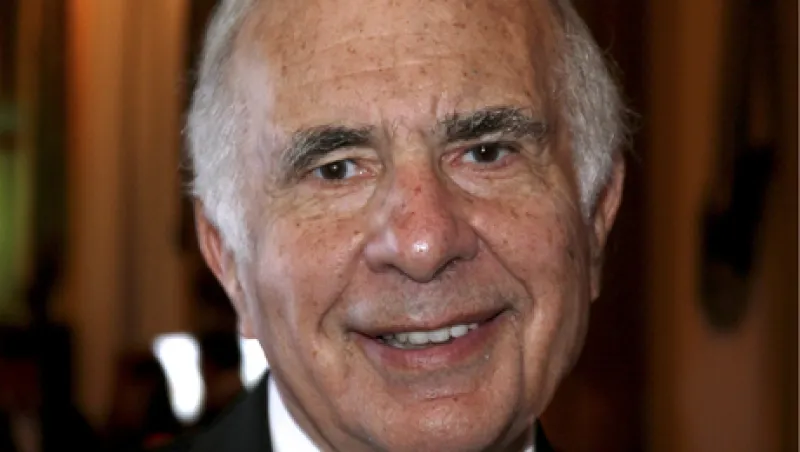

Market commentators are aghast at Carl Icahn’s decision late on Friday to abandon his proxy fight with Clorox, announcing he has decided withdrawing his slate of directors after concluding that “a considerable base of shareholders would not support” his campaign.

After all, they can’t remember the octogenarian ever walking away from a proxy fight. However, this is actually not much of a surprise.

The reality is that Clorox is the fourth company in less than a year in which management or shareholders rebuffed Icahn’s takeover efforts, the other three being Forest Laboratories, Dynegy, and Lions Gate Entertainment.

In the case of Clorox, the octogenarian noted in his announcement that “several large shareholders may believe that now is not the best time to run that process,” given the deteriorating conditions of the financial markets and Clorox’s view that Icahn’s $80 per share offer “substantially undervalues” the company; Icahn subsequently lowered the offering price to $78.

However, besides Icahn and Clorox, few others shared this valuation. On Monday morning, the stock sunk more than 6 percent to $65.12 from $69.40 before Icahn’s following.

And as I pointed out when Icahn initially made his bid in June, the stock began to tumble almost from the first day he made his announcement. Part of the reason is that no other company has stepped forward with its own higher bid, as Icahn had publicly hoped for.

Wall Street analysts paid to follow the household products company were skeptical of a deal at that price as well. I noted at the time Oppenheimer cut its rating on the shares to Perform from Outperform. Deutsche Bank Securities reminded its clients in a note it has a Hold rating and a $70 price target.

A week or so before Icahn made his initial bid for Clorox, Morgan Stanley had a $63 price target. After the bid was made, Morgan Stanley raised its rating on the stock to Equal Weight and said it believed the stock will trade close to the offer price. It should have stuck with its initial conviction.

UBS had a Neutral rating before Icahn’s announcement and a $70 price target. Afterward, it raised that target to $74 but kept its Neutral rating.

Meanwhile, back in August, Icahn lost his proxy fight against Forest Labs when none of his four director nominees received enough votes.

Late last December, Icahn repeatedly pressed to buy Dynegy for $5.50 a share, which was 10 percent above the price earlier offered by Blackstone Group. Today Dynegy is still independent.

Its stock is now down to $4.66 and the company is being sued by bondholders — including hedge fund Avenue Capital Group — for a controversial restructuring supported by Icahn.

Lions Gate, meanwhile, rebuffed a number of acquisitions offers from Icahn. The battle then turned contentious and litigious. Finally, in August the two sides finally reached an agreement. In a complex deal, Icahn unloaded his stake — he had been the company’s largest shareholder — for $7 a share, enabling him to break even on his investment. Of course, this does not include costs associated with proxy filings and court fees.

Then there is the case of Mentor Graphics, which I call a gray area. On February 8, shares of Mentor jumped 3.7 percent when Icahn said the company should be acquired or put up for sale. Exactly two weeks later, Icahn offered $17 a share to buy the company, a 17 percent premium to its prevailing price at the time. But — as in the case of Clorox — Icahn said in a letter to management that “there are potential strategic bidders” for the company that should pay more than he offered.

Icahn then launched a proxy fight and in May his three nominees were voted to Mentor’s board. So, score this a win for Icahn ... but not entirely. Shareholders have not exactly been big winners. So far, no bidder has yet emerged for the company. And on Friday the stock closed at $9.98. It is down another 1 percent on Monday, perhaps in reaction to Icahn Clorox decision.

In fact, as I earlier pointed out, history shows that investors rarely fare well when they participate in Icahn’s proxy battles, especially if the company is not in the biotech or pharmaceutical industry.

FactSet SharkWatch looked at the stocks of 18 companies that were targets of Icahn campaigns in which the dissident gained at least one board seat going back to 2005.

And what happened to the stocks of these 18 companies? If you go back one month, six months, one year and two years after Icahn secured a board seat, the stocks, on average, underperformed a number of widely followed indices in all of the timer periods studied.

In fact, only drug and biotech stocks fared well and outperformed.

Now Icahn has suffered at setback at Forest Labs, a drug company.

Icahn needs a resounding win to regain the old reputation as someone to fear and deal with.