Illustration by Laura Breiling

Legendary switch-hitter and New York Yankee Mickey Mantle once quipped, “You don’t realize how easy this game is until you get up in that broadcasting booth.”

Likewise for calling and solving a market crisis.

The global financial system skirted death about ten years ago. To mark that milestone, business media and Wall Street firms have unleashed a torrent of takes on what went wrong, how it ought to have been handled, and what fresh horror is coming next — and, conveniently, when.

To be sure, market players and commentators have learned powerful lessons from the last devastating crisis. Institutions hired chief risk officers for the first time. Asset managers started respecting them. A whole generation of institutional investors see their art as underwriting, not as allocating. Finance’s evolution postcrisis matters deeply. The topic has been parsed and pontificated over by the brightest minds from Wall Street and academia. They’ve done the heavy thinking, so we don’t have to.

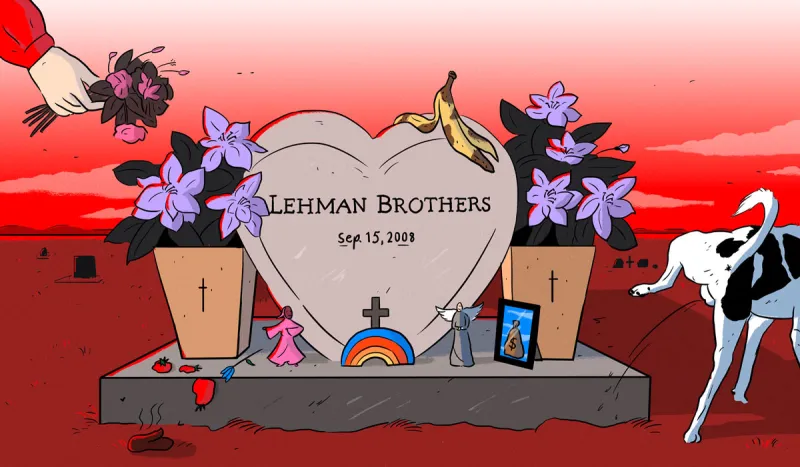

Investment bank Lehman Brothers — still the largest corporation ever to do so — filed for bankruptcy protection on September 15, 2008. Lehman’s filing became the consensus anniversary of the great financial crisis. Each year market participants reflect on the catastrophe and its impact — or why “Ben Bernanke Is a Complete Idiot and/or Pathological Liar.” That blog, from Investment Research Dynamics, came out in mid-September 2009. Indeed, the ritual airing of grievances goes back to Lehman’s very first insolvency anniversary. But this year is special.

At Institutional Investor we concluded that the world did not need another think piece called “Ten Years on: Lessons From the Financial Crisis.” But in the spirit of September 15, here is an overconfident case for the worst takes on Lehman’s ten-year anniversary.

“Lehman Insider: Why the Bank Could and Should Have Been Saved”

— Former Lehman Brothers chief administrative officer Scott Freidheim, Financial TimesAll the other banks got bailouts, so why not us? Freidheim’s tenth-anniversary takeaway is that Lehman failed because then–New York Federal Reserve president Timothy Geithner unfairly and “tragically” refused to spot it a little cash.

“We felt like the wounded lion who climbed up the mighty baobab tree to escape a pack of hyenas — only to have the branch break,” writes Freidheim. “Ironically, the Fed turned Goldman Sachs and Morgan Stanley into bank holding companies one week after Lehman filed for bankruptcy, sending the right message — and giving them exactly what we had been denied.”

The former executive recognizes that his position “may sound self-serving. However, let’s consider the facts.” First, Lehman was healthy — just a little dehydrated! Freidheim argues that the bank “delivered record net revenues and earnings in 2007, giving it the second-best revenue and earnings growth in the industry over the previous five-year period. That year our net leverage — the measure of how much of our company was financed with debt — was in line with that of our peers. And by 2008 we had meaningfully reduced that leverage” and improved other vital signs. (A study by two noted economists offers a different conclusion: “Lehman was insolvent — probably deeply so — whereas the other institutions arguably were solvent.”)

Second, saving Lehman would have “prevented the carnage the world experienced.” Freidheim contends that the investment bank’s collapse didn’t start the crisis; it largely caused it. He says he and other finance executives should have lost their jobs and wealth. But if they hadn’t, then Main Street wouldn’t have either. And that was a sacrifice worth making.

Readers of the FT are a banker-friendly lot, but even they denounced Freidheim’s ten-year take. “Lehman was not a wounded lion, but a sick, bloated, malformed creature,” the top-rated comment says. “In nature such creatures drop dead. They do not propagate, and they most definitely do not pontificate. Next time no bailouts. Let capitalism take its course.”

“[x] Years After the Financial Crisis, We’re at Risk of Another Major Meltdown.”

— Permabears, September 1–30, annually since 2008Threats of imminent catastrophe define the genre of ten-year GFC anniversary literature. Sound reasons support downturn warnings now — cyclical, fundamental, geopolitical. But they’re well covered by actual experts and also are boring.

The press spices up crisis lookbacks with doomsaying because it works and it’s easy: People click on sensational stories, and there’s nothing a reporter has to prove about something that hasn’t happened. “Will Mark Spitznagel’s Doomsday Bet Pan out in 2014?” II asked in a headline that year. Nope, but the story got read.

Being wrong has not dissuaded the take-ocracy from marking the GFC anniversary by calling the next one. For example, Business Insider in 2013: “Five Years After Lehman, Could Another Collapse Be on the Horizon?” Business Insider in 2018: “10 Years After the Financial Crisis, Wall Street Pessimist Albert Edwards Thinks We’re at Risk of Another Major Meltdown.” And so on, until finally, inevitably, they are proven correct. Markets will melt down, and when they do, Edwards gets to go on CNBC every anniversary thereafter as The Genius Who Predicted the Crash and opine on the next one.

But permabears don’t even have to wait to be right for their strategy to pay off. Edwards — co-head of global strategy for Société Générale — is clearly wise to the game. “Known for his long-running, often outlandish bearish forecasts, Edwards is not impressed with the progress we’ve made. Or, perhaps more accurately, he’s skeptical of the progress we think we’ve made,” reporter Joe Ciolli wrote earlier this month for Business Insider, before summarizing a SocGen client note.

With the neat little trick of crying crisis, Edwards got to talk SocGen’s book on MarketWatch and CBS News and in Barron’s, the FT, MoneyWeek, and Financial Tribune (the “First Iranian English Economic Daily”), and more. Forecasting doom for free publicity is pretty much the definition of noise. But as a member of the press, I give full credit to Edwards and his dour den of permabears. You’ve successfully hacked us. See you next year.

“Nice Portfolio You’ve Got There. Shame If Something Happened to It.”

— Active money managers, both great and smallInvestment firms likewise have a distinct motivation for dangling crises: margins. For many active managers, Lehman’s collapse ushered in the last of the good old days (for one cycle, at least). As institutions’ portfolios bounced back, clients bounced out. They went to Vanguard, iShares, Blackstone, AQR — pretty much everywhere except traditional long-only equity managers. With their now-abundant spare time, these active managers churn out top-notch takes, research, and content of all types. Client notes gleam with the sweat of a dozen analysts and compliance officers.

Those notes can also verge on wistful in reflecting on the crisis, when many active managers outperformed the market as their clients’ portfolios cratered in absolute terms. “As a stock picker, it is at this point you can then sit there and look at it and say, ‘Here is a chance to buy the long-term winners I want, as we may never get these prices again,’ ” one PM said during a big-name firm’s lookback. “We did that then, and I hope we have the nerve to do so again.”

Crash fantasy porn pervades professional crisis takes. For instance, one early anniversary blog declared, “It’s been a rocky start to 2018 for equity markets globally — volatility has returned with a bang and February saw the first 10% market correction in a while. So why are active managers smiling?” We all know why.

Anniversary specials for institutions broadly trace the same arc. Shot: “It’s been just over a decade since the sale of stricken investment bank Bear Stearns to JP Morgan Chase.” Chaser: “Passive investing can be a very crowded trade and can lead to highly concentrated exposures. If a particular sector or country dominates the index, you are not going to be diversified, and if the market goes down, you’ll go down with it.”

They may well be right. But for a week or so every September, no one has to be.