Even before the Covid-19 pandemic there were existing expectations of more frequent and dramatic swings in volatility. In fact, in an interview with II in the summer of 2019, Michael Hunstad, Ph.D., Head of Quantitative Strategies at Northern Trust Asset Management, said it was “unambiguous” that an inflection point in volatility had already been reached. Curious to hear what Hunstad thinks about the most recent and by far most dramatic volatility spike, II caught up with him and Bob Browne, CIO at the firm.

Is the Covid-19 pandemic changing or accelerating what will drive capital markets in the long run?

Browne: The way countries, companies, and individuals operate in what was a globally integrated world will change. It was anticipated these changes would lead to a lower growth trajectory before a pandemic was on anyone’s mind, and now we believe that will be more of an issue moving forward. Will China and the U.S. view themselves as competitive threats, or simply competitors? Will the coronavirus have further changed the nature of that relationship once things calm down? How will it affect supply chains? Will companies be able to be entirely dependent upon one market for key parts of production? I think the answer to that last one is “No.”

How might all this affect what you call Stuckflation – or persistently low inflation?

Browne: That’s a long-term secular theme for us in that secular forces dominate cyclical ones in keeping inflation low. Again, that probably will be even more so the case. We need to observe whether a coordinated, potentially massive fiscal response will finally be the answer to Stuckflation. The Fed and central banks around the world continue to have to review what is their purpose in a zero-rate environment.

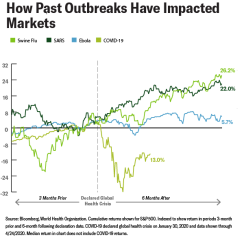

How do you interpret what’s happening in the markets right now compared to previous public health crises?

Browne: Compared to how the market behaved during the swine flu epidemic, SARS, and the Ebola crisis, Covid-19 has produced the most painful underperformance. From a historical perspective, once the markets turned upward during those other public health events they remained so on a steady basis. That’s not necessarily our forecast, but the reality is that with so many unknowns about this epidemic and what lies ahead markets are a discounting mechanism. The markets will come to a conclusion long before the health issue has been resolved. Looking for that turning point is going to be a critical job for all of us who are investing money for our clients.

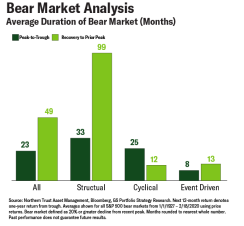

We found ourselves in a bear market more suddenly than anyone anticipated a few months ago. How does this bear market compare to previous ones?

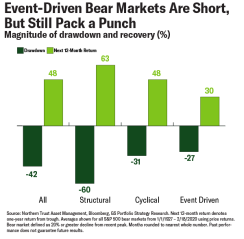

Browne: Bear markets can be bucketed into three categories based on their catalysts: structural, like the 2008 global financial crisis; cyclical, like the 1980 recession; and, event-driven, such as the one-off shock of Black Monday in 1987. The previous 12 S&P 500 Index bear markets dating back to 1927 have resulted in an average 42% decline over 1.9 years, and, on average, the market returns to its prior peak 4.1 years after bottoming out. Structural bear markets have occurred the most among the 12 mentioned, and tend to result in the most severe durations and drawdowns. Event-driven bear markets have drawdowns similar to those of cyclical bear markets, though the period of decline and recovery is the most rapid.

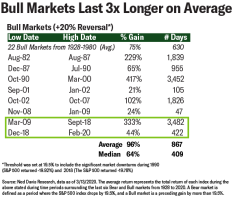

What we’re seeing right now resembles an event-driven bear market, with the risk that inadequate policy response or a worsening of the virus could turn it into either a cyclical or structural bear market. The decline has been one of the fastest in history, hovering around the historical event driven bear market average drawdown at 27%. Among the bear markets we’re talking about, this is the only one caused by a viral outbreak, which raises questions around the efficacy of monetary policy in combating its market impact. That concern is magnified by the fact that interest rates were already near historic lows. The risk is that today’s bear market begins to exhibit characteristics of cyclical or structural bear markets, extending its duration and magnitude.

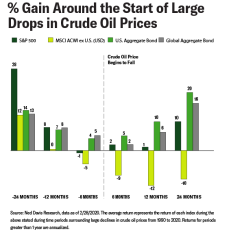

There’s also a bear market in oil. Many of our clients and peers are focusing on that as an ongoing structural issue for the energy sector and ancillary sectors that live off a higher price of oil than we’re likely to see anytime soon. The demand destruction that seems to be associated with oil price declines does have an impact on the bond market that is sustained for 12 to 24 months. With regard to tactical positioning, that’s one of our takeaways from what’s happening in the markets.

What are central banks doing in the wake of all this?

Browne: One of our key tactical themes for the year has been structural accommodation – we should probably change the term to “permanent accommodation” as it’s certainly going to be a multi-year period of monetary accommodation, and that has implications for cash rates and money market funds. Once things stabilize, what is the discount mechanism for determining the present value of long-term cash flows? If a 10-year Treasury stays below 1% for an extended period of time, which is our expectation, high quality income streams become extremely valuable.

How do all of these considerations translate to portfolio construction?

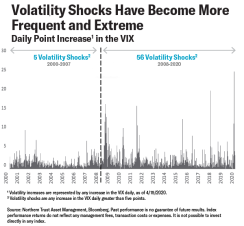

Hunstad: We’re seeing a new type of volatility – a pattern of asymmetric volatility where the severity and frequency of recent market drawdowns have increased significantly. When we’re thinking about our risk assets, especially equities, this leads us down the path of crafting our portfolios around a lower volatility factor profile. We want exposure to equities in general, but we want to mitigate volatility skew – the increased severity of volatility spikes. We want to lower the volatility of the portfolio overall, and participate in the upside return potential as much as we can. Factors – especially defensive factors like low volatility – have done very well in heightened volatility environments.

What’s behind the more frequent and severe volatility spikes?

Hunstad: Most recently the coronavirus, of course. But there is also the issue of a potential negative interest rate – which is the policy in much of the world. This has increased leverage overall since the global financial crisis, and might also be contributing to the more extreme volatility spikes that we’re seeing.

There are a lot of microstructure issues going on, too. Most trading today is computer dominated, and we see a very high frequency of volatility selling in the markets – investors trying to capitalize on the difference between implied and realized volatility, a lot of volatility targeting, and momentum chasing going on in the markets. This capitalizes on calm moments in the market, but pushes them over the edge in times of stress. In other words, stability breeds instability. There’s a general consensus in the industry and the markets that these volatility spikes will continue, and all evidence suggests that the severity will also increase.

How would you characterize the few years prior to the Covid-19 market shocks?

Hunstad: A time of very easy money policy and generally low volatility in the markets. But as I mentioned, this has been punctuated by a higher frequency of volatility spikes. This means that the skewness of volatility is increasing. Volatility has increased during both up and down market swings, but the ratio of volatility in down markets to up markets has gradually been trending upward over the decades.

This is an important aspect of risk that is frequently not included in decision making. It’s common to think about mean variance types of optimization – long run return expectations, the strategy versus long-run volatility – but not necessarily to take volatility skew into account. But we see that when times get tough, they seem to be worse and worse with the passage of time. This is unambiguous, and is increasing in the U.S. and globally, including in emerging markets.

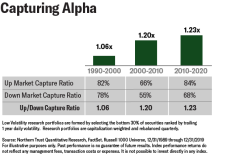

So how do investors find opportunity in the scenario you describe?

Hunstad: Gone are the days when we can view the equity markets as pure beta exposure. More and more, we’re at the individual components of equity markets, the drivers of risk and return, and trying to isolate the risks we are getting paid to take. As I mentioned, defensive factors like low volatility tend to do quite well during heightened volatility, along with quality and dividend – these are the more classically defensive factor orientations. We’ve never seen an increase in volatility skew like we have in the last few weeks, and the efficacy of these low volatility strategies may be increasing as well. We measure this empirically, i.e. how much does a low volatility portfolio participate in the market when it’s going down versus participate in a market when it’s going up? There is definitely an asymmetry that’s highly correlated to volatility skew.

Has that held as the crisis has continued?

Hunstad: Right now, we have price-related volatility, not an economic contraction. Appropriately constructed low volatility strategies have done very, very well. Value has basically been flat. Value has not been a good insulator over the last several weeks filled with volatility spikes, and low volatility has done a fantastic job of that. Both can do very well in times of economic contraction, but we’re not there yet.

Learn more about a Quality Low Volatility strategy.

IMPORTANT INFORMATION. This material is provided for informational purposes only. Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice.

All material has been obtained from sources believed to be reliable, but the accuracy, completeness and interpretation cannot be guaranteed. The opinions expressed herein are those of the author and do not necessarily represent the views of Northern Trust. Information contained herein is current as of the date appearing in this material only and is subject to change without notice.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited, and The Northern Trust Company.

© 2020 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.