When hedge funds blow up, they tend to inflict lasting damage on managers’ careers, research has shown.

The foremost study — “Career Risk and Market Discipline in Asset Management,” published through the University of Indiana’s Kelley School of Business — found that hedge fund employees typically progress quickly early in their careers, but fund underperformance, and eventual liquidation, can leave them struggling to find new employers.

[II Deep Dive: The Fastest Way to Wreck Your Hedge Fund Career]

So how does one not wreck his or her hedge fund career — if they’re lucky and talented enough to get one started in the first place? These are plum jobs despite the risks, study authors Andrew Ellul, Marco Pagano, and Annalisa Scognamiglio pointed out.

Even within the competitive broader finance industry, these alternative asset managers tend to hire the best of the best and pay them handsomely, the data suggested.

“Hedge funds carry out very complex trades and arbitrage strategies, which require scarce and highly specialized talent,” the authors wrote. “Hence, they compete keenly for such talent.”

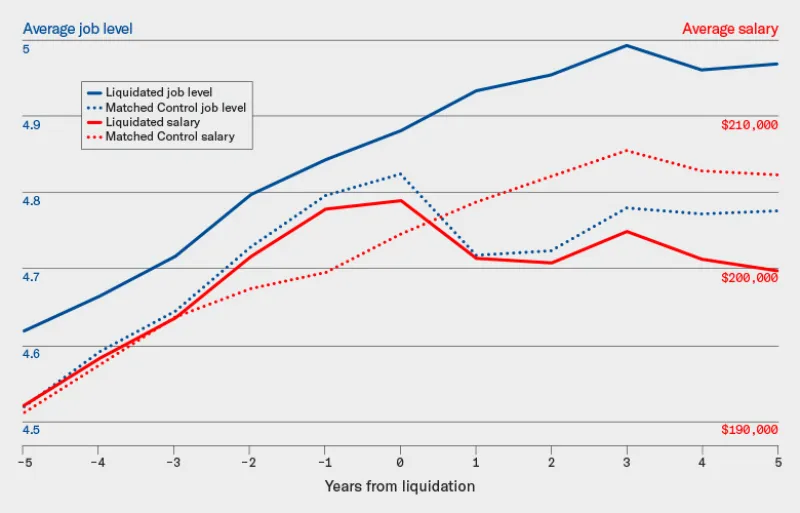

To remain on the blue track in the chart above, graduate degrees from top schools and prior experience in asset management would certainly help, the research indicated. So would being a man. Career trajectories were steeper for men than for women, all else being equal, in the study’s 1,627-person sample. These individuals spent at least some time working in hedge funds between 2007 and 2014.

To further hedge downside career risk, work somewhere that won’t tend to perform below its benchmark. Employees at funds that outperformed their benchmarks in the previous three years likewise outperformed their peer cohorts, the study found. These young up-and-comers got promoted faster and higher than the baseline.

And if the dreaded shut-down does arrive, outperformance mitigates most career damage.

Because it’s not that fund liquidation itself caused career slowdowns, the authors explained, but rather persistent negative performance followed by liquidation. Notably, top-level executives felt most of the career damage, while middle managers were not typically impacted beyond increased turnover.

“Only employees with substantial decision-making power over funds that persistently under-performed prior to liquidation” are penalized, according to Ellul, Pagano, and Scognamiglio.

Hedge funds shutter for reasons beyond poor returns, such as corporate restructuring, mergers, regulatory activity, and changing investor appetite. Teams with healthy fund track records felt the impact of closures, too: many employees left the company entirely.

“The probability of switching to a new employer increases by 11 percentage points in the years following liquidations of well-performing funds. Hence, in the wake of fund liquidations, top managers do move to other companies, yet only those who do so after persistent fund under-performance see their subsequent career being hurt,” the authors wrote.

Managers have long-term career incentives to lead strong funds, according to the study — or at least to avoid burning them to ground.