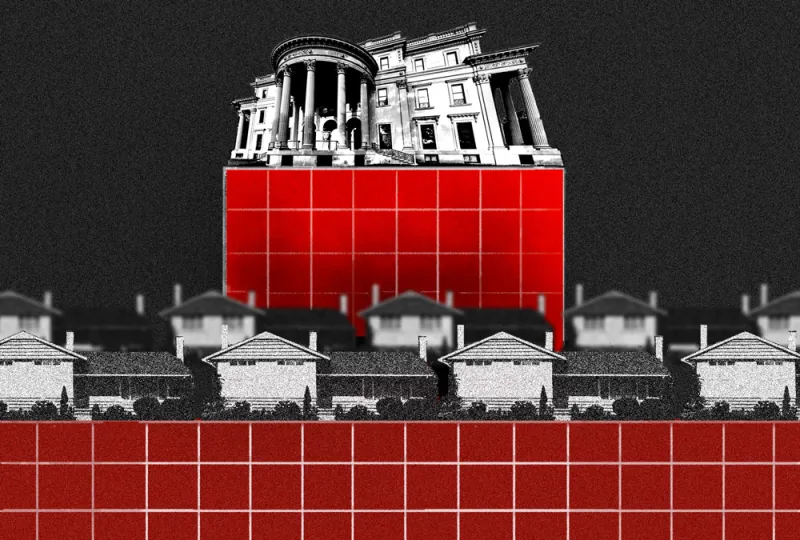

An Obsession With Size Is Costing Advisors

RIA Intel illustration, Bigstock

“There’s a blue ocean opportunity out there to appeal to the mass affluent. And most people aren’t going after it.”

Md.

Monique Morrissey

Pinnacle Advisory Group

Randy Thurman

Morrissey