Photo-illustration by II

In the fall of 2017, a young credit analyst sat in a New York bar after a long day on the job.

He unlocked his phone, opened the Instagram app, and returned to a dormant account he had created months earlier, @hoeingforyield. At the bar, for the first time, he posted a meme about working in finance. It got about six likes, low by almost any standard but enough to make him feel like it was worth continuing. As the fall turned to winter, he began regularly posting memes poking fun at the investment industry, and in the process joined the growing ranks of “finmeme” creators.

“There’s just a lot of shit to make fun of,” @hoeingforyield says.

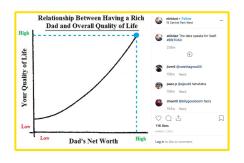

Think of memes as inside jokes on a massive scale. For instance, an image of a surprised cartoon character called Pikachu stands in for someone who is shocked but shouldn’t be. Or Kermit the Frog drinking tea with a superior grin while claiming that something is not his business. Users add text to the meme to make it relevant to their own interests.

Finmemes are memes that are highly specific to finance. And on Instagram, they’re growing more popular by the day — the modern equivalent of cocaine and liar’s poker games on 1980s trading floors.

Your analyst might be posting one now. Or maybe you’re that analyst.

Started in August of that year, the account, which published quotes allegedly overheard on Wall Street, operated anonymously, just like top finmeme accounts today. The account grew quickly in popularity and still has nearly 1 million Twitter followers. At one point, @GSElevator had its own Business Insider column.

It was eventually revealed that the account’s owner, John LeFevre, never actually worked at Goldman Sachs. Instead, he spent some years at Citigroup in Texas. He did reportedly receive a job offer from Goldman in 2010, only to have it rescinded for a noncompete clause issue.

Like @GSElevator, most folks who run finmeme accounts have a strong desire to remain anonymous — hence the use of handles instead of real names in this article.

With social media users primed for more anonymous Wall Street content, @ebitdad sprung up. He tagged the location of his first post, published in March 2015, as 15 Central Park West, a condominium where in today’s dollars rentals fetch $40,000 per month on average.

“I think he kind of founded the finmeme thing,” says @hoeingforyield. “Then he completely dropped off. His engagement metrics are nuts too.”

@ebitdad stopped posting in April 2018, but returned, briefly, to post a meme this past summer. His 38,500 followers rejoiced: “After disappearing this long, you better be an MD now,” one commented. He hasn’t posted since.

He claims to work in finance at a large institution, and says he was inspired by Total Frat Move, which chronicles the messiest parts of college party culture on social media through user submissions.

“When I interned on Wall Street, I saw certain similarities,” @litquidity says by phone. “The whole culture is something easy to mock. You can mock a frat guy with their polos or whatever. You can do the same thing with finance.”

“One of the most important characteristics of remixed internet memes is their simplicity” — a simplicity that makes creation easy with the available leverage, wrote Linda K. Börzsei of Utrecht University in a paper on the subject. “Most of them are made by using two functions at maximum: cut-copy-paste and text tool.”

“The evolution in the art form — and I’m going to use the word ‘art form’ here — has been incredibly rapid,” @hoeingforyield says. “I think you can see meme accounts for almost any subculture and any profession. There’s a construction-guy meme account.”

The average Wall Streeter is known as a hardo or hardess — a try-hard, if you will — depending on gender identity, in the world of finmemes. They Juul regularly and wear Airpods and Patagonia. They went to a target school and idolize former Federal Reserve chair Janet Yellen.

“I’m literally wearing Vineyard Vines and Airpods right now,” jokes @wallstreetconfessions. The woman behind the account is actually a finance major at a non-target school who posts anonymously submitted accounts of what it’s like to work on Wall Street. While she says she hopes to eventually work on the Street, she’s not there yet.

“What I find funny is making fun of managing directors,” @litquidity says. “The guys who are up top, they bring in all the money. As a junior, you’re like, ‘Man, my boss is quite a character.’” He started a hashtag called #whomstMD to chronicle the exploits of wealthy-looking men doing “something outlandish” like wearing Gucci loafers to the gym. Out of that hashtag, as well as #MDMovesOnly, grew one of @litquidity’s offshoot accounts called @thisguyfuchz. The account belongs to a fictional 40-year-old who lives in Connecticut and works on Wall Street. Fuchz has trouble dialing into conference calls, plays phone games like Candy Crush under his desk, and uses archaic abbreviations like “thx” when signing off his emails. Bart P. Fuchs IV doesn’t exist — but he has 16,000 followers.

Similarly, @litquidity pokes fun at interns using #internszn — that’s “intern season” — and via a separate account called @wallstreetintern. The intern sends long-winded goodbye emails to his colleagues, asks what abbreviations like EOD mean (“end of day”), and stays up late on the weekends drinking White Claw hard seltzers.

“What’s critical is knowing the context of the link pictures of the meme,” @litquidity says. “Certain pictures are ‘meme templates.’ You know them because you’ve seen the same image with a different caption 100 times.”

“The pronunciation of EBITDA is one of the most absurd things in my job,” @hoeingforyield says. “All the crazy ways people pronounce and get away with it is funny to me.” He often pokes fun at folks who say “EBIT-Dee-Ayy” rather than the more accepted “EBIT-Dah.”

Finmeme makers and their followers are highly educated young folks who spend upward of 14 hours a day at their desks mired in Excel spreadsheets that their friends outside of the industry don’t understand. One creator, @otherbondgirl, who works for a bond fund in New York, says one benefit of running her account is feeling a sense of community among her Instagram followers.

“It’s crazy that everybody who uses the term ‘free cash flow’ means a different thing by it,” she says. “It’s cool to see how many people can relate to something weird like that.”

So who exactly follows these accounts?

Mostly men under 35. Between 85 and 90 percent of @hoeingforyield’s followers are between 18 and 35, according to his Instagram demographic insights, he says. Just 1 percent of his followers are older than 50. @litquidity claims similar stats: Only 10 percent of his audience is over 35, and it skews about 80 percent male.

One reason folks follow finmeme accounts is to stay abreast of industry news and gossip, according to @otherbondgirl. She says that because of finmemes, she learned that Goldman Sachs was hiring coders before the news was posted online. “It’s funny how quickly information gets disseminated and how quickly perceptions are changed in that little subculture. It’s different from what happens on Twitter.”

For some finmeme creators, the experience is a strange one. “People know my brain, but they don’t know what I look like,” remarks @litquidity. Or for @hoeingforyield, “I have had co-workers show me my memes, which, the first few times it happened, was very surreal.”

The desire for anonymity results in a difficult-to-parse social media landscape, where anyone — a Wall Street hotshot or an undergrad student — could be posting similar content. “There are definitely a lot of people who pretend to be somebody else,” @otherbondgirl says. “It causes a lot of confusion.”

Yet finmeme creators are quick to distinguish between creators who work in finance and those who do not. “You can tell the difference,” @litquidity says. For those without Wall Street jobs or aspirations, monetizing their followings can be much less complicated.

@mrsdowjones is a glaring example of this. The account was created by Haley Sacks, who studied film before becoming a full-time influencer without ever having worked in finance. Sacks did not return an email seeking to schedule an interview. She now runs an online personal finance book club and sells merchandise on her website, including J.P. Sonja Morgan baseball caps and EBITDA pullovers. She’s appeared on CNBC, and is rumored to have met Jamie Dimon, the chief executive officer of JPMorgan Chase & Co., much to the chagrin of her peers.

“She seems to be doing a lot of really cool stuff,” @hoeingforyield says. “If I were to reveal my identity, would I get to partake in these sorts of things?” He says that he and other meme creators who stay anonymous wish they could do what Sacks is doing — that is, leveraging her platform to make media appearances and earn money.

But compliance regulations make it difficult for these creators to take advantage of the perks that can come with a large following.

Before posting a meme, @hoeingforyield says he considers whether he could stand in front of his company’s compliance department and his managers and justify posting it without getting fired. “You’re a trusted gatekeeper of some information, and you have a mouthpiece that can reach an audience of followers. That’s a really big voice that I don’t think my employer would be comfortable with me having.”

“I’m not monetizing it,” @otherbondgirl says of her account. “It’s not a business activity. I’m not doing anything that would embarrass my employer. My content very specifically is very PG. Other accounts are a little bit more incendiary. Mine is just a bit nerdier.”

Others, like @wallstreetconfessions, say the decision not to monetize has been difficult. “I’ve gotten offers to sell it. I would be lying if I said I didn’t think about it. I could literally buy myself a designer bag and go on a trip if I sold my account.”

But @litquidity shills products for cash. He hosted a giveaway for Paul Evans dress shoes (“sleds,” in memespeak), which sell for upward of $400, and partnered with midtown chain Dos Toros Taqueria and vest purveyor Mizzen+Main, according to his website. He says typical sponsored posts can command between $5 and $10 per 1,000 views, based on his research, and the range depends on engagement.

“You have to take into account your total likes, comments, viewership per post,” @litquidity says on monetization. “I view it as running a business in the same way that I go about advising clients or conducting my own investments.”

Both @otherbondgirl and @wallstreetconfessions have been targets of gender-based harassment in the form of comments and direct messages. “I feel like on a weekly basis, I have the thought of whether I should keep running the account,” @wallstreetconfessions says. “I get a lot of misogynist comments and messages.”

@hoeingforyield, who says he is a white man, has noticed that a lot of the digital bullying targets women and minorities. “Unfortunately, women with platforms tend to get a lot more abuse. In terms of the content that gets put out there, it really is skewed toward white men.”

When gender and race come up, so too, inevitably, does President Donald Trump. “There’s kind of this view of New York finance that they’ll do anything for a tax cut and deregulation of the industry,” @hoeingforyield says. “It’s important for my audience to know that people in my office can’t fucking stand Trump.”

He adds that when he criticizes Trump or touches on politics, his DMs, or direct messages, become more polarized.

One thing these accounts have been able to do, though, is to give voices to folks who aren’t always equally represented in the industry. “One of the things that I wanted to do was bring some female energy to it without making it dumb,” @otherbondgirl says. “There are a few accounts that are finance in name and it’s about random celebrities or getting your hair done. Where’s the conversation about the yield curve? I wanted to show that you could do both.”

For all his online celebrity, @hoeingforyield has doubts about the future of his own account. He says that as memes have become popularized, many creators have started to use Photoshop to create more intricate posts. He can’t “do Photoshop,” so keeping up with other creators could get difficult.

“The other thing too is what do you keep talking about?” he says. “I’ve made so many fucking EBIT-DA jokes and ‘index match is superior to vlookup’ jokes. What do you keep mining?”