What do the best-performing hedge fund managers do differently? Three European researchers attempted to find out in a new study of hedge funds’ strategies.

What they found was evidence that top performers were better able to anticipate market conditions and “exploit fleeting opportunities” for profit, according to the paper by Alessandra Canepa of Italy’s University of Turin, María de la O. Gonzáles of Spain’s University of Castilla-La Mancha, and Frank Skinner from Brunel University in London.

The study, which focused on hedge funds operating between 2001 and 2012, found that top-performing hedge funds took on less risk leading up to the 2008 financial crisis compared to “mediocre” performers, which appeared to “react rather than anticipate future economic events.”

Outside of apparent market timing skill, the authors identified just two risk factors that could explain the returns of the best performers: the market premium and momentum, or the tendency of securities to keep trading in the same direction. Mediocre hedge funds, meanwhile, had exposures to a broad range of risk factors, according to the paper.

“The more mediocre funds seem to be all over the place,” Skinner said by phone. “It appears that the top funds accept fewer risks and that their strategies are more targeted.”

[II Deep Dive: The Best Hedge Fund Manager of All Time Is…]

Notably, both top-tier and middling hedge funds derived excess returns from momentum. However, the authors found that mediocre hedge funds suffered from momentum reversal — in other words, they held on to securities for too long.

“The research suggests that when the top funds find a strategy that works well, they monitor it and cut if off when it starts to go bad,” Skinner explained. “Mediocre funds don’t get out of the asset in time and end up losing money.”

Another difference was the liquidity of their portfolios. Skinner and his co-authors found that “relying on illiquid assets to achieve performance is a prevalent feature of mediocre performing funds,” as opposed to top performers. However, the hedge funds with the biggest gains overall were found to have excess returns that were associated with liquidity risk — “hinting that the very best of the top performing funds could be successfully following a more refined strategy,” according to the paper.

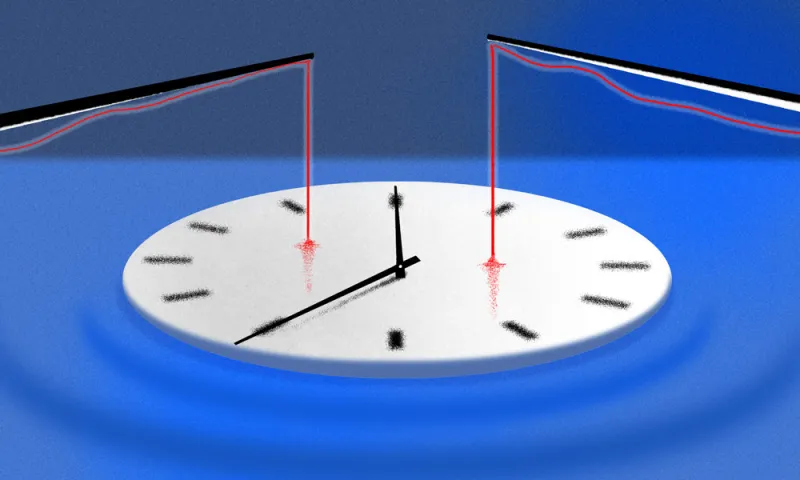

Still, despite these differences in skill and strategy, the authors found that the top performing hedge funds did not stay on top for very long. The “superior” performance of top-quintile hedge funds was only found to persist for about six months. As Skinner concluded, “last year’s performance is not much of a guarantee of how they’ll do next year.”