Global equity markets have now seen two weeks of unabated selling pressure while moves in U.S. Treasuries and currencies like the Swiss franc point to a broad flight to safety by investors. Concerns over the sustainability of U.S. borrowing levels that were central to the debt ceiling crisis negotiations, combined with abysmal second quarter GDP, have created tremendous uncertainty over the economic health of the world’s most important consumer market, financial center and largest debtor. Although U.S. equities rose initially on today’s surprisingly strong employment report for July, this rally quickly faded as investors continue to recalibrate risk levels.

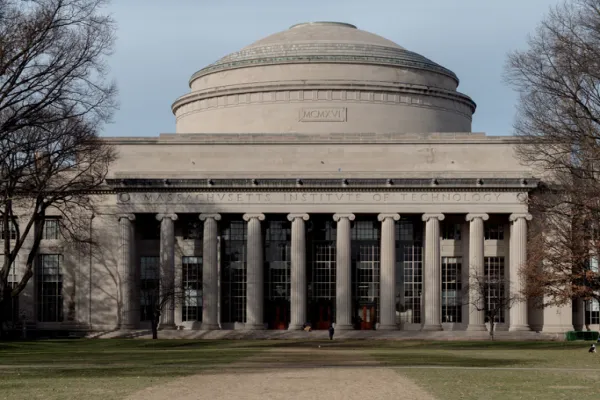

There are few people that have a deeper understanding of the challenges facing the U.S. economy than Randall Kroszner. As a former governor of the Federal Reserve System and a voting Federal Open Markets Committee member, Kroszner chaired the committee on Supervision and Regulation of Banking Institutions during the credit crisis and took a leading role in developing responses to the emergency. He is currently the Norman R. Bobins Professor of Economics at the University of Chicago Booth School of Business.

Kroszner spoke briefly with Institional Investor Contributing Editor Andrew Barber about the risks facing current U.S. policymakers as they attempt to navigate both political and economic minefields simultaneously, as well as the factors that he believes are critical to sustainable growth

Institutional Investor: There has been a tremendous amount of media discussion of more action on the part of the Federal Reserve to stimulate the economy — so called QE3. Do you think this is a likely scenario and do you think that significant benefits could be accomplished through more fiscal intervention?

Randall Kroszner: Estimates of the bang-per-buck of fiscal stimulus, called the fiscal multipliers, vary quite a bit. Also, not all types of fiscal actions would have the same impact. That said, I think the best type of fiscal “stimulus” would be to reduce inefficiencies of the tax system to stimulate investment and job creation to make it more pro-growth.

At the moment, I don’t see a foundation for a so-called QE3 by the Fed but, of course, Bernanke has said he will continue to weigh the costs and benefits of further action as the growth and inflation evolve.

The image of the U.S. as becoming a mirror of Japan is wildly in vogue now. With a distorted debt-to-GDP ratio, sustained low policy rates, rapidly aging demographics, a fractured political environment that has resulted in stalemate and no obvious organic growth prospects domestically, Japan does seem to have many parallels with the developing situation in the U.S.

One of the key differences is that the Fed has been pro-active here to avoid the tail-risk of deflation, which has plagued Japan for more than a decade. The demographic challenges are real in the U.S. but not nearly as great as in Japan: We still have population growth, both domestically and through immigration. That said, we have only taken the first steps on fiscal sustainability; we must follow through on these steps in a credible way to avoid a Japan-style fiscal burden

What can the government do to stimulate growth for the U.S. economy?

First, we need to reform the tax code to encourage growth and jobs formation. The president’s bipartisan deficit commission recommended eliminating loopholes that would allow the government to maintain revenue collection while reducing overall taxes rates — this is an effective way to stimulate investment and job creation. Tax code reform would be a top priority for promoting intermediate and long-run growth and competitiveness.

Second, I’d reform Freddie Mac and Fannie Mae. Even though housing was at the heart of the financial crisis, the Dodd-Frank regulatory reform did not address these giants. The key is to provide certainty. The Treasury has put forward three options. What is most important now is to have clarity about the government’s role in the housing market going forward in order for the private sector to come back in a robust way into this market.

Andrew Barber is the CEO of Waverly Advisors, a Corning, NY-based tactical research and asset management firm.