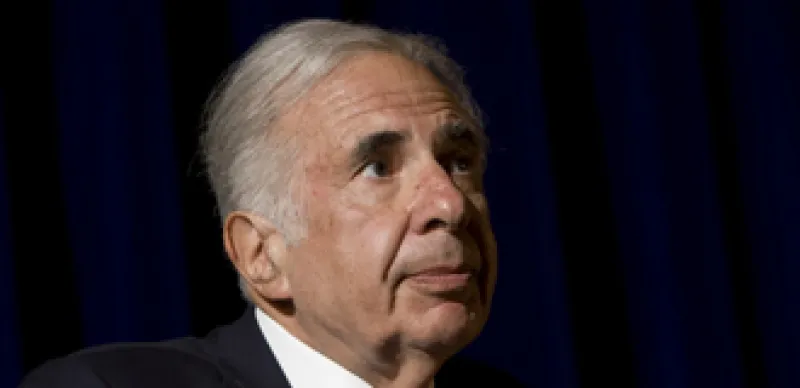

Analysts who follow Clorox are unimpressed with Carl Icahn’s announcement that he owns nine percent of the company’s shares.

This will come as no surprise to InstitutionalInvestor.com readers, who know already that Icahn’s record is not nearly as good as some people think it is.

UBS downgraded the stock to Neutral from Buy while Citi Investment Research & Analysis maintained its Hold rating. “We don’t think that it signals a foregone conclusion that he will be able to create incremental shareholder value from current levels,” Citi told clients in a note Monday morning.

The initial euphoria over Icahn’s regulatory filing that he owns nine percent of the stock sent the shares surging 7.5 percent, to close at $71.26 on Friday.

In his filing, Icahn said he believes the shares are undervalued in light of Clorox’s emphasis on "mega-trends" and its portfolio's focus on innovative brands that are number one in their respective categories.

He also said he supported the company’s plan to buy back between 10 and 11 million shares of the stock by the end of its fiscal year.

And then, the corporate raider cum hedge fund manager said what seemed like the magic words: He “may seek to have conversations with management” to discuss the company's business. Ooh. Hence, the stock run-up.

However, on Monday morning, the analysts who follow the stock had second thoughts.

In a report titled: “We’re Not Sure What He Sees Here,” Citi detailed a number of reasons why it does not believe Clorox’s stock is undervalued.

For one thing, compared to its peer group, Citi says the consumer products company is too much focused on domestic markets—85 percent of its revenues come from the US—preventing the company from realizing any benefit from the faster category and consumption growth rates seen in emerging markets. The bank also asserts that Clorox is heavily exposed to slower-growth categories in the US, such as bleach, plastic bags & wraps, household cleaners, kitty litter, and salad dressings and sauces.

Citi also asserts Clorox is not undervalued based on margin potential for the mere reason it is so well managed it is already very profitable. Many corporate activists prey on companies run by lousy management whose ouster alone would be worth a few more bucks in the stock. Not Clorox. “Part of our cautious stance on the stock in recent years has been our skepticism that from a profitability perspective, things can’t get much better at CLX than they already are,” Citi tells clients in its report.

Rather, the bank says the best time to own the stock is when sales growth is accelerating based on successful new product activity or EPS growth is accelerating due to margin expansion initiatives. However, Citi is not confident these scenarios will exist in 2011.

"While Icahn taking a stake in CLX is interesting, we don’t think that it signals a foregone conclusion that he will be able to create incremental shareholder value from current levels,” Citi tells clients.

UBS took more drastic action, downgrading the stock altogether to a similar level as Citi’s, keeping its price target at $72. “While Mr. Icahn is a successful activist investor, we struggle to have high conviction in any activist scenario playing out,” UBS states in its note to clients.

The UBS analyst, who also stresses how well Clorox is managed, says Icahn’s historical targets seem to fall into three categories – break-ups, M&A candidates, and a push to improve business fundamentals. “We do not see any high conviction/compelling theses for Clorox along these strategies,” it then adds.

Did someone say Dynegy or Lionsgate?