Institutional investors have increasingly chosen the tiny U.K. island of Jersey to domicile their assets over the past year, according to a new report.

Assets under administration on the Channel Island grew by more than 17 percent in the year to June 2017, according to research conducted by research consultancy Europe Economics and released on Tuesday, with assets growing from £209 billion (US $274 billion) at the end of June 2016 to £246 billion a year later. This figure excludes some £600 billion held in special-purpose vehicles for businesses and institutions.

Jersey was among those jurisdictions highlighted in last week’s Paradise Papers, a series of reports based on leaked documents that exposed the offshore investment habits of international companies, funds, and wealthy individuals. These reports found the sums invested offshore by institutional investors and some individuals, globally, are often far larger than previously thought. A report on offshore mega trusts that was based on documents in the Paradise Papers found that a single hedge fund manager had stockpiled $7.25 billion in a Bermuda trust. Other offshore jurisdictions popular with investors include the British Virgin Islands, Guernsey, and the Isle of Man.

News of the increase in assets is a boost to Jersey, an island jurisdiction highlighted in a parliamentary report in March as a financial center that may find its assets shrinking after the U.K. leaves the European Union in 2019.

[II Deep Dive: Fund Firms Face Billion Dollar Brexit Risk from U.K. Offshore Dependencies]

The Europe Economics report suggests that investors choose the island because of its zero tax rate, its “range of fund structures,” and its ability to tailor “simple investment holding vehicles through to complex multi-jurisdictional structures.”

It also notes that pension fund assets account for around £39 billion of the £246 billion of assets under administration, with sovereign wealth funds accounting for around £14 billion. Around 60 percent of tax-exempt institutional investor cash was invested in private equity or venture capital funds. Last week, the Financial Times reported that the pension fund for Britain’s members of parliament was among those retirement funds investing in Jersey.

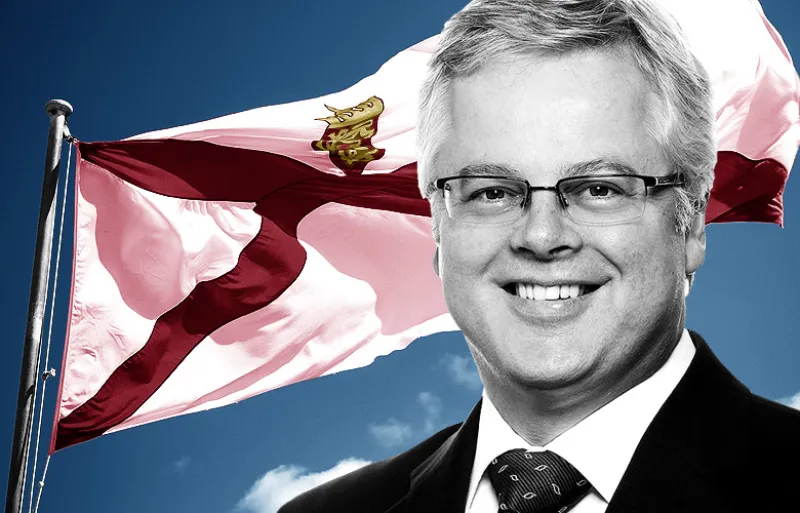

In a foreword to the report, Geoff Cook, chief executive of Jersey Finance, a trade group representing fund groups on the island, explained that pension funds investing in some offshore jurisdictions could face a tax bill, even when they are not eligible to pay tax in their home country.

“This could deter them from making such investments to create the diversified portfolios needed to maximise returns and minimise risk,” he said. “Cross-border investments through Jersey allow them to make better returns for their beneficiaries — such as retired people, in the case of pension funds.”

Institutional Investor approached seven major U.K. pensions consultancies for comment on the practical and ethical considerations of offshore investing. Of those, Aon declined to comment; Barnett Waddingham and Xafinity said they had no representatives available to comment; and Redington, Mercer, Willis Towers Watson, and Punter Southall did not respond to the query.