But as Zero, the number, becomes more associated with benchmark interest rates and returns on bonds, its importance cannot be understated. At the beginning of what could be a prolonged period of policy fueled financial repression, we will all have to focus on Zero, its impact on investment decision making, and its impact on asset allocations. We have only begun to see Zeros everywhere.

At its most basic level, Zero is the absence of anything; that absence can be a hard concept to explain. Most simply, the absence of things can be taught to children, much in the same way I taught it to my brother when I took all his toys away.

Perhaps he would see it as poetic justice that the concept of taking away, until nothing remains, is my focus here. Today, #TheZero means simply this, that nothing is left.

The CIRCLE of life

The absence of income manifests with Zero Interest Rate Policy (ZIRP), when benchmark yields approach Zero. In this instance, the basic 60/40 investment portfolio strategy seems to inspire more questions than answers. Can we achieve a balance between growth and safety? Will bonds any longer offset equity volatility? How do we earn income? If the base return is Zero, or negative, are we still looking for alpha? Or, do we need to now re-examine the risks that we take on in order to earn that alpha. Indeed, should we revisit the merits of exposures to certain asset classes and their current efficacy as return generators? Clearly, there is some basic math to reconsider, not just at the fundamental level, but at the investment allocation level, and at the life planning level. #TheZero has material implications for how we live our lives, not just for our investments.

Add the Zeros to the end through hard work

I’ve always liked simple concepts. The simple plan: work hard, get a scholarship, educate yourself, get a job, care for your loved ones, save money, invest, retire and live off of the income your invested savings generate. Invested savings, as a simple rule, meant bonds. Using bonds was the plan because you could earn income and maintain your principal. Simple plan, ironclad... or so I thought.

What happens when simple becomes complicated? What happens when the coupon income generated by bonds is close to Zero?

With Zero income, the math no longer works for retirees, not to mention for those that manage pension plans for the benefit of retirees. Furthermore, in a demographically top-heavy society, this problematic paradigm is compounded. If savings do not generate adequate income, you have three options: you must be willing to spend down your savings, you must be willing to reduce your expenses, or you must continue working for a longer period prior to retiring. This reality is becoming more common and I’ve seen a new acronym to represent it, “D.A.D.”, which stands for “Die At Desk”.

This is the impact of “The Zero”, and it will get a lot of attention, it certainly has ours (or mine). Macabre? Yes. Escapable? Definitely.

How we got to Zero

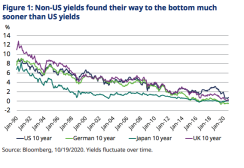

Interest rates for developed countries have been structurally declining. Globalization, low levels of inflation or even deflation, and lower growth rates have all contributed to the multi-decade decline.

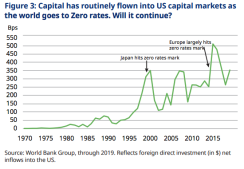

Japan, in the 1990s, was the first near-Zero interest rate regime. In 2014, Europe joined Japan, as local rates went beyond Zero into a negative interest rate regime. It is worth noting, in both cases, investment capital flowed to countries with higher structural interest rates, notably the US.

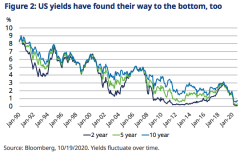

In the US, policy action has resulted in short-term interest rates near Zero, notably during the Global Financial Crisis (GFC). But today, the yield curve is flatter, so it is not only short-term rates that are near Zero.

Central banks are the buyer of last resort, not only for sovereign debt, but now for other corporate debt as well. With little additional yield available for longer term investments (term premium), the search for “any” yield has led to increased demand for more traditional “risk assets”, with a commensurate reduction in credit risk premium for most “run-of-the-mill” fixed income instruments. Facetiously we ask, should we call it fixed “income”, or is it now just “fixed principal”.

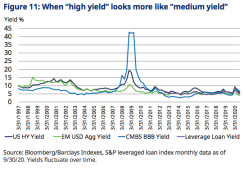

The jokes like that are adding up, and they’re becoming increasingly less funny. How many times in the last few years have you looked at the term “high yield”, scoffed at it, and thought, “more like medium yield”.

So we agree The Zero is not new... we have seen near-Zero interest rates in Japan as well as in Europe. However, when those local rates declined the US represented a haven of sorts, the higher yielding developed economy... that is not so anymore. We believe with current market dynamics will now write this in neon, ‘blink, blink, blinkity blink’.

The Federal Reserve (Fed) first ventured to ZIRP in December 2008 and it held the Fed funds rate near Zero through December 2015. What is the difference now?

Time, for one, and the flatness of the yield curve, for another.

We tend to forget that the term structure of the yield curve offers the markets opinion of the future for interest rates. The flatness of the yield curve today is potentially pointing to a prolonged period of low interest rates.

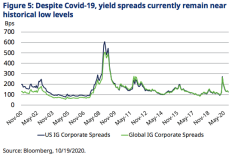

Low discount rates have also resulted in appreciation of assets, both real and financial. Cheap leverage is available in the government-supported debt markets. So there seems a disconnect between the economy and, valuations, spreads and leverage.

There have been three principal boosters that have propelled markets forward from a valuation perspective (and pushed yields lower), and their combination makes the prospects for generating income and return more challenging. Namely:

- Monetary support

- Fiscal support

- Perceptions around recovery

Policy dependence has brought us here, and with very little yield in traditional fixed income, with crowding in traditional “risk assets” like equity, and with correlations pulling together, traditional asset allocations may be in for a reconsideration.

Zero begets Zero?

#TheZero feels like it’s here to stay. With that, what should not go unappreciated is the impact low rates and low income may have on consumer behavior and, therefore, economic fundamentals.

Let’s take D.A.D., “Die At Desk”, as an example. If investment income is insufficient to support a retiree, a potential retiree must continue to work, likely past the retirement age assumed. The potential extension of working years has significant consequences for the labor pool.

If everyone must work forever, we have an infinitely expanding pool of labor. Say it again, “infinitely expanding labor pool”. It surely makes it difficult to imagine wage inflation, and limited inflation means lower interest rates for longer.

Zero may be spelled the same in many languages, but not in all of them

The impact of interest rates falling to Zero in the US may be broader in scope than what has been seen for other markets. The US is not the same. There are two important issues as Zero comes to the US.

- The US is big. When other countries have seen their local interest rates depressed, the US often became the harbor for foreign capital flows. The US was the recipient of foreign capital flows when Japan (1999) and when Europe (2014) went to Zero or negative interest rates. At times, the US has been referred to as “the higher yielding developed economy”. To be sure the US is a large country with a lot of debt, including government debt and corporate debt and, as such, foreign capital had a placeto flow, even on a currency unhedged basis. The World Bank captures this in Foreign Direct Investment figures and we see spikes when Japan went to Zero rates in 1999 and when Europe went to Zero rates in 2014.

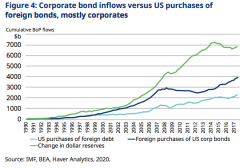

The increase in foreign purchases of US corporate debt, coinciding with Europe’s negative interest rate policy implementation in 2014, has also been a factor in the reduced credit risk premium for corporate securities.

- The US has a larger population, and retirement implications are different than other countries that have adopted Zero or negative interest rate policy. The social safety nets and retirement provisions in the US today are less than most European countries.

You can add Zero to anything and not change it

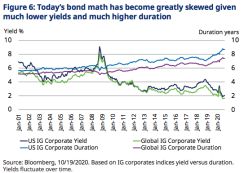

If the impact of Zero on income is material, let’s look at the change in bond maths!

Typical return generators for bonds are:

- Duration

- Roll-down

- Coupon

- Yield Spread

Roll-down is the concept that if the yield curve is positively sloped, a bond’s price can increase as it shortens. Currently the yield curve is very flat, so roll-down will contribute much less to a bond’s return. Notably, amortizing bonds receive less benefit for roll-down when the yield curve is steep, and they may be more attractive in a flat yield curve environment.

Coupon A bond, priced at par, earns its returns from coupon income. Today those coupons are lower given the 1-yr Treasury yields 15 basis points (bps). The coupon will be determined by the level of yield spread, which is also low.

Yield Spread is the risk premium added to the benchmark rate, to establish a bond’s coupon.

Each of these sources of return has been material over the past four decades, and each is likely to be far less material going forward, a bit reminiscent of the disclaimer, “past results are not indicative of future performance.”

Zero cushion?

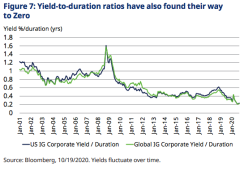

Many investors in bonds have looked at carry and the cushion it provides against volatility or spread widening. The concept is this: the yield (or carry) a bond generates provides return, but also typically provides enough return so that it can offset some widening in yield spread.

Today, yields are very low, and duration has extended materially for corporate debt. With this as a backdrop, the traditional relationship between yield (or carry) and duration is no longer what we are seeing. The cushion carry offers to spread widening is now very low, and with higher duration, the impact, or sensitivity, to yield spread widening is, at the same time, much higher.

Looking back to the early part of the 2000s, investment grade (IG) corporate securities had enough coupon income they could sustain more than 100bps of spread widening and still break even to a Zero percent return. Figure 7 offers a simple measure of the yield, divided by the duration. A yield of 6% for example, divided by a duration of 6 years, would result in a yield/duration of 1%, or 100bps. This is similar to what we saw in the early 2000s. Post GFC, the yield/duration metric increased to 160bps; what a value! Since 2013, the yield/duration declined to 40bps and today it is only 20bps. With yields around 1.5%, and duration near 7.5 years, a 0% return break-even occurs after yield spread widening of only 20bps.

From Zero to Hero

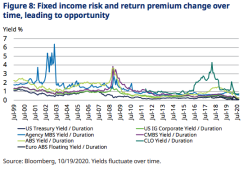

With traditional yield metrics and return cushion alike, declining, where can attractive return be found? In our view, returns should be married to their risk premium, and the compensation for risk factors can range over time. Some examples are thus:

- Maturity risk premium – today this premium is near Zero. US Treasuries (long versus short) are guaranteed, but do come with maturity risk

- Credit risk premium – with everyone flocking to the traditional risk assets, these risk premiums have declined, even with considerable economic uncertainty. Corporate credit IG and high yield are traditional credit risk assets

- Sovereign risk premium – country credit risk. Emerging market versus developed countries would showcase this risk premium

- Convexity risk premium – guaranteed US Agency MBS, versus US Treasury notes would be a way to examine this premium

- Complexity risk premium – structured product versus treasuries or versus corporate credit can be compared

- Liquidity risk premium – being able to hold and compare public versus private assets

Presently, we see better carry/duration metrics coming from areas such as ABS, CLO and CMBS, rather than the common credit benchmarks (IG credit). For example, today the European ABS index offers more attractive metrics relative to US IG credit than at any point in the last three years, implying that the premium for the complexity is more attractively priced today. This is the benefit of off benchmark assets, or in the words of the poet Robert Frost, “the road less traveled”.

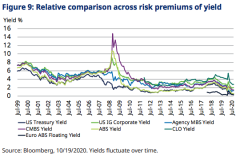

When looking at yield alone, it is observable that the risk premia, for most traditional assets, have been reduced the most expeditiously in the search for yield.

Closer to 10 than 0

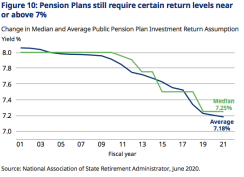

Some business models, like insurance-guaranteed returns (i.e. annuities), may have to use capital should current income fall below the yield they need for replacement investments as existing investments mature. Pension funds also evaluate their capital contributions using assumptions for returns, these assumptions are closer to 10 than Zero.

Given their required rate of return, there is a prominent case to be made for using alternatives or assets that earn a liquidity premium to achieve additional return through a diversification of risk premium, rather than just additional credit risk.

Regardless, in an environment of Zero, 7% is a tall order.

Over the last two decades, there has been a persistent decline in asset yields below that 7-8% sweet spot. Across the board, it looks like 5% is the new 7%.

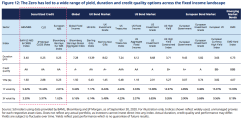

In light of the near-Zero benchmark rates, we expect that investors will need to look more carefully at the spectrum of risk factors that are tolerable today.

Figure 12 shows a number of market indices and the eyepopping numbers including the very low level of the yields to maturity (YTM), as well as the much higher level of volatility. Using only benchmarks, we cannot easily capture the benefit of diversification, or of asset selection. But we can demonstrate the benefit of a lower volatility product like European ABS, or the attractive yield versus duration ratio of AAA ABS/MBS or AAA CLO. Regrettably for many structured products, there is not an index to show off other comparisons. But the absence of an index is one reason that structured product often offers more compelling yield. That it doesn’t sit in a major benchmark means that it may offer a liquidity premium much like we see for private assets. Notably missing from the Figure 12 are attractive diversifiers like real estate debt, which, according to Prequin, offer IRRs of 9%-10%, with lower volatility.

Given today’s level of economic uncertainty, asset owners will need to reconsider how they pursue their required outcomes, and reconsider their exposure risk. To be sure, based on today’s facts and circumstances: policy support, idiosyncratic risk and disruption, there are factors worth emphasizing and factors worth de-emphasizing. There is merit to taking some risk exposure, specifically exposure that will benefit from accelerating trends.

There will also be opportunities created as the world changes post Covid-19. Access to opportunity, has a place in an investment portfolio. But, there is merit to diversifying that exposure, given uncertainty. By contrast, in a low carry, low rate environment, de-emphasizing duration may be desirable for some, especially if duration is unlikely to play the same role within an asset allocation that it has in other cycles.

We strongly believe that evaluating solutions for #TheZero includes a prudent assessment of factors that can and should be emphasized: stronger fundamentals, better tolerance to volatility, and lower sensitivity to interest rates. Equally required is an assessment of factors that should be de-emphasized. This analysis should be framed within the context of the unique interest rate environment, with a mind for differences from the past that may manifest.

Within a portfolio, each asset should serve a purpose, based on the factors that it emphasizes. The building blocks of a successful strategy will likely require new thinking about sources for return such as: Fast liquidity, Carry, Opportunity or Recovery.

Fast liquidity: For most, some component of a portfolio needs to be used for liquidity. Liquidity is one area that requires a re-examination in light of the changing size of various markets, and the securities within them. Increases in government or corporate debt relative to dealer inventories, the balance sheet of the Fed, among the chief considerations. But in March of 2020, the experience was different than the expectation. And with a new set of rules, it is important to re-assess liquidity and its sources. Maintaining pockets of liquidity with as little spread risk as possible, offers an investor, even a return-seeking investor, the flexibility to benefit from further dislocation. We believe this favors securities being bought by the government that do not bear default risk, such as Treasuries or Agency guaranteed MBS.

Capitalizing on opportunities as valuations change can be a critical component to seeking to achieve higher returns. This is likely to involve liquidity or complexity premium.

Opportunity: Based on their exposure to certain themes or trends, some products benefit from opportunity, either right now, or down the road. Opportunities today are more likely to include those that are housing related, but future opportunities will include real estate related, consumer related and corporate related. It is important to remember, not all opportunities come at once. For now, it is clear to us that housing benefits from a quality of life trend, and the shelter-in-place demand. But even thinking beyond the obvious, if retirees question the ability of savings to generate income, they may look to lower their cost of living. If financial assets are expected to generate a substandard/low return or low income, individuals may recalibrate their retirement by changing the cost/or expense side of their equation. It is equally possible they move investments, to a barbell of liquidity (for safety) and less liquid assets such as an investment in a home in a desired retirement location, that can be used in the interim to earn rental income.

Recovery: Other types of opportunity can be driven by mispricing. Emotional bias or fear, can be a principal driver of opportunity.

Regulation can be another. Recovery opportunities are often the “babies thrown out with the bathwater” in dislocated or uncertain markets. The real estate market facing the impact of change is a good example. In this way, a range of opportunities may be created in both favored sub-sectors (industrial) and loathed sub- sectors (retail, office or hotel).

Carry: Assessing the carry of a bond in consideration of its duration and potential volatility should be a key driver. If this is desirable, our view is that a sector like ABS affords these characteristics more so than many other sectors.

Evolution: Lastly, liquidity takes us into another dimension of risk premium. The terms of liquidity can range in terms of return and in terms of lock-up. This is another tool that could be used to improve or reduce risk within a portfolio in #TheZero, and is likely a potential area that is critical to assess, given that in markets where capital provision is limited, or less efficient, excess return is more likely.

In looking across the landscape, there is a need to solve the problem of #TheZero. Participants in income markets alike will need to consider diversifying sources of return beyond traditional markets, or traditional thinking.

It has been said that “underneath every revolution lay a Zero”, and from an asset allocation perspective, this time is no different. We believe that we are just now at the beginning of changes to fixed income asset allocations in order to more aptly navigate #TheZero.

It was the poet, Vanilla Ice, who said, “better drop that Zero and get with the hero”. In the context of portfolio allocations, this means with very low structural yields and returns we must consider more risks, rather than just more risk. With that as our guide, we can “stop, collaborate, and listen”. Consider a more diverse basket of less correlated assets to embed resiliency. We believe this is the order of the day.

With a wider range of possibility, assessment of liquidity becomes a more important lever. To make available a broader toolkit, managers may need new structures to provide access to some of the asset classes that have typically been accessible only to larger investors. For some there will be more material changes to create a diverse portfolio by using a range of alternative or private assets, non-traditional asset classes, or structures. For others it maybe be a first step into considering a non-benchmark sector with a better income or maturity profile.

This re-assessment is set in an environment of new challenges. The easy sustainability of this recovery may be challenged.

Even the delay in the expected US fiscal package has altered expectations. Unemployment perceived as temporary will begin to shift to unemployment perceived as permanent. Policies that helped companies and consumers bide time through non-payment will expire, and we may see another wave of layoffs and increases in bankruptcy filings. We believe these challenges will begin to mark the second phase of this economic crisis and recovery, as we begin to see new data, we may initially see the #deathofoptimism. There will likely be renewed opportunities to benefit from structural changes taking place in the economy, be they social, political or economic.

Generating successful investment outcomes with an uncertain economic backdrop is hard. With high asset prices, and with very little income offered in traditional markets, it is very hard. But as Tom Hanks said in A League of Their Own, a movie about women taking over the US Professional Baseball League during WWII, “It’s supposed to be hard. If it wasn’t hard, everyone would do it. The hard… is what makes it great.” – and there is NO crying in baseball.

Schroder Investment Management North America Inc.

7 Bryant Park, New York, NY 10018-3706

For more information please visit our website at www.schroders.com/us/institutional.

Twitter: @SchrodersUS

Important information: The views and opinions contained herein are those of the authors and do not necessarily represent Schroder Investment Management North America Inc.’s (SIMNA Inc.) house view. Issued November 2020. These views and opinions are subject to change. Companies/issuers/sectors mentioned are for illustrative purposes only and should not be viewed as a recommendation to buy/sell. This report is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for accounting, legal or tax advice, or investment recommendations. Information herein has been obtained from sources we believe to be reliable but SIMNA Inc. does not warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the document when making individual investment and / or strategic decisions. The opinions stated in this document include some forecasted views. We believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee that any forecasts or opinions will

be realized. No responsibility can be accepted for errors of fact obtained from third parties. While every effort has been made to produce a fair representation of performance, no representations or warranties are made as to the accuracy of the information or ratings presented, and no responsibility or liability can be accepted for damage caused by use of or reliance on the information contained within this report. Past performance is no guarantee of future results.

SIMNA Inc. is registered as an investment adviser with the US Securities and Exchange Commission and as a Portfolio Manager with the securities regulatory authorities in Alberta, British Columbia, Manitoba, Nova Scotia, Ontario, Quebec and Saskatchewan. It provides asset management products and services to clients in the United States and Canada.

Schroder Fund Advisors LLC (SFA) markets certain investment vehicles for which SIMNA Inc. is an investment adviser. SFA is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker dealer with the Financial Industry Regulatory Authority and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Quebec, Saskatchewan, Newfoundland and Labrador. This document does not purport to provide investment advice and the information contained in this material is for informational purposes and not to engage in a trading activities. It does not purport to describe the business or affairs of any issuer and is not being provided for delivery to or review by any prospective purchaser so as to assist the prospective purchaser to make an decision in respect of securities being sold in a distribution. SIMNA Inc. and SFA are indirect, wholly-owned subsidiaries of Schroders plc, a UK public company with shares listed on the London Stock Exchange.

Further information about Schroders can be found at www.schroders.com/us or www.schroders.com/ca. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY 10018-3706, (212) 641-3800.