Prop Trading Goes Underground

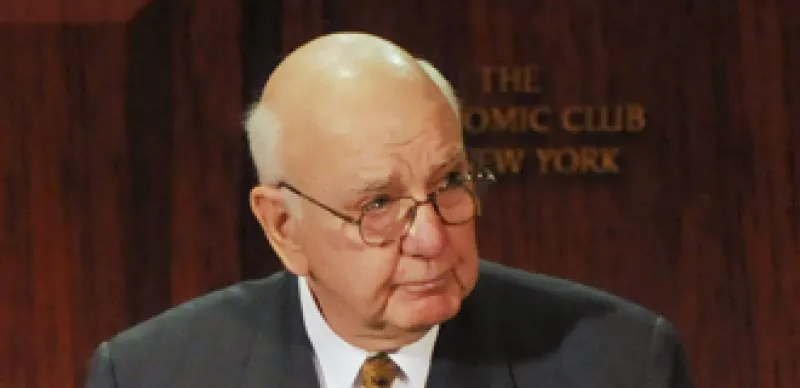

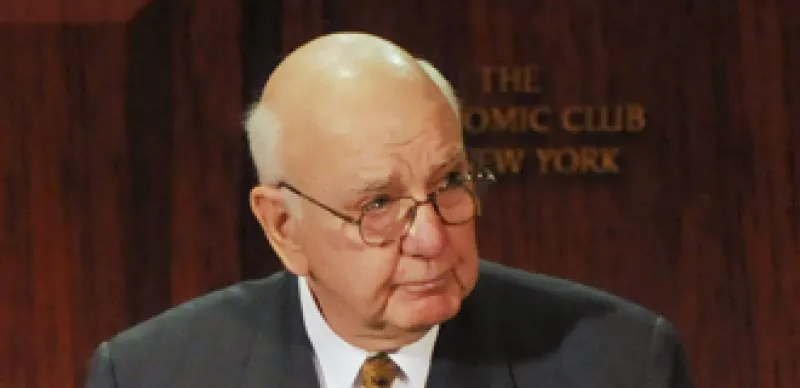

The Volcker rule - which forces banks to cease proprietary trading - is likely to change prop trading rather than end it. The question is where will it go and are regulators going to find it?

David Adler

November 8, 2010