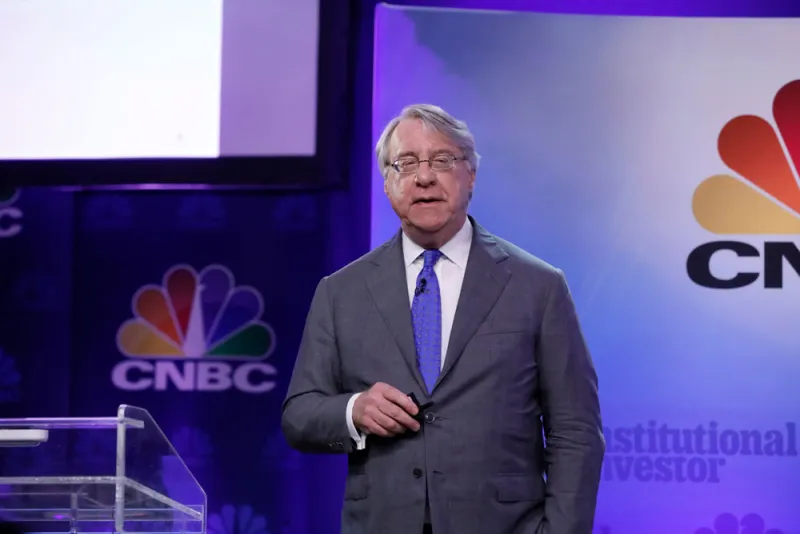

Saying it’s a “rough time for short sellers,” Kynikos Associates founder Jim Chanos asked his “good friend” Tesla CEO Elon Musk to help them out.

That was the only reference Chanos made to Tesla – which he has been shorting for years – while speaking at the Institutional Investor and CNBC Delivering Alpha conference on Wednesday. He then launched into a bearish presentation on physician practice management companies, which he called an “accounting scam.”

The famed short seller took aim at Envision Healthcare, which KKR recently agreed to acquire, and Florida-based Mednax. Envision Healthcare fell 1.40 percent to $44.19 by 2 p.m. Wednesday, and Mednax was down 1.41 percent to $43.42 over the same time frame.

Physician practice management companies were hot in the 1990s, Chanos recalled, but eight of the nine biggest ones went bankrupt. “In 2018, we have PPM 2.0,” he said.

The problem with these companies, according to Chanos, is that when they are acquired, the new owners cut doctors’ salaries in half, giving those doctors a lump-sum upfront payment to make up for it. That payment is amortized for 30 to 50 years, essentially writing off the salaries for that long time period, he explained.

The problem occurs five to seven years later when the doctors’ compensation contracts are up, and they want a big raise. Medmax’s contract terms were revealed in recent lawsuits, showing that they “had to increase the salaries by 45 percent and were turned down,” Chanos said.

While the companies are being valued based on Ebitda – earnings before interest, taxes, depreciation, and amortization – Chanos said that measurement is “a fiction in this business because depreciation and amortization understate what the new contracts need to do to get doctors to reup.”

KKR has offered roughly $5.5 billion for Envision Healthcare, for a deal worth about $10 billion including debt. But the company has not been growing. “This deal is going to have to borrow money from the get go,” Chanos predicted.

Noting that he’s now seeing the same kind of deals that occurred in 2006 and 2007, Chanos warned that people do things that are “uneconomic towards the end of market cycles.”

Speaking on the panel with Chanos, Alex Roepers, the founder and CIO of Atlantic Investments, recommended Huntsman Corp. He said the global diversified chemical company with $8 billion in sales has a “dramatically transformed” balance sheet, as the firm has cut its debt dramatically.

Roepers is expecting a 60 percent return on the stock over the next 18 months. The stock rose 3 percent on his talk and was trading at $31.50 around 2 p.m.