South Korea’s sovereign wealth fund is considering pulling assets from Elliott Management over a conflict between the hedge fund firm and national government, local press reported.

“If the U.S. hedge fund Elliott Management is involved in an issue which causes a conflict of interest of the South Korean government, or found to have violated a law, we will consider cancelling our contract,” Heenam Choi, the Korea Investment Corporation’s new chief executive, said in a Thursday news conference, according to the Korea Economic Daily.

“We’re looking minutely into whether they are involved in a conflict of interest and violated a law,” Choi said, noting that Elliott’s performance had been strong and was not at issue.

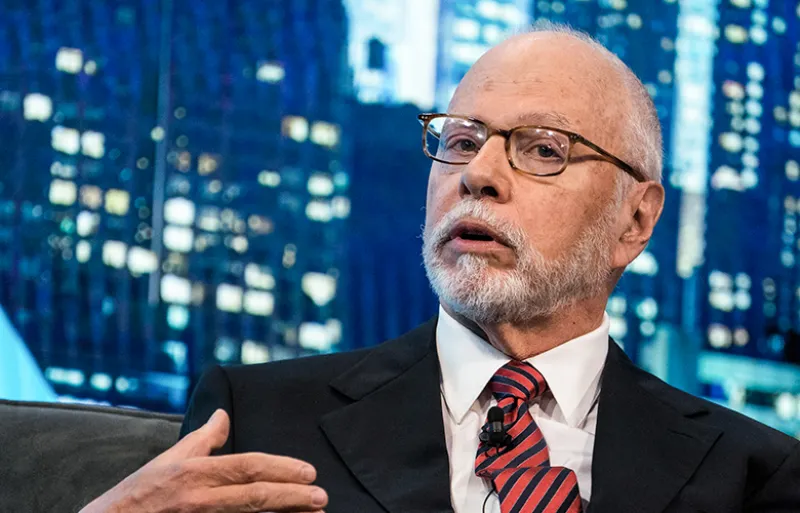

[II Deep Dive: Paul Singer, the Last Hedge Fund Pit Bull]

The Korea Investment Corporation, or KIC, manages about $134 billion for the state and reportedly allocated $50 million to Elliott in October 2010, shortly after it began investing in hedge funds.

But KIC has become caught in the middle of a conflict between its investment partner, Elliott, and the nation’s government, which oversees and funds the organization.

In 2015, the multistrategy hedge fund firm known for its shareholder activist battles tried to block a merger between two Samsung units, and nearly succeeded. But the former Presidential administration intervened, pressuring the national pension fund to side with Samsung, according to Bloomberg. The merger went though, sparking a massive corruption scandal that landed the former president and several officials in prison, according to Bloomberg.

The merger also allegedly cost Elliott a lot of money, which it is attempting to recoup from the Korean government, citing free-trade regulations.

A spokesperson for Elliott declined to comment, and KIC’s New York and Seoul offices did not respond by time of publication.