Paul Wightman and Elizabeth Hui, CME Group

AT A GLANCE

- With COVID-19 restrictions forcing restaurants to provide outdoor dining in the dead of winter, propane heating has been bolstering business

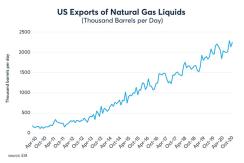

- U.S producers reported record propane export volumes in 2020 as Asia demand soared

U.S. Producers See Record Exports

Large numbers of U.S producers reported record 2020 export volumes. Enterprise Products saw their Q4 2020 volumes increase by over a quarter to 24 million barrels per day. Total exports for the 2020 calendar year are expected to reach 47.1 million tons or 546.3 million barrels, up 15% from 2019 levels.

Mother nature has also been a force this winter season. Frigid weather with an Arctic blast delivered some of the coldest temperatures seen in decades to the Great Plains and Midwest. Mont Belvieu propane futures responded with prices soaring as high as $0.94 cents per gallon in February compared to $0.39 per gallon a year earlier.

Conway propane futures prices have risen with premiums trading at highs not seen since April 2014. Surges in both domestic and international winter heating demand put intense pressure on supply. Furthermore, exports continued to gain traction despite higher prices in U.S. and global freight costs.

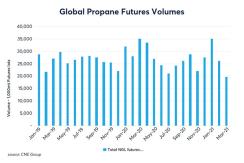

Futures trading volumes were also higher year on year, reflecting the growth of NGLs. The latest data from CME Group shows total volume in 2020 was around 200,800 contracts, an increase of 29% compared to 2019.

Propane Flows Into Asia

Rising petrochemical margins in Asia have supported demand for propane as a replacement feedstock for naphtha. Part of the reason has been the cheap gas prices due to the ample availability being exported into the region from suppliers in the Middle East and the U.S. Asia propane has traded at a discount to the naphtha price but the influence of U.S imported propane has increased the volatility in Asia propane prices.

Asia propane prices have traded in a huge range to Japan naphtha prices, partly due to the change in dynamics being seen in the market. Since April 2020, Asia propane prices have traded in a range of around $130 discount to naphtha to a premium of close to $200 per metric ton. This partly reflects the ebb and flow nature of imports into the region which has influenced the level of margins at key chemical plants.

U.S. Propane Feeds Chemical Demand

Regional supplies from the Middle East, North Africa, and northern Europe are fiercely competing on price with cheaper U.S imports and, in some cases, are resorting to exporting cargoes to other markets to sell their available volumes.

Strong industrial demand growth in Asia can be attributed to chemical producers and increasing propane demand. Propane Dehydrogenation (PDH) units for the production of propylene, a critical component for the chemical supply chain, will be coming online in the months ahead which could drive further demand. Propylene is a chemical that is used to manufacture polypropylene, a polymer that is used to produce automotive parts and packaging for consumer products like toys, plastic bottles, luggage and personal protective equipment. The combination of these dynamics may be helping to fuel Asia-bound propane exports.

Strong U.S Demand

With COVID-19 restrictions forcing many restaurants to provide outdoor dining, even in the dead of winter, propane heating has been a bolstering business. Residential prices are up more than 20% since late November 2020, averaging $2.36 a gallon as of the week of March 15, 2021.

Exports have played a key role in the global natural gas liquids markets and the U.S. has been at the center of these changing dynamics. Increasing flows from the U.S may bolster the role for Mont Belvieu on the global pricing stage as it continues to evolve into one of the leading energy benchmarks akin to the likes of WTI crude oil and Henry Hub natural gas.

Read more articles like this at OpenMarkets