Fred Seamon, CME Group

AT A GLANCE

- Growing U.S. consumption and rebounding exports along with lower production has resulted in significant consumption over production the past two years.

- Estimates suggest the U.S. has exported one billion bushels of soybeans through November, a record for that time frame.

The higher prices have also come along with higher price volatility. Current price volatility is at levels usually associated with the summer U.S. growing season when weather uncertainty drives volatility.

There are multiple economic conditions, both domestic and global, that are driving both higher prices and volatility.

U.S. Domestic Situation

U.S. soybean demand is robust as total use continues to grow. For example, USDA projects the 2020/21 U.S. soybean crush to be record large at nearly 2.2 billion bushels. This represents growth of over 15% over the past five years. In addition to this growth is a resurgence in export demand. Despite head winds caused by the U.S. trade war with China over the past two years, USDA projects export demand to recover to pre-trade war levels under the U.S. – China Phase One trade deal. AgResource estimates that the U.S. has exported 1 billion bushels of soybeans through November. The U.S. has never exported this quantity of soybeans in a single crop year quarter.

Meanwhile, U.S. production has disappointed the past two crop years. A cold and wet spring in 2019 resulted in the lowest U.S. soybean production since 2013 and late season dryness this past summer curtailed what was expected to be a healthy 2020/21 crop.

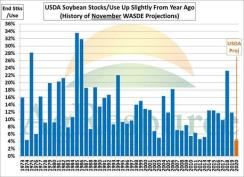

Combining growing domestic consumption and rebounding exports with smaller than expected production has resulted in significant consumption over production the past two years. Just two years ago the U.S. domestic stock-to-use ratio set a record at over 20 percent. The November 2020 USDA WASDE report projects that 2020/21 stocks-to-use will dip below 5 percent, the lowest stocks-to-use ratio since 2013. AgResource notes that, for November WASDE reports, the projected U.S. stocks-to-use ratio is the lowest in history.

The Global Situation

Global production in 2020 has already exceeded global production of the past two years. A developing La Niña weather pattern also increases the risk for adverse weather events in South America. Argentina soybean production peaked in 2014 and returning to those levels will be challenging during a strong La Niña. AgResource reports that only two vessels are in the line-up to load soybeans as of the last week of November, which suggests that Brazil is nearly sold-out of old-crop soybeans. The market will be watching closely Brazilian weather conditions and any potential crop losses.

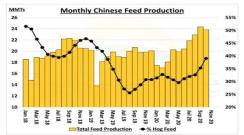

Global consumption also continues to grow. China is the largest consumer of soybeans and after several years of relative lackluster demand growth due to a smaller domestic hog population, Chinese usage is projected to be a record high in 2020/21.

Eyes on South America

Rising global demand along with smaller than expected production over the past two years is driving the lowest stock-to-use ratios in years. A large South American crop is needed to avoid rationing and the potential for even greater volatility. South American weather and a developing La Niña weather pattern will be watched very closely over the next few months. Increased volatility is likely to remain until more is known about the South American crop.