Jim Iuorio, for CME Group

AT A GLANCE

- Supply disruptions followed by a recent rebound in demand for commodities like copper could be defining a larger trend

- Central bank stimulus across the globe could be combining with demand factors to spark a commodities supercycle

Commodities are on the move. Copper is at an eight-year high and lumber has tripled in a year’s time. Is this the start of a commodities supercycle or are these price moves “transitory” like the Federal Reserve keeps telling us?

In order to answer this question it’s important to identify why prices are rising. Veteran futures trader Jack Bouroudjian cited “supply disruptions across the globe” being a primary driver of the rally. Bob Iaccino, Co-Founder & Chief Market Strategist at Path Trading Partners, concurred and added that there is also the phenomenon of “demand shrinking at the beginning and then spiking” as the worst of the pandemic appeared behind us.

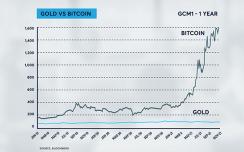

Perhaps this explanation may be an oversimplification. If the commodity markets were entirely driven by supply chain disruptions and volatile demand swings than why would gold be up 20% and Bitcoin be up 900%? Clearly the supply of those assets has remained fairly constant. The answer is that there must be a currency confidence element to the story as well.

A Perfect Storm of Drivers

Most major central banks have lowered rates and greatly accelerated spending in order to ease the pain of lockdowns and this has caused some concern. The U.S. national debt alone has increased by a staggering 16% since the onset of the pandemic. When asked about Bitcoin’s meteoric rise, Bob Iaccino commented that “Bitcoin appears to respond to global currency devaluation.” I believe this is the most salient point of this discussion. If the world’s central banks are all adding stimulus in unison than perhaps the traditional methods of valuing currencies are less reliable.

It appears that commodities, particularly industrial and base metals, are responding to the perfect storm of drivers. Organic demand, lingering supply disruptions and a desire to hedge dollar risk in the wake of recent currency policies all seem to be playing a role.

Read more articles like this at OpenMarkets