Getting a group of independent money management firms to work harmoniously -- and profitably -- under a single corporate umbrella isn't easy, as a new generation of investment executives is discovering.

Entrepreneurs at a number of little-known firms, such as Convergent Capital Management, Matrix Global Investments and Value Asset Management, have tried -- mostly without success -- to build on the groundbreaking business models of two money management pioneers, Norton Reamer and William Nutt. Reamer and Nutt, who started their firms more than a decade apart, created holding companies for asset management firms that allowed the firms to retain their names and investment styles while operating as part of a larger corporate entity.

A former Putnam Investments CEO, Reamer founded his company, United Asset Management, in 1980. UAM bought complete control of midsize investment firms but granted the managers autonomy. The formula worked successfully for nearly 20 years, and at its peak, in 1998, the company had 50 firms in its stable, with a combined $214 billion in assets.

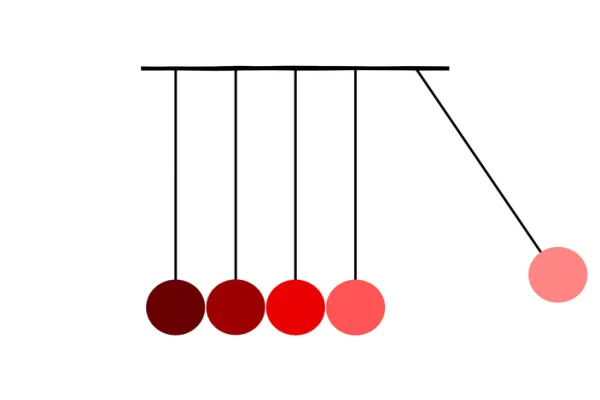

Then trouble struck. UAM's investment firms relied on defined benefit pension money, and they tended to focus on value stocks. When defined benefit plans and value investing went out of style in the late 1990s, Reamer was forced to sell UAM at a huge discount to prevailing prices.

Nutt, a former CEO of Boston Company Asset Management, created his holding company, Affiliated Managers Group, in 1993 using a variation on Reamer's formula. Rather than buy 100 percent of its firms, Nutt left the key managers with minority stakes, which gave them an incentive to grow. So far Nutt's firm is thriving: AMG currently has 17 affiliates and nearly $82 billion under management.

The most recent generation of practitioners, most of whom started in the mid-1990s, offer a twist on Nutt's AMG mod- el: They leave equity on the table, but they provide affiliates with distribution assistance. By expanding their subsidiaries' marketing capabilities, they are often able to bolster fund sales.

To date, however, none of them has succeeded as resoundingly as Nutt or reached the prominence that Reamer did before the bottom fell out of the market. In fact, one such firm has already disappeared, and the others are struggling to readjust their plans and stay afloat.

To raise cash, Stamford, Connecticut based Value Asset Management is selling off one of its three affiliates. After the sale VAM will eliminate its holding company structure. This past April, Convergent Capital Management, a holding company for nine low-profile firms, was sold to City National Corp. in Los Angeles for a paltry $49 million, a less than 1 percent price-to-assets ratio, compared with an industry average of 4.1 percent. CCM and its collection of firms, mostly boutiques like Philip V. Swan Associates and Bufka & Rodgers, were never able to put together a joint distribution strategy or fund family, and CCM's individual managers could not grow their assets.

Long gone is Matrix, launched in 1997 by Clinton Kendrick, who had served as COO of Lehman Brothers' asset management division. Backed by private equity investor Castle Harlan, Matrix initially got a lot of business press coverage, but it only bought one company, Carret and Co. Kendrick's Matrix called it quits in 1999.

"Great concept, poor timing," says W. Denman Zirkle, CEO of Carret, which absorbed Matrix's capital.

Matrix's purchase of Carret was ill- fated in part because the firm's balanced portfolios proved a tough sell in the institutional marketplace. Other managers found that bringing various firms together on one platform resulted in culture clashes and unanticipated costs.

"Some of them repeated the same mistakes that Reamer made," explains Lehman analyst Mark Constant. "You can't just buy up a bunch of companies; they need to fit strategically. UAM was steeped in value at a time when growth dominated. These other players were equity-driven at a time when fixed income rose to prominence."

"Did we have the kind of success AMG has had?" asks Convergent Capital CEO Richard Adler. "No. But we've got a great new owner, we've paid off our backers, we've recapitalized. Don't write us off just yet." Adds Value Asset Management CEO David Minella, "You have to adapt or die."

Minella, formerly CEO of Chancellor LGT Asset Management, joined VAM in 1997. BancBoston Capital had created the company two years earlier to emulate AMG. But after VAM swiftly executed three big-ticket purchases -- among them, equity managers Harris Bretall Sullivan & Smith -- the raging bull market pushed acquisition prices out of reach. Almost as quickly, the bear market "put all acquisitions on hold," says Minella.

VAM recently announced that it plans to sell its 51 percent stake in New York based Dalton, Greiner, Hartman, Maher & Co., to Boston Private Financial Holdings for $75 million. VAM is reconfiguring its remaining pieces: Harris Bretall will become a showcase platform for traditional long-only products, and Grosvenor Capital Management will continue to specialize in alternatives.

"We realized, Why should we build some new shared distribution platform for the three when we could take advantage of HBSS' existing distribution system, which is first rate," says Minella.

There are some signs of life. In the past year Douglas DuMond, ex-president of Invest, a money management holding company purchased by CDC IXIS Asset Management North America in 2001, started a new holding company, Overture Asset Managers, with backing from brokerage firm Oppenheimer & Co. Overture has acquired New Yorkbased tactical asset allocation overlay specialists Avatar Associates and reports that it has several more deals in the pipeline.

"The idea is to learn from all of the mistakes made by these others and really build something that buys strategically, not just financially," says DuMond.

That's easier said than done.