The International Monetary Fund’s internal Independent Evaluation Office has delivered in 59 pages of exhaustive, often stinging detail a report on how the agency’s “groupthink” and inadequate governance prevented it from identifying and raising warning flags about the financial market weaknesses that precipitated the global crisis of 2008.

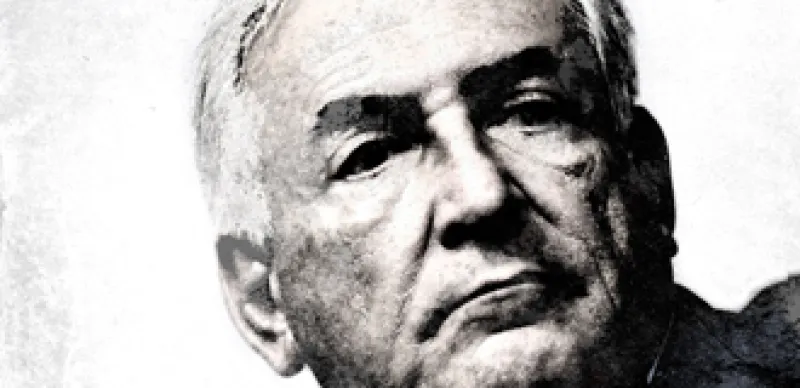

In a formal statement to the IMF board that was released on February 9 with the report, IMF Performance in the Run-Up to the Financial and Economic Crisis: IMF Surveillance in 2004-07, IMF managing director Dominique Strauss-Kahn called it a “humbling fact” that the fund failed to “warn about a systemic crisis in a sufficiently early, pointed and effective way.” Strauss-Kahn also sought to focus attention on the evaluation’s “many constructive ideas” and put a positive spin on what the report termed “steps already taken” to improve reporting and surveillance, break down organizational silos and encourage debate and dissent.

If the analysis and prescriptions sound familiar, it’s because the shortcomings are much like those that afflicted major financial institutions and regulators and that have been described in post mortems ranging from the U.K. Financial Services Authority’s Turner Review of March 2009 to the extensive self-examinations of UBS that the Swiss banking giant’s board published in April 2008 and October 2010. Even the IMF’s periodic World Economic Outlooks and Global Financial Stability Reports pinpointed systemic problems and vulnerabilities in the financial infrastructure – but mostly in retrospect.

“The IMF did appropriately stress the urgency of addressing large global current account balances that, in the IMF’s view, risked triggering a rapid and sharp decline in the dollar that could set off a global recession,” the Independent Evaluation Office said in its executive summary. “But the IMF did not link these imbalances to the systemic risks building up in financial systems.”

The report enumerates some two dozen “factors [that] played a role in the IMF’s failure to identify risks and give clear warnings,” categorized as analytical weaknesses, organizational impediments, internal governance problems and political constraints.

It is in the report’s fifth chapter, “Toward More Effective IMF Surveillance,” that the evaluators turn their attention to remedial actions. They concede that because “crises and their triggers are inherently unpredictable,” the objective should be to better enable identification of risks and vulnerabilities “and alert the membership in time to prevent or mitigate the impact of a future crisis. . . It needs to take measures to prevent or mitigate future crises as much as address the weaknesses that were uncovered by past crises.”

The call for being “proactive” and not “primarily reactive in crisis response and management” dovetails with systemic-risk monitoring efforts such as those of the Financial Stability Oversight Council, which was mandated by the Dodd-Frank Act in the U.S., and the Basel Switzerland-based Financial Stability Board, of which key national financial regulatory bodies and the IMF are members.

As noted in the IMF evaluation, among the desirable steps already taken are “the inclusion of advanced economies in the Vulnerability Exercises, the launching of the Early Warning Exercise, increased research on macro-financial linkages, the preparation of reports that analyze spillovers and contagion from systemic economies, and the recent decision to make financial stability assessments under the FSAP a mandatory part of surveillance for the 25 most systemic financial sectors."

That statement refers to several ongoing programs within the IMF, and perhaps the most critical of these in terms of macro-prudential monitoring is the FSAP, or Financial Sector Assessment Program. It was established in 1999 in conjunction with the World Bank to offer country-by-country assessments of financial stability and development on a voluntary basis.

Last year – the first year in which the U.S. was in the program – FSAP tightened its focus on systemically important economies by becoming “a mandatory part of the IMF’s bilateral surveillance for the world’s top 25 financial centers,” the IMF evaluation document noted. It said it welcomed this development but emphasized that “coverage of institutional, regulatory and supervisory issues issues is critical to ensuring the robustness of these assessments.” And it suggested that the IMF board consider requiring the mandatory assessments every three years instead of every five.

Strauss-Kahn said the FSAPs will contribute to the IMF’s ability to “connect the dots better.” FSAPs will inform the fund’s so-called Article IV economic surveillance, and he called better integration of the separate World Economic Outlook and Global Financial Stability Report analyses “a crucial dimension of that task.”

In a speech last September on the G-20 financial reform agenda, on which the Financial Stability Board is playing a key coordinating role, IMF first deputy managing director John Lipsky described the more comprehensive FSAP as “a more risk-based approach to financial sector surveillance.” Lipsky explained, “FSAPs represent an in-depth, independent assessment of whether financial regulations meet agreed international standards and gauges how effectively they are being applied. The goal is to establish an effective dialogue about how the regulatory/supervisory system can be improved – in the interest of bolstering the financial sector’s ability to contribute to strong and stable growth.”

In addition, Lipsky went on, “Peer reviews of regulatory and supervisory practices are being undertaken under the auspices of the Financial Stability Board. These reviews will promote an enhanced dialogue among regulators and supervisors regarding the implementation of international best practice. The goal is to enhance efficiency, promote a level playing field internationally and help monitor potential new vulnerabilities.”

Jeffrey Kutler is editor in chief of Risk Professional magazine, published by the Global Association of Risk Professionals.