By Alison Coughlin, CME Group

AT A GLANCE

- Pandemic shutdowns meant people had nowhere to go, so they bought bigger homes or tackled home renovation projects

- “Last year was our busiest in 10 years of business and we expect 2021 to continue on that trajectory,” says one home builder

Source: Bloomberg (LB1 Comdty).

Limited Supply, Exceptional Demand

The current lumber market is a confluence of limited supply – both long term and short term – and exceptional demand.

There are three main sourcing points for spruce, pine, and fir– western Canada, the Pacific Northwest, and eastern Canada. While production has been relatively consistent in the latter two, western Canada has faced events in recent years that have led to diminished production. According to Michael Almond, a General Manager of Canfor, long term availability of raw timber has been decreasing in recent years.

Prior to 2015, forests were susceptible to the mountain pine beetle. Once the mountain pine beetle epidemic had been placed under control in British Columbia, a sustainability plan was put in place to regrow impacted forestland. This has led to lower annual harvests over the past couple of years – a plan that will continue for another decade. Coupled with less timber availability, 2019 saw lumber prices so low that it cost sawmills more to produce and export boards than they could sell them for, which led to the closure of a number of sawmills. Mr. Almond estimated that approximately 3 billion board feet were taken out of production between 2019 and 2020. When demand started to ramp up in mid-2020, the sawmills were already producing at capacity and are unable to increase the amount of lumber coming to market.

Demand for lumber skyrocketed in the summer of 2020, bolstered mostly by demand for housing and DIY housing projects. The shutdowns that occurred as a result of the novel coronavirus meant people had nowhere to go and less places to spend their money, so they started to look for bigger homes or began to tackle home renovation projects. Existing home inventory levels are low, and housing starts continue to rise, signaling a steady demand for real estate. Stinson Dean, owner of Deacon Lumber, says he is “watching interest rates.” Mr. Dean emphasized that even though rates are increasing, they are still significantly lower than average, which is helping to drive demand.

Source: U.S. Census Bureau, LIRA from JCHS.

As shown, demand is not just increasing for new housing – it is increasing for home renovations as well. “Overall, the net demand for renovations feels very strong with so many people spending the majority of their time at home. People aren't spending money on vacations, restaurants, and events, so it seems they are putting into their homes,” said Jeffrey Mayra, owner of Relevant Homes. While Mr. Mayra reports that some colleagues have had clients hold off on projects in hopes that raw material prices come down, he also noted that “last year was our busiest in 10 years of business and we expect 2021 to continue on that trajectory.”

Through the Roof

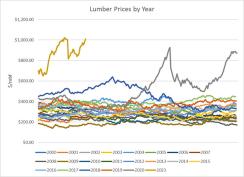

The tumultuous nature of the lumber market over the past year cannot be overstated. As seen below, lumber prices over the past two decades have tended to stay within a relatively firm range, with little intra-year movement. However, three of the last five years have bucked that trend completely.

Source: Bloomberg (LB1 Comdty).

So far, 2021 prices have already ranged from $650/mbf to over $1,000/mbf. Similar patterns were observed in 2018, with housing demand skyrocketing until interest rates grew and cooled the market. Ultimately, 2021 has set multiple pricing records and the continued inverse of the forward curve indicates that demand isn’t diminishing yet.

Examination of pricing data also unearthed some other interesting pricing trends. Over the last two decades, the highest prices of the year have occurred most often in the first quarter. From 2000 through 2020, about 40% of the highest price observations of the year took place in the first quarter. Additionally, from 2000 until the housing crash in 2008, the second half of the year almost always had lower than average (for the year) prices, but that trend has not held true since the recovery. Since 2010, the seasonality has not been as consistent, with lower than average prices occasionally occurring at both the beginning or end of the year, or during the summer months.

The wild swings in lumber prices during the past year could not have been anticipated – either by sawmills closing due to diminished supply, or by those demanding real estate and home renovations. Past price trends may be able to provide context, but the confluence of these factors has been historically unmatched.

Read more articles like this at OpenMarkets