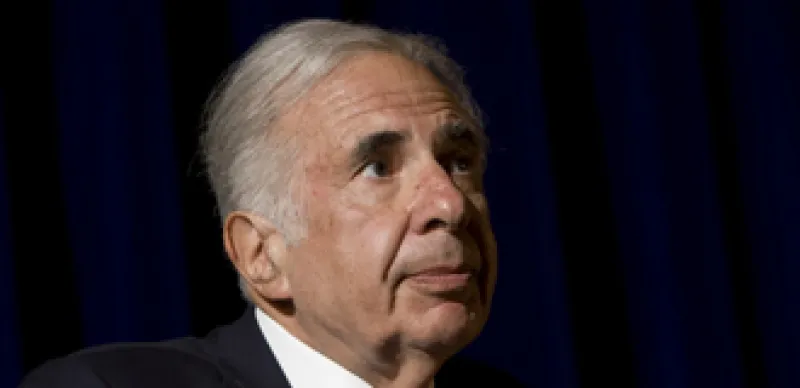

Is Carl Icahn becoming the Rodney Dangerfield of shareholder activists? Is he losing his touch? It sure is starting to look this way.

His announcement Thursday that he is extending his offer for Dynegy for the second time — to February 14 from February 9 — is the latest proof that investors and fellow activists don’t believe the road to riches is by blindly following the septuagenarian investor.

Icahn said the $5.50 per share tender offer is being extended because certain conditions to the tender offer have not been satisfied as of the previously scheduled expiration date, including receipt of the approval of the Federal Energy Regulatory Commission.

However, the reality is that more than 95 percent of shareholders failed to tender their shares the first time around.

At the same time, Seneca Capital, which Icahn supported in their opposition to Blackstone Group’s earlier failed deal to buy the power company, is now opposing Icahn.

Late last month, it fired off a letter to the special committee of the Dynegy Board announcing that it opposes selling Dynegy at even $6 per share.

Now it is launching its own, separate, proxy fight. It is nominating two directors of its own — rail executive E Hunter Harrison, and power industry veteran Jeff Hunter — stressing Seneca opposed Icahn’s bid as too skimpy.

Wall Street, however, is skeptical of Seneca’s efforts. JPMorgan analyst Andrew Smith says in a note to clients that he doubts a bid in excess of $6.50 per share will materialize, and the shares could trade down to Icahn’s $5.50 offer or even further. So, he downgraded the shares to Neutral from Overweight.

Icahn also has a rival in his bid to take control of Mentor Graphics, the electronic design firm.

Icahn, who owns 15 percent of the company’s stock, said in a regulatory filing the company “should put itself up for sale.” He added that a strategic acquirer should find extremely attractive the fact that the company spent $407 million on SG&A (Selling, General and Administrative Expense) — $313 million on marketing and selling expenses and $94 million on G&A — over the last 12 months.

In a separate filing, Icahn said he informed the company that he intends to nominate three individuals to the company’s board at the 2011 annual meeting, but may nominate a different number of individuals, up to a full slate. He said this decision is in response to the company’s announcement last week that it will hold its 2011 annual meeting six weeks earlier than last year, leaving shareholders with only 10 days to nominate a dissident slate.

Icahn, however, has competition. Casablanca Capital LLC, headed by Donald Drapkin, a former Vice Chairman of Lazard International and one-time key advisor to Ronald Perelman, and Douglas Taylor. Taylor said in a regulatory filing that Casablanca owns 5.5 percent of Mentor’s stock.

In a letter fired off to the company’s Board, Taylor rebuked their decision to move up the date of the annual meeting, leaving shareholders just a few days to nominate candidates for election to the Board. “The investors are concerned that you may have deviated from traditional timing because you recognize that certain shareholders, not limited to us, have demonstrated an interest in engaging management to discuss the affairs of Mentor,” he wrote, urging the company to change the date of the meeting. “These entrenching actions require shareholders to evaluate the incumbent Board’s dedication to shareholders and consider whether you are putting your personal positions with Mentor ahead of the interests of all shareholders.”

This action was taken independent of Icahn. Earlier this week, both Icahn and Drapkin appeared on the same show on CNBC, where it was suggested the two individuals would probably submit separate slates of director nominees. And both individuals made it clear on CNBC they do not plan to team up in their efforts.

You may recall that last year Icahn had trouble mustering support in his bid for Lionsgate, postponing his tender offer countless times. At one point, he raised his bid to $7.50 per share after earlier insisting he would never increase the price of his offer. But this did not work either. Then at the annual meeting, shareholders failed to nominate any of Icahn’s nominees.

Icahn needs a win real fast if he wants to maintain his credibility—and his ability to move stocks. Otherwise, target managements will become more confident in their strategy to oppose any overtures Icahn may make in the future.