By Kentaro Takayanagi, Nomura

When I began managing the Japan Strategic Value (JSV) strategy in July 2000, I would have summed up market conditions and sentiment as follows. See if these highlights sound familiar:

- Technology companies were the darlings of the stock market.

- Old economy, cyclically oriented companies were seeing depressed valuations.

- Prominent value investors were closing down their business operations.

- Industry pundits were increasingly vocal about the notion that structural growth couldn’t be encapsulated within traditional valuation metrics.

- Pundits further declared value investing was dead

Anniversaries are typically moments of celebration, but I would like to take this moment to share some introspection and an open letter to my peers who share my passion for contrarian investing. Hopefully, the reflections shared here will be helpful for those who look back on this in 20 years.

Stylistic element

While the relative popularity of value and growth as investment styles has ebbed and flowed over the years, the plight of value investing has been sufficiently documented for more than a decade now. Over the last few years, growth has been outperforming value by a sizable degree in the U.S. and Japan. Despite the market reversal in favor of value in late 2020, the MSCI Value vs. Growth (V/G) ratio has recently reached all-time low levels. As you can see in the table below, the most recent 10 years were particularly difficult for value.

Source: Nomura Asset Management, based on Bloomberg data

Value stocks tend to be characterized by low price-to-earnings (P/E) and low price-to-book (P/B) ratios, while growth stocks generally have high P/E and high P/B ratios. Value stocks look cheap on these measures against their intrinsic value. Growth stocks are usually characterized by above average earnings growth and seem expensive and overvalued based on many traditional measures. However, there are many stocks that can offer a mix of value and growth characteristics.

The outperformance of growth stocks has been driven by a number of factors, most notably:

- Moderate GDP growth

- Falling interest rates – linked to moderate GDP growth and central bank action

- The emergence of new technologies that are not easily copied or widely shared, particularly if accompanied by what in effect are monopolies.

Such powerful trends often look all-conquering, prompting expressions such as “things are different this time,” but they are not guaranteed to persist. Moreover, for equity investors mean reversion is a powerful factor even if secular trends continue, as valuations can rise to unrealistic levels prompting corrections.

However, the switch from one style to another is difficult to time as valuation differentials can last for longer and stretch further than anticipated. As practitioners, during headwinds we have sought to control what we can through disciplined investing.

Performance

Our approach to value investing has been and remains a pursuit of combining undervaluation with potential, and it has delivered attractive upside/downside capture that compounds over time.

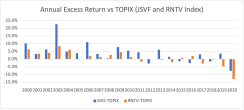

That said, 2020 proved to be the toughest year in the fund’s history compared to the broader index, even though the fund outpaced value indices by a comfortable margin. While value has faced a stylistic headwind for more than a decade, it has intensified over the last couple of years. The graph below shows the annual excess returns of the JSV strategy (SVO) and the Russell Nomura Total Value Index (RNTV) vs. the TOPIX index over the last 20 years, during which time we have outperformed the broader index.

Source: Nomura Asset Management based on Japan domiciled SVO fund, as of December 30, 2020.

(Note) Strategic Value Open (SVO), which is representative of the Japan Strategic Value (JSV) Strategy, is a Japan domiciled investment trust fund established under Japanese law and distributed only in Japan. The return (gross of fees) is computed based on the NAV by adding back the annual management fees on a monthly basis from August 2000 to September 2007 when the mother fund was established. From Oct 2007, return of the mother fund, which is gross of fees, is used.

Portfolio positioning

Despite the difficult stylistic headwind, we have increased the value bias of the JSV strategy over the last couple of years given the opportunities created by the market conditions. (The graph below depicts relative P/B ratio vs TOPIX using Barra’s value factor.)

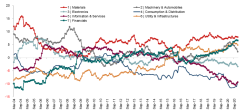

While we have maintained the value exposure through the years, our sector agnostic approach has led us to take positions in an ever-evolving slew of industries. You can see the breadth of our historical sector positioning below:

Source: Nomura Asset Management based on Japan domiciled SVO fund, as of December 30, 2020. (Note) SVO, which is representative of the JSV strategy, is a Japan domiciled investment trust fund established under Japanese law and distributed only in Japan.

Most recently you can see that our relative overweight has increased in materials, financials, and utility/infrastructure, while our exposure to information services and consumption has decreased. This may appear to be a shift away from in-vogue secular winners and into mature, largely cyclical areas. However, we believe many of holdings we have added contain high value-added products and services that are poised to benefit from overarching secular developments, including the electrification of vehicles, migration to the cloud, and renewable energy. Our focus on uncovering undervaluation and potential remains unchanged.

Opportunity set

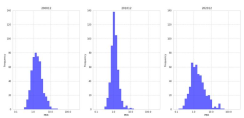

The market has become increasingly distorted due to the style-return differentials, and we believe the conditions are set for a major reversal similar to the one seen in the early 2000s. The P/B ratio histograms below show that the dispersion in 2020 is similar to the level seen in 2000.

This level of dispersion is among the reasons I am very excited about the opportunity set despite the difficult environment – but what would it take for value to make a comeback?

Thought Exercise: What are some longer-term catalysts for a reversal?

I am as curious as anyone about what could finally reverse value’s fortune. The following hypothesis are based on historical parallels and the premise that market participants are human, even if the degree to which they rely on technology has increased.

Hypothesis 1: Growth stocks fail to meet expectations

With valuation dispersion historically high, secular winners are enjoying equally noteworthy high multiples – but we believe they are essentially priced for perfection and susceptible to contraction when results fail to meet lofty expectations (similar to what happened in 1999 and the fall of IT companies). I believe this convergence would be exacerbated by the presence of significant passive vehicles, which would amplify momentum in both directions. This could occur during the recovery from COVID-19. Timeframe: 1-3 years.

Hypothesis 2: Material improvements in the fundamentals of value stocks

This would be spearheaded by changes in corporate behavior, prompted by a more difficult operating environment that sees a surge in industry restructuring and consolidation, and strategic shifts. Timeframe: 1-4 years.

Hypothesis 3: Whittling down of value manager.

This is similar to what occurred in 2000, when value managers were forced to sell positions. Forced selling presents opportunities. All things equal, the liquidation of likeminded investors increases the likelihood of favorable excess returns when positions become less crowded. We have already observed some well-regarded value managers announcing their exits in 2020. Timeframe: Within one year.

I am particularly excited about Hypothesis 2 (material improvements in the fundamentals of value stocks) as a catalyst that may be uniquely conducive for Japanese companies. Despite material improvements in corporate governance practices among Japanese companies in recent years, significant room for improvement remains. Not surprisingly, many of the laggards are considered to be value stocks, many of which are trading below their book value. While I agree with those who argue that the abundance of analytical tools and corporate disclosures mean cheap stocks are much more likely to be cheap for good reasons compared to their counterparts in 2000, I also believe that this increasingly prominent preconceived notion has created pocket of overlooked opportunities, especially in Japan.

Key takeaways

Reflecting on the journey of our Japan Strategic Value strategy so far, we have seen that:

- Decade-long stylistic headwinds for value have accelerated in recent years, reaching a new level in 2020 as COVID-19 shook up the global economy. Our 20th anniversary proved to be our worst year in terms of performance against the broader index. Despite this, our attractive upside/downside capture remains in place against both the broader index and value index.

- Through the ups and downs we have managed to maintain a significant value tilt throughout our history. Valuation dispersion has returned after a long hiatus, which we believe creates attractive long-term opportunities for judicious stock pickers following the value discipline.

- We believe that the components which may be conducive for a shift from growth to value are gradually materializing.