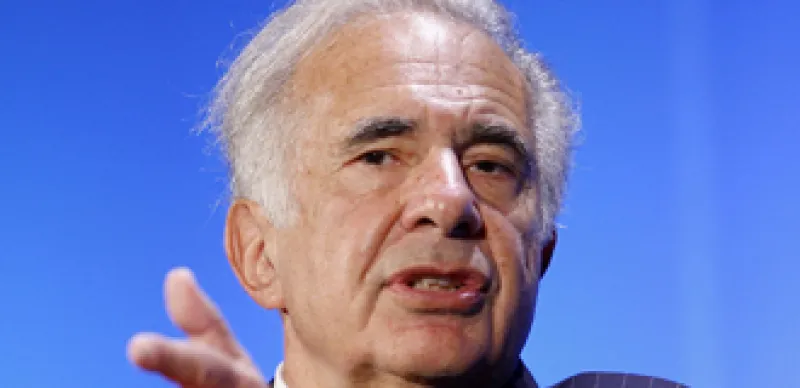

Lionsgate and Carl Icahn have turned up the rhetoric and PR machines ahead of December 10, the activist hedge fund manager’s latest deadline for his $7.50 per share tender offer at the entertainment company’s December 14 annual meeting.

On Wednesday, Lionsgate fired off a press release that contained a letter to shareholders making the case for why selling their shares to Icahn is a bad investment. Once again asserting that Icahn and his five Board nominees pose a significant risk to Lionsgate if they obtain board representation, Lionsgate states that “Icahn has a frightening record of destroying value.” The company went on to point out over the past 10 years, if you invested a dollar in the companies where Icahn or his representatives have secured board representation, outside the biopharmaceutical sector, and sold after they left the board, you would only have $0.18 left, based on median performance.

It also stated that since 2000, nearly two thirds of the companies (9 of the 14) where Icahn has secured board representation have seen significant share price declines. It noted, for example, that Blockbuster's share price declined by 96 percent when Icahn served on the board.

Lionsgate also pointed out that during Icahn's tenure as chairman of the board of WCI Communities — which followed a failed tender offer and prolonged proxy fight — the company’s stock shriveled to nearly zero and one year after Icahn joined its board, the company filed for bankruptcy. It also pointed out that Lear’s shares fell 93 percent before Icahn's Board nominee resigned from the board. Similar failures occurred at BKF Capital and of XO Holdings, according to Lion’sgate.

So, the over-riding question, of course, is whether or not Lions Gate is correct about Icahn. It certainly provided a few good examples of Bad Moments in Icahn Activism. So, I asked the folks at FactSet SharkWatch to crunch the numbers. The results: Like the press release earlier today, this data shows Icahn, on average, way underperformed the market.

FactSet looked at the stocks of 15 companies that were targets of Icahn campaigns in which the dissident gained at least one Board seat. Seven of them were proxy fights. Icahn won one of the fights, two resulted in split votes — which FactSet generally calls the dissident a de facto winner — and the target company agreed to settle four of the proxy fights in which concessions were made.

And what happened to the stocks of these 15 companies? It is not pretty. One month after the board seat was granted, the stocks, on average, fell 5.07 percent compared with very slight losses for both the S&P 500 (minus 0.09 percent) and S&P 1500 (minus 0.02 percent) and a gain of about 0.2 percent for The Russell 3000. Six of the 15 stocks rose, however, including two by more than 17 percent (Lear and Amylin Pharmaceuticals) while another climbed more than 14 percent (Genzyme). Amylin and Genzyme, however, are biopharmaceutical companies.

Okay, now let’s go out six months. During this period, the group of 15 fell on average by 13.76 percent. This compares with gains ranging between 0.64 percent and 2.09 percent for the three indices. Again, not too good. And once again, six of the 15 stocks rose during this period. They include a gain of 49 percent for Genzyme, 26.5 percent for Lear, 24.3 percent for Enzon Pharmaceuticals and more than 18 percent for Amylin. The gains were mostly enjoyed by the biopharmaceuticals, of course. It gets uglier the further out you go. One year after Icahn secured a board seat, the 15 stocks were down, on average, by 18.73 percent, compared with losses of between 3 percent and 4 percent for the S&P 500 and S&P 1500 and a loss of about 1 percent for the Russell 3000.

At this point, just four of 12 stocks (three of the 15 are more recent investments) were in the black — Enzon and Amylin were up in the low- to mid-40 percent range, Lear was up over 18 percent, and another biopharmaceutical stock — Imclone Systems — was up 11.5 percent.

Finally, FactSet looked at these stocks two years after the board seats were acquired. The eight stocks that qualify lost, on average, 27.1 percent, versus losses ranging from 7.7 percent to 12.4 percent for the three indices. At that point, just one stock was in the black—Imclone, up 128 percent. The moral of the story: Lionsgate is right. Icahn has only mostly added value to biopharmaceutical stocks after securing a board seat.