Ten-year treasury yields barely moved last year, despite three Fed rate hikes. As the early evidence this year suggests, this can’t last. Bond yields seem to have finally shaken off their indifference to policymakers’ steps towards monetary policy normalisation.

The global economy is in its best shape in a decade. The IMF has raised its forecast for global economic growth in 2018 and 2019, citing sweeping US tax cuts and their benefits to the world’s largest economy and its main trading partners. It’s no surprise bonds are in the eye of the storm.

Nearing normal

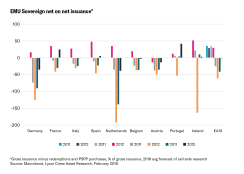

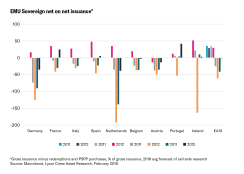

For all that, central banks are only likely to adjust their monetary policy stance gradually. Few will want to risk choking off a recovery they’ve tried so hard to stimulate. Many investors maintain some interest rate sensitivity via long-duration positions in their portfolios as a result. Staying true to this course may prove testing.US and German 10-year yields are already up by around 25-30 basis points this year, although the less hawkish tone of the most recent central bank meetings suggests the pressure could abate at some point. In Europe at least, reflation dynamics and stronger growth now appear to be priced in. The European Central Bank’s (ECB) Public Sector Purchase Programme for 2018 still implies the bank will buy more debt than Germany will issue this year (on a net basis), which could also create a ceiling for yields – for now. Lyxor still expects yields to rise everywhere, albeit more gradually from here on in.

Why bunds might outperform OATs in 2018

Lyxor ETF

Lyxor ETF

The ECB position is crucial. As recovery gathers momentum, the bank is busily preparing to bring its era of QE to an end. This could happen as early as September, with a rate hike as early as the start of 2019. Economic expansion alone justifies policy normalisation steps, even if inflation remains sluggish. The market now prices a normalisation of the deposit facility rate to 0 percent in late 2019. Anything more would mean a tightening of monetary policy in 2019, as opposed to rate normalisation only.

Readying for a new regime

In this environment, it’s a natural move to reduce interest rate sensitivity and defend against inflation by moving to asset classes with positive expected returns. As such, we prefer bonds of countries where inflation (or growth) is less likely to surprise to the upside and hasten more rapid rate rises. Japan appeals for example. We are also maintaining our position in peripheral eurozone bonds, believing tight spreads are unlikely to change while global risk appetite remains broadly buoyant. We favour Spanish bonds over Greek bonds, but politics clouds the issue for Italian BTPs yet again.In the US, inflation expectations are increasing, helped by a tight jobs market (as seen in the January employment report). Wage inflation may finally be on the rise – especially if tax reform delivers as its architects believe it will. January data showed a 2.9 percent increase year-on-year in average hourly earnings. This, along with higher oil prices, could prompt a notable rise in US CPI from March or April onward. We like US breakevens and may look at eurozone issues later in 2018. Floating rate notes, and smart cash products, could help deal with the threat of rising rates, as could short duration bonds.

Read more on Lyxor’s inflation range.

With 10-year treasury yields touching 2.8 percent, 2-year treasury yields back at 2.05 percent for the first time since 2008, and the markets pricing in at least three hikes this year, we could be on the cusp of a regime shift. Yields of 3 percent+ on the 10-year treasury now appear a question of when, not if.

Finding it hard to take credit

Credit – notably high yield – remains a concern. Equity markets are reaching for the stars and credit spreads remain tight. Leverage has increased in both the US and Europe. Leverage alone does not create a credit crisis, but it does set the stage for one to occur. Debt growth has been outpacing GDP growth, and the most leveraged non-financial companies are those with the least cash. Furthermore, median balance sheet leverage in the US has returned to 2003 levels, i.e. the end of the telecoms crisis. As such, credit needs to be approached with caution. We prefer European issues to their American counterparts given the ECB will keep a heavy hand in markets at least through SeptemberThe global expansion needs higher real rates. They are likely to rise slowly but surely from here, and there is room for more as central banks look to adjust their monetary policy stance in line with the buoyant economy and rising asset prices. Bond investors, and bond yields, have been reluctant to accept this new environment, but this is set to change.

Check the latest yield news with Lyxor’s Interactive Tool.

Disclaimers:

FOR PROFESSIONAL CLIENTS ONLY

All opinions/data sourced from Lyxor & SG Cross Asset Research teams. Opinions expressed are as at 2 February 2018. Past performance is no guide to future returns.

This document is for the exclusive use of investors acting on their own account and categorised either as “Eligible Counterparties” or “Professional Clients” within the meaning of Markets In Financial Instruments Directive 2004/39/EC.

This document is of a commercial nature and not of a regulatory nature. This document does not constitute an offer, or an invitation to make an offer, from Société Générale, Lyxor International Asset Management or any of their respective affiliates or subsidiaries to purchase or sell the product referred to herein.

We recommend to investors who wish to obtain further information on their tax status that they seek assistance from their tax advisor. The attention of the investor is drawn to the fact that the net asset value stated in this document (as the case may be) cannot be used as a basis for subscriptions and/or redemptions. The market information displayed in this document is based on data at a given moment and may change from time to time. The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data. The potential return may be reduced by the effect of commissions, fees, taxes or other charges borne by the investor.

Lyxor International Asset Management (Lyxor ETF), société par actions simplifiée having its registered office at Tours Société Générale, 17 cours Valmy, 92800 Puteaux (France), 418 862 215 RCS Nanterre, is authorized and regulated by the Autorité des Marchés Financiers (AMF) under the UCITS Directive and the AIFM Directive (2011/31/EU). Lyxor ETF is represented in the UK by Lyxor Asset Management UK LLP, which is authorised and regulated by the Financial Conduct Authority in the UK under Registration Number 435658.

Lyxor International Asset Management (“LIAM”) or its employees may have or maintain business relationships with companies covered in its research reports. As a result, investors should be aware that LIAM and its employees may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

CONFLICTS OF INTEREST

This communication contains the views, opinions and recommendations of Lyxor International Asset Management (“LIAM”) Cross Asset and ETF research analysts and/or strategists. To the extent that this research contains trade ideas based on macro views of economic market conditions or relative value, it may differ from the fundamental Cross Asset and ETF Research opinions and recommendations contained in Cross Asset and ETF Research sector or company research reports and from the views and opinions of other departments of LIAM and its affiliates. Lyxor Cross Asset and ETF research analysts and/or strategists routinely consult with LIAM sales and portfolio management personnel regarding market information including, but not limited to, pricing, spread levels and trading activity of ETFs tracking equity, fixed income and commodity indices. Trading desks may trade, or have traded, as principal on the basis of the research analyst(s) views and reports. Lyxor has mandatory research policies and procedures that are reasonably designed to (i) ensure that purported facts in research reports are based on reliable information and (ii) to prevent improper selective or tiered dissemination of research reports. In addition, research analysts receive compensation based, in part, on the quality and accuracy of their analysis, client feedback, competitive factors and LIAM’s total revenues including revenues from management fees and investment advisory fees and distribution fees. Please see our investment recommendations disclosure website www.lyxoretf.com/compliance.