As competitive forces and technologies can drive returns down over time, it is important for businesses and investors alike to ensure they are on “the right side” of the disruption. With volatility returning to the market with a vengeance, it is once again a critical time for investors to re-examine their holdings and allocations.

The Resurgence of Active Management

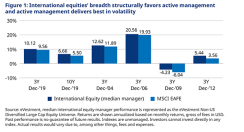

International large cap equities have seen net negative flows from institutional investors in nearly every quarter in the past five years according to eVestment. Where flows have seen positive growth has been in the passive end of the market. This may seem counterintuitive given the breadth of the international equities universe and the opportunity for active managers to add value. In fact, over the past 10 years the median large cap international equity manager has delivered over 1% of annualized outperformance, whereas the median US large cap manager has trailed the S&P 500 by over 40bps annualized over the same period.

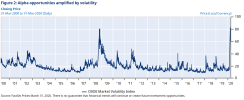

More recently there has been a notable reduction in the level of outperformance from active international equity managers with the median delivering only 56bps excess return over the trailing 3-year period. This shift may have prompted many to conclude that large cap international equities were becoming more efficient and that low-cost passive options could deliver a better overall outcome. However, that conclusion may be misplaced as the reduction in outperformance seems to be more of a function of the suppressed market volatility and return dispersion in recent years.

When we look back at the 3-year annualized periods ending in 2004 and in 2006 where volatility was similarly at suppressed levels the marginal outcome for active international equity managers was not particularly dissimilar from the most recent 3-year period. However, during the spikes in volatility during the global financial crisis and subsequent European sovereign debt crisis, the 3-year periods ending in 2009 and 2012 were quite ripe for active managers as the median manager delivered over 180 bps in each period and top quartile managers delivered well over 3% in excess returns. With volatility levels now spiking again we are potentially entering an exceptional period for active stock pickers and investors sitting in low cost passive options may be leaving a very important source of excess return on the table.

Capitalizing on Conviction

Stock selection is at the core of harnessing opportunities during volatile markets. Amidst the current backdrop it is nearly impossible to know precisely the severity and duration of the COVID-19 pandemic and its impact on the global economy, but we as investors can focus on understanding the levels of stress companies in various industries and markets may face under a range of revenue scenarios given their exposures. We examine the flexibility in the cost base, end market exposure, balance sheet strength and speak with the companies to ensure we have our assumptions correct.

At Schroders, we also have the ability to leverage alternative fundamental insights through the work of our Data Insights Unit, which is providing real-time data tracking, virus modeling and footfall data in severely impacted industries to help us further refine our forecasts. This is both a labor- and time-sensitive undertaking, and having the breadth of resources to do it well is critically important.

We also believe that it’s critical to carefully manage position sizes through a framework based on forward-looking business risk. This leads to the ability to have a concentrated portfolio by stock names, but quite a diversified portfolio by risk, which helps to potentially deliver lower relative risk and overall higher portfolio efficiency.

We believe that maintaining low factor exposure and focusing on stock-picking translates to greater consistency of returns and less dependency on market environments, which ultimately underpins greater repeatability. These elements are arguably more important now as we expect markets to remain volatile which may result in rapid swings in market, style, sector and factor leadership.

We believe our high conviction approach provides the flexibility to actively navigate through the areas of the market offering the greatest opportunities while minimizing exposure to troubled areas. We believe that demonstrating consistent success in delivering alpha from stock selection across the broad spectrum of markets and sectors is the key to delivering over the long term through both stability and volatility.

Balancing Opportunities with Downside Risk

Volatility can be one of the biggest sources of alpha for an active manager. Investors often fail to discriminate when selling assets in tumultuous markets, a trend only exacerbated by the larger presence of passive money. For the most contentious areas – companies with significant operating and financial leverage – a “shoot first, ask questions later” mentality often pervades. In many instances, this instinct may prove correct, but in others it will prove an overreaction. Good active managers with significant resource can take advantage of these opportunities and this is what we have begun to do over the past month, particularly in the hardest hit areas of consumer discretionary.

As we move through the recovery phase, whenever that may be, equities will likely return to the key themes of low nominal growth and low interest rates. Political pressure will also diminish one of the market’s biggest recent drivers, that of the leveraged buyback. We continue to evaluate the potential to concentrate our portfolio positions toward the quality structural growth stories still able to deliver and re-rate in this environment. However, the valuations are generally still not compelling enough to become overly bullish in this area. While there is good value in some of the more troubled areas, there are also many value traps and diligent research and selectivity remain critical.

Longer term, central banks may have to grapple with an interest rate dilemma as debt piles grow and inflationary pressures reassert. Firms with durable business models and pricing power beyond their own cost inflation will likely command a premium and skillful investment managers will once again be required to identify them.

Click here to download a PDF of this article.

Schroder Investment Management North America Inc.

7 Bryant Park, New York, NY 10018-3706

For more information please visit our website at www.schroders.com/us/institutional.

@SchrodersUS

Important information: The views and opinions contained herein are those of the cited authors, and do not necessarily represent Schroder Investment Management North America Inc.’s (SIMNA Inc.) house view. These views and opinions are subject to change. Sectors/regions/asset classes mentioned are for illustrative purposes only and should not be viewed as a recommendation to buy/sell. This material is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument mentioned in this commentary. The material is not intended to provide, and should not be relied on for accounting, legal or tax advice, or investment recommendations. Information herein has been obtained from sources we believe to be reliable but Schroder Investment Management North America Inc. does not warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the document when taking individual investment and / or strategic decisions. Past performance is no guarantee of future results. The opinions stated in this document include some forecasted views. We believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee that any forecasts or opinions will be realized. This document does not constitute an offer to sell or any solicitation of any offer to buy securities or any other instrument described in this document. All investments, domestic and foreign, involve risks including the risk of possible loss of principal.

Schroder Investment Management North America Inc. (“SIMNA Inc.”) is registered as an investment adviser with the US Securities and Exchange Commission and as a Portfolio Manager with the securities regulatory authorities in Alberta, British Columbia, Manitoba, Nova Scotia, Ontario, Quebec and Saskatchewan. It provides asset management products and services to clients in the United States and Canada. Schroder Fund Advisors LLC (“SFA”) markets certain investment vehicles for which SIMNA Inc. is an investment adviser. SFA is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker-dealer with the Financial Industry Regulatory Authority and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Quebec and Saskatchewan. This document does not purport to provide investment advice and the information contained in this material is for informational purposes and not to engage in a trading activities. It does not purport to describe the business or affairs of any issuer and is not being provided for delivery to or review by any prospective purchaser so as to assist the prospective purchaser to make an investment decision in respect of securities being sold in a distribution. SIMNA Inc. and SFA are indirect, wholly-owned subsidiaries of Schroders plc, a UK public company with shares listed on the London Stock Exchange. Further information about Schroders can be found at www.schroders.com/us or www.schroders.com/ca.

WP-VOLAINTLEQ