By the end of August, US equities had gathered record YTD inflows of nearly €15bn – that’s nearly 65% of all equity flows and almost more than developed market equity ETFs in total given the sustained outflows from Europe between February and July. To boot, these flows have not been limited to traditional large cap exposures. As the economic cycle has aged, investors have become more selective in their allocations with sector ETFs and, latterly, small- and mid-cap ETFs have been gaining traction. Sector inflows hit a record €1.6bn YTD by the end of August, with around €900m of that going into technology. But can the run continue?

Life in the old bull yet

Despite the strength and popularity of US equities, at Lyxor we feel there’s still more to come from them – even at this late stage of the cycle. President Trump’s belated, but unprecedented, fiscal stimulus should foster more inflation at a time the economy is running at or above full capacity. Strong top-line revenues and margin expansion (as well as share buybacks) have bolstered the earnings-per-share outlook for corporates, while recovering capex and the associated upturn in productivity could help mitigate the negative effects of rising wages on profit margins. All of which suggests there’s some further upside ahead. Little wonder investors are still being drawn to the US, despite the unpredictability of the administration on the Hill and the looming mid-term elections.

So, for now at least, we’re not put off by seemingly stretched valuations, although they may limit long-term upside potential. We, like many others, have said that before … and the bulls have kept on running.

Recent US Institute for Supply Management surveys have reached new cycle highs and the job market has remained strong, suggesting solid growth in the coming months. Outside the US, business survey results such as PMI manufacturing in emerging countries and Europe have dipped on trade tensions, but they’re still pointing to economic expansion. That could change should the trade war escalate or become more global in nature, but we still think a negotiated settlement is ultimately more likely. In truth, a move from sporadic, temporary sell-offs into a lasting bear market requires a more meaningful, cyclical turn down – something we don’t foresee just yet.

Choosing your vehicle

So how should you invest? Choosing the right investment vehicle in most markets is often challenging – except that is, in the US, where active managers really do struggle to beat conventional benchmarks.

At the end of H1 2018, fewer than 1 in 5 large-cap managers (19%) were giving investors what they paid for, but at least that’s better than the 11% that have delivered over the last decade. Small-cap managers fared a little better but, with just 1 in 4 having outperformed by the end of H1, the pattern is clear – at least among the broad benchmarks*. But which passive vehicle should you choose?

Sophisticated investors tend to believe futures are more liquid options than ETFs and cost less overall, but in our view the results don’t stack up as often as they’d have you believe. Taking three of the major US equity markets as our examples, we can see that ETFs were more effective for a broad S&P 500 exposure as well small-caps via the Russell 2000. In contrast, for the NASDAQ 100, futures contracts still win out. When choosing your passively managed investment, you still need to be selective wherever possible.**

* Source: Morningstar & Bloomberg, data from 31/12/2007 to 29/06/2018.

**Source: Lyxor International Asset Management, as at August 2018. Detailed methodology and assumptions made available on request. Market conditions may change and have an impact on performance of ETFs and futures. Past performance is no guide to future returns.

You are here

Although every business cycle is different, they do tend to follow a similar pattern. As an economy progresses through the cycle, some sectors naturally perform better than others and vice versa.

Convention has it that when an economic recovery matures, the energy and materials sectors – which are closely tied to raw material prices – tend to do well because inflationary pressures are building and demand is still solid. On the other hand, IT and consumer discretionary stocks tend to suffer because profit margins are being eroded and investors are more wary of luxury spending. We’re seeing some of this today in the US with the recovery now entering its dotage, but there are specific issues at play helping some sectors defy convention.

Of sectors, sizes and styles

When assessing US equity allocations today, you have to factor in the fallout from the fiscal push. It helped US corporates avoid typical late-cycle issues like slowing earnings growth and a squeeze on profit margins, and also ensured a favourable environment for financials and technology, through deregulation and tax reform respectively.

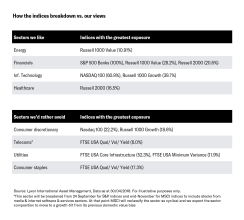

Quite naturally, we also favour some more conventional late-cycle calls, including energy and healthcare. Energy in particular appeals to us because of its improved corporate fundamentals and the recovery in oil prices.

There are some areas we’d rather avoid, too. We’re wary of the consumer discretionary sector given company-specific risks and problematic valuations, particularly in e-retailing. We’re also keeping a watchful eye on the most defensive sectors – especially those more sensitive to interest-rate rises including utilities and consumer staples. We had held a negative view on telecoms too, but the sector’s recent expansion and conversion to “communication services” – which led to the inclusion of companies like Facebook and Netflix and more of a leaning towards growth – does change our view. That said, regulatory issues affecting data privacy still merit some caution

Meanwhile, Trump’s tax cuts should still stimulate additional profit growth for smaller companies, many of which benefit from a domestic bias to their business – making them slightly less vulnerable to the ongoing trade disputes.

Choose your index wisely

Precision and selectivity are the watchwords at this late stage of the cycle. Look to lower cost exposures to make the most of whatever upside remains, tilt towards tech or bet on the specific issues boosting banks with indices like the Morningstar US Large-Mid Cap, the NASDAQ 100 or the S&P 500 Banks. Alternatively, you could seek to add some resilience to your portfolio with quality income or minimum variance strategies.

In contrast, the S&P 500 and MSCI USA look most exposed to those areas we favour least, while the FTSE USA Core Infrastructure comes with a 50%+ allocation to utilities.

Why Lyxor for US equities?

If you still see the US as a land of opportunity, look no further. Our US equity range opens up 14 possible routes to travel, across mainstream and more specific indices from just 0.04%. And, because we’ve been managing ETFs in the region for over 16 years, and run over €8bn* in assets, we may just be the guide you need.

* Source: Lyxor International Asset Management. Data as at end August 2018. TERs correct as at 11/09/2018

DISCLAIMERS:

For professional clients only. All views & opinion are sourced Lyxor Cross Asset & Lyxor ETF Research teams as at 10 September 2018 unless otherwise stated. Past performance is no guide to future returns.

Conflict of interest: This research contains the views, opinions and recommendations of Lyxor International Asset Management (“LIAM”) Cross Asset and ETF research analysts and/or strategists. To the extent that this research contains trade ideas based on macro views of economic market conditions or relative value, it may differ from the fundamental Cross Asset and ETF Research opinions and recommendations contained in Cross Asset and ETF Research sector or company research reports and from the views and opinions of other departments of LIAM and its affiliates. Lyxor Cross Asset and ETF research analysts and/or strategists routinely consult with LIAM sales and portfolio management personnel regarding market information including, but not limited to, pricing, spread levels and trading activity of ETFs tracking equity, fixed income and commodity indices. Trading desks may trade, or have traded, as principal on the basis of the research analyst(s) views and reports. Lyxor has mandatory research policies and procedures that are reasonably designed to (i) ensure that purported facts in research reports are based on reliable information and (ii) to prevent improper selective or tiered dissemination of research reports. In addition, research analysts receive compensation based, in part, on the quality and accuracy of their analysis, client feedback, competitive factors and LIAM’s total revenues including revenues from management fees and investment advisory fees and distribution fees.