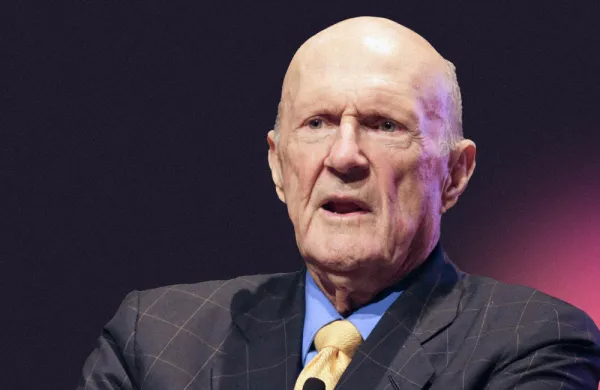

Tiger Management founder Julian Robertson Jr. has warned of a bond bubble that will end “in a very bad way.” Speaking at the Bloomberg Markets Most Influential Summit in New York, the octogenarian proclaimed, “Bonds are at ridiculous levels. It’s a worldwide phenomenon that governments are buying bonds to keep their countries moving along economically.”

Also at the conference, Omega Advisors’ Leon Cooperman called bonds “very overvalued.” On another panel, Howard Marks, the chairman of Oaktree Capital Group, warned that investors were taking too much risk. “If you participate in that enthusiasm then you’ll also participate in the correction,” Marks reportedly said in a Bloomberg Television interview. “As the environment becomes more enthusiastic we have to become more cautionary and try to clip the top of that cycle rather than participate in it.”

___

The director of the Securities and Exchange Commission’s unit that examines hedge funds and other investment firms said the agency has found “deficiencies” at the 185 or so hedge-fund firms where it completed exams, according to the Wall Street Journal. These deficiencies included cases of firms frequently changing valuation methods in order to select the one that offered the highest values in a quarter or year, some firms cherry picking which funds to use in marketing materials depending upon their quarterly or annual performance and other cases where firms did not tell their clients precisely how they evaluated different securities or assets.

“You’ve got to tell them everything so you can’t cherry pick,” said Andrew Bowden, the director of the SEC’s Office of Compliance Inspections and Examinations, speaking at a conference sponsored by newsletter IA Watch, according to the report. Bowden also said he expects the agency to meet its goal of examining about 400 of the 1,500 or so newly registered advisers by year-end, half of which are hedge funds and half of which are private equity funds.

___

Citadel’s Kenneth Griffin donated another $1 million to Republican Illinois governor candidate Bruce Rauner, according to the Chicago Sun-Times, citing state campaign records. Altogether, the Chicago-based hedge fund manager has donated $4.58 million to Rauner in the form of cash or in-kind services since last year, the newspaper reported. For example, Griffin has lent his jet to Rauner, according to the report.

Meanwhile, Citadel disclosed it owns 5.3 percent of Sunesis Pharmaceuticals, a clinical-stage biopharmaceutical company. The investment is passive.

___

September redemptions from hedge funds amounted to 3.25 percent, down from 4.19 percent in August, according to the SS&C GlobeOp Forward Redemption Indicator. The firm says the bulk of this activity represented quarter-end requests.