Trillion-dollar-plus asset manager Nuveen engaged in “an aggressive and widely dispersed campaign to use almost any pressure necessary to cut off a competitor from its chief source of business as well as its financing,” a Delaware judge has ruled.

The ruling is the conclusion of a 2019 lawsuit by Dallas-based Preston Hollow Capital, a municipal finance company with $3.6 billion in investable assets. Nuveen, by comparison, had $1.1 trillion in assets under management at the end of 2019, including $150 billion in municipal assets and $27 billion in high-yield muni-bond funds.

Preston Hollow had filed suit against its larger competitor in February of last year, accusing TIAA subsidiary Nuveen of interference with its business relationships and contracts in the municipal bond market.

The judge, Delaware Chancery Court’s vice chancellor Sam Glassock, found that Nuveen “used threats and lies in a successful attempt to damage [Preston Hollow] in its business relationships,” according to the opinion published April 9.

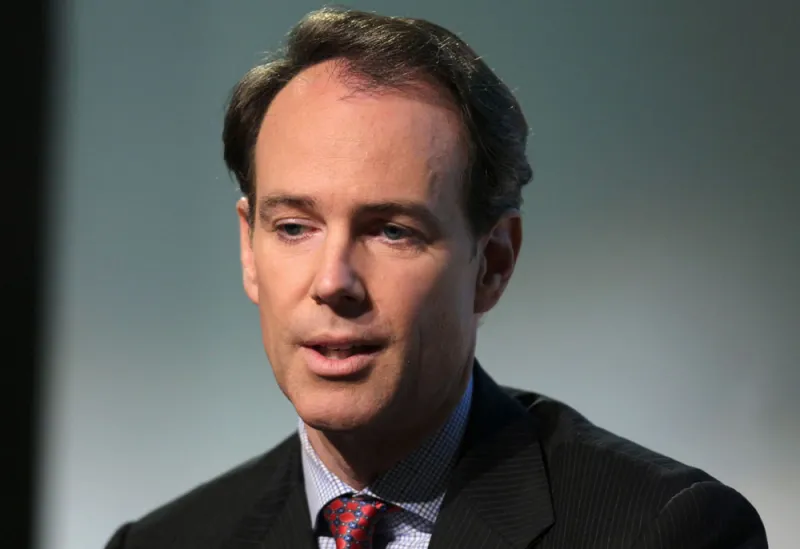

Specifically, the judge ruled that Nuveen pressured major investment banks, including Goldman Sachs Group and JPMorgan Chase & Co., to stop doing business with Preston Hollow or risk losing business from Nuveen. The ruling cited recorded conversations as well as testimony from Nuveen employees, including municipal fixed income chief John Miller.

For example, Miller reportedly told his contact at Goldman that “to be a partner with Nuveen… you can’t do any of this private bullshit business with Preston Hollow.” (Miller testified at trial that this was “a very blustery introduction… to get his attention,” according to court documents.)

“Nuveen was not simply attempting to achieve a competitive edge; it meant to use the leverage resulting from its size in the market to destroy Preston Hollow,” Glassock concluded.

He did not, however, grant Preston Hollow’s requested injunction against Nuveen, writing that the plaintiff failed to show “a likelihood of future harm absent injunctive relief.”

A spokesperson for Nuveen said in an emailed statement the firm “respectfully disagree[s] with the court’s finding that Nuveen tortiously interfered with Preston Hollow’s business.”

“We are pleased the court did not grant any injunction against Nuveen, and we continue to fully support John Miller and his entire team, who can continue delivering strong investment performance on behalf of our clients,” the spokesperson said in the statement. “John and his team remain motivated by a desire to protect client investments while also supporting a fully transparent municipal-bond market for all participants.”

In addition to the business interference claim, Preston Hollow had also accused Nuveen of defamation and violation of a New York antitrust rule, but the judge declined to rule on the latter. The defamation claim is currently pending before the Delaware Superior Court.

“Municipal borrowers deserve a truly competitive marketplace where they are able to select the capital provider that meets their needs in funding their vital projects, not the needs of a large money manage like Nuveen,” Preston Hollow chief executive Jim Thompson said in a statement Monday.