Asset management professionals make more money over their entire careers than workers in other fields — including other areas of finance.

New research documenting lifetime incomes of employees in finance, manufacturing, and technology finds that finance wages start out high and increase at a much steeper rate than pay in other fields. Much of this “career premium,” however, is concentrated in asset management jobs, according to Indiana University professor Andrew Ellul and Marco Pagano and Annalisa Scognamiglio of the University of Naples Federico II.

“While asset managers enjoy a large career premium and no commensurate career risks, the opposite applies to banking and insurance employees,” they wrote in a paper on the findings.

The researchers analyzed the resumes of nearly 10,000 individuals who worked in finance, manufacturing, or technology at some point between 1980 and 2017. They found that more than 80 percent of workers who started working in finance or another industry still had jobs in those fields ten years later, while 75 percent worked in the same industry 30 years later.

Within finance, the researchers determined that between 30 percent and 40 percent of asset management and commercial banking professionals remained in those industries for their entire careers. The same could be said for 45 percent of insurance workers and 50 percent of real estate professionals.

Entry-level salaries in finance were found to be 9 percent higher than non-finance jobs — a disparity that grew to 18 percent after 25 years of work. This difference in starting pay disappeared when the authors factored in bonus compensation. However, the steeper trajectory for finance earnings remained: Average compensation for finance professionals grew to almost $1.5 million, compared to $971,000 for non-finance careers.

[II Deep Dive: How Far Will Asset Management Pay Fall?]

“The finance premium seems associated with careers being faster in finance than in other sectors,” the authors wrote. “After the first decade of experience, finance employees are more likely than non-finance ones to achieve top executive jobs entailing high bonus pay.”

Still, they found disparity in pay across finance jobs. Entry-level workers in asset management earned a premium of $20,000 relative to other jobs, including bonuses. But employees starting out in banking or insurance earned $20,000 less than workers outside of finance, according to the study.

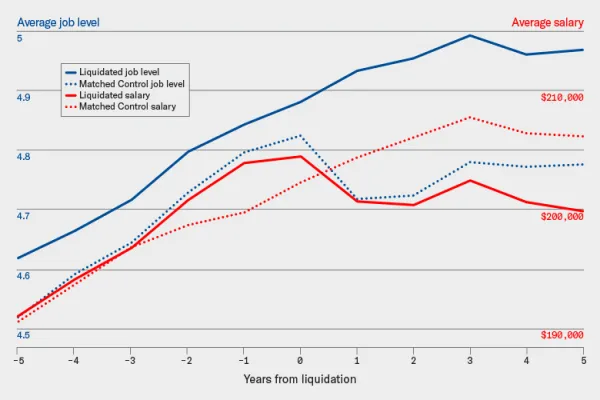

These differences in pay could not be explained by differences in career risk — for example, the likelihood of being demoted or laid off. “In asset management the yearly probability of demotion is not significantly higher than in other sectors, except for real estate, and is in fact significantly smaller than in commercial banking and high tech,” the authors said.

Even the 2008 financial crisis did not have “persistent scarring effects” on the careers of individuals who entered the asset management industry around that time, according to the study.

Still, the authors determined that asset management’s status as the best-paying career could be threatened by another growing industry: high tech. According to the study, pay in tech has increased relative to other fields, with the career premium matching that of asset management jobs for employees starting between 2005 and 2008.

“Since the financial crisis, high tech has emerged as a serious contender of talent from asset management,” the authors concluded.