More investors are joining matchmaking services online to access sought-after funds of funds and deals involving secondary stakes, but there’s only so much transparency they can expect to find instantly.

While websites run by Palico and Artivest are increasing in popularity, their full potential is limited by federal regulations that prohibit private companies from listing asset prices in public, according to Antoine Drean, founder of Palico. Buyers and sellers that connect online must communicate about asset prices by phone or through private messages sent on the firm’s platform.

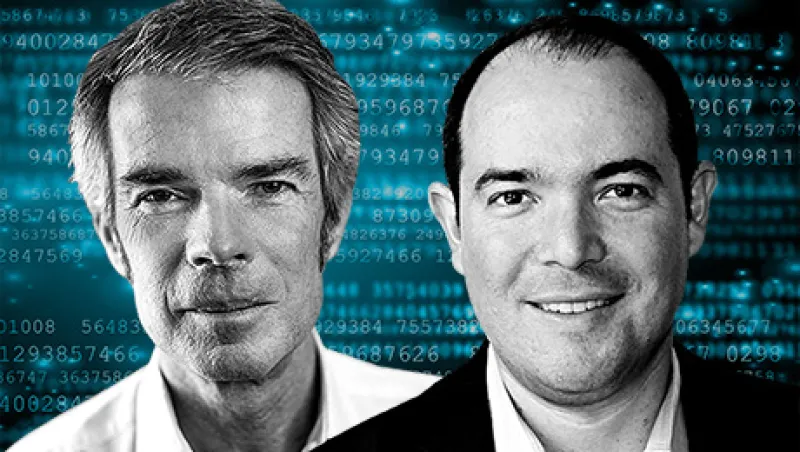

“You cannot talk to the whole market at once,” said Drean, but a web-based platform quickly gives a broad view of who is looking to make a deal. Palico began in 2012 matching asset allocators with private-equity firms, as well as investors seeking to buy or sell stakes in buyout funds. KKR & Co.-backed Artivest, which matches investors with funds of funds in the hedge-fund and private-equity industries, is similarly attracting allocators who want more transparency.

Having a clear, full view of the market is a big deal to institutional investors, who remain dissatisfied with the transparency they receive from private-equity firms, according to data room provider Intralinks. More than half the limited partners in its survey this year said they were “only somewhat satisfied” with the transparency they receive from fund managers about investment performance.

“Private equity is only 1.5 percent of financial global assets,” Drean said. “Our bet is that this 1.5 percent will grow to five percent to 10 percent over the next five to 10 years. This is really just the beginning.”

[II Deep Dive: Co-investments in Private Equity Rise Along With Risks]

Palico has more than 3000 accredited limited partners from more than 1900 firms as members, plus more than 5000 accredited private-equity managers, according to a spokesman for the firm. Artivest, which was founded in 2012, received a round of funding from private-equity firm KKR and venture-capital investors including Peter Thiel in 2015.

“An investment platform helps you quickly get up to speed,” said Michael Kosoff, director of investment research at Artivest. He said the firm is gaining traction in the marketplace because its technology and user interface make the allocation process easier.

Palico sees itself making the market more efficient by collecting information on investment preferences before suggesting matches.

“It’s not just a question of reaching out manually, it’s also a question of making sure you’re talking to the right people,” Drean said.